New York Telecommuting Policy

Description

How to fill out Telecommuting Policy?

You might spend hours online looking for the legal document template that satisfies the state and federal criteria you need.

US Legal Forms offers a vast collection of legal documents that have been reviewed by experts.

You can easily download or print the New York Telecommuting Policy from my services.

If available, use the Preview button to browse through the document template as well.

- If you have a US Legal Forms account, you can sign in and click on the Obtain button.

- Afterward, you can complete, modify, print, or sign the New York Telecommuting Policy.

- Every legal document template you obtain is yours permanently.

- To get another copy of any acquired document, navigate to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the county/town of your choice.

- Review the document description to ensure you have chosen the appropriate form.

Form popularity

FAQ

New York-Based Employees Who Work Remotely Out-of-State Are Subject to New York Income Tax. New York State taxes New York residents on worldwide income and nonresidents only on New York source income.

NEW YORK STATE The New York State Assembly has passed a bill that would allow state employees to work remotely when possible, and it is getting support from the workers themselves.

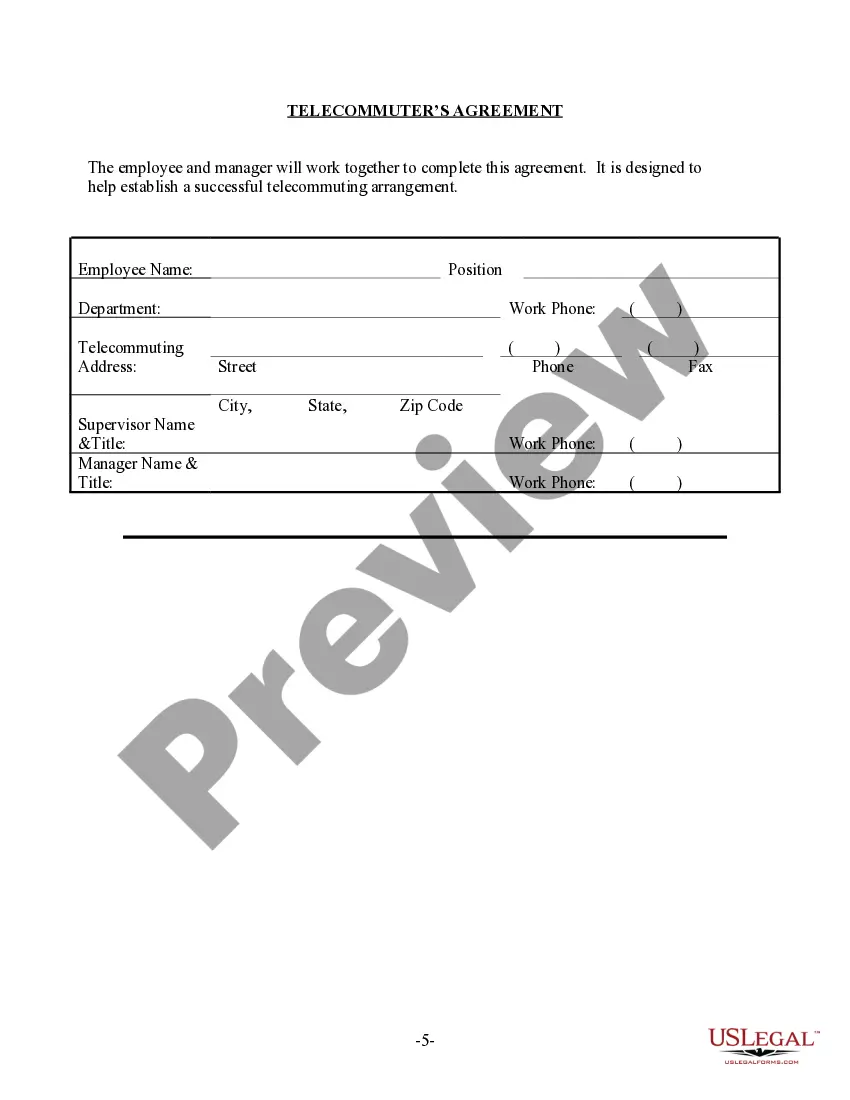

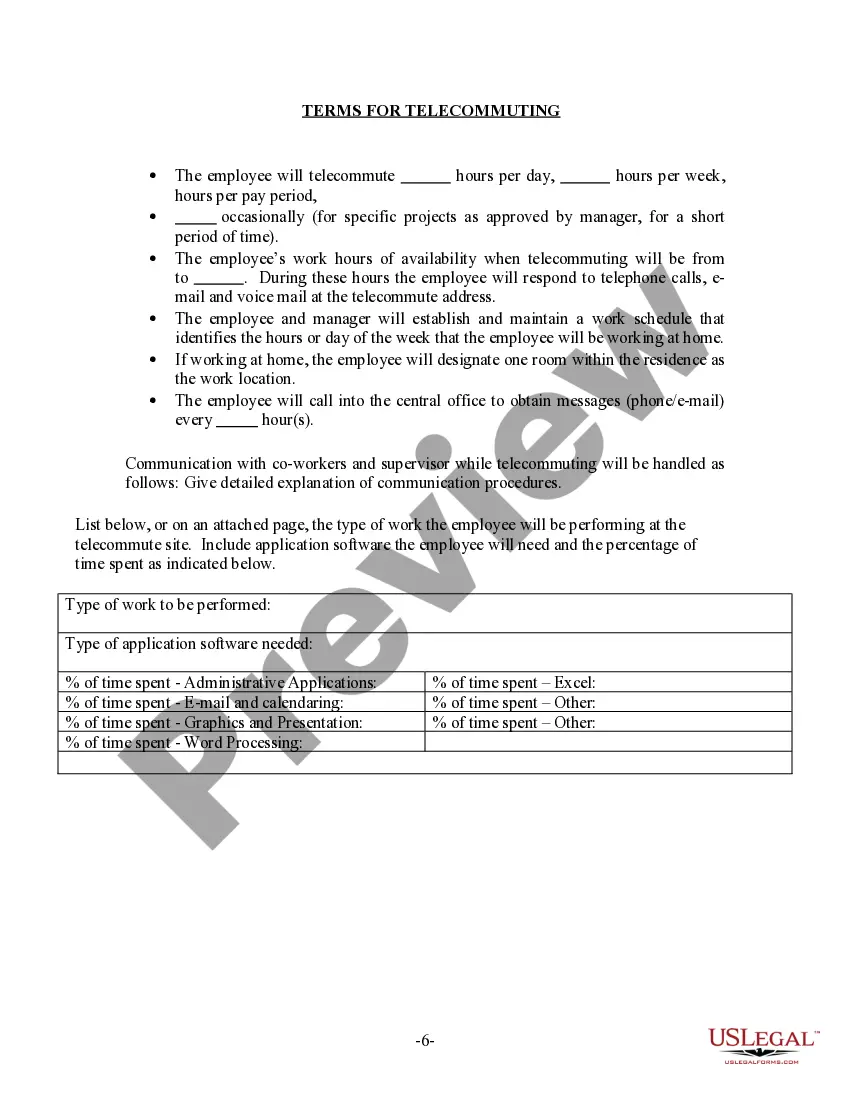

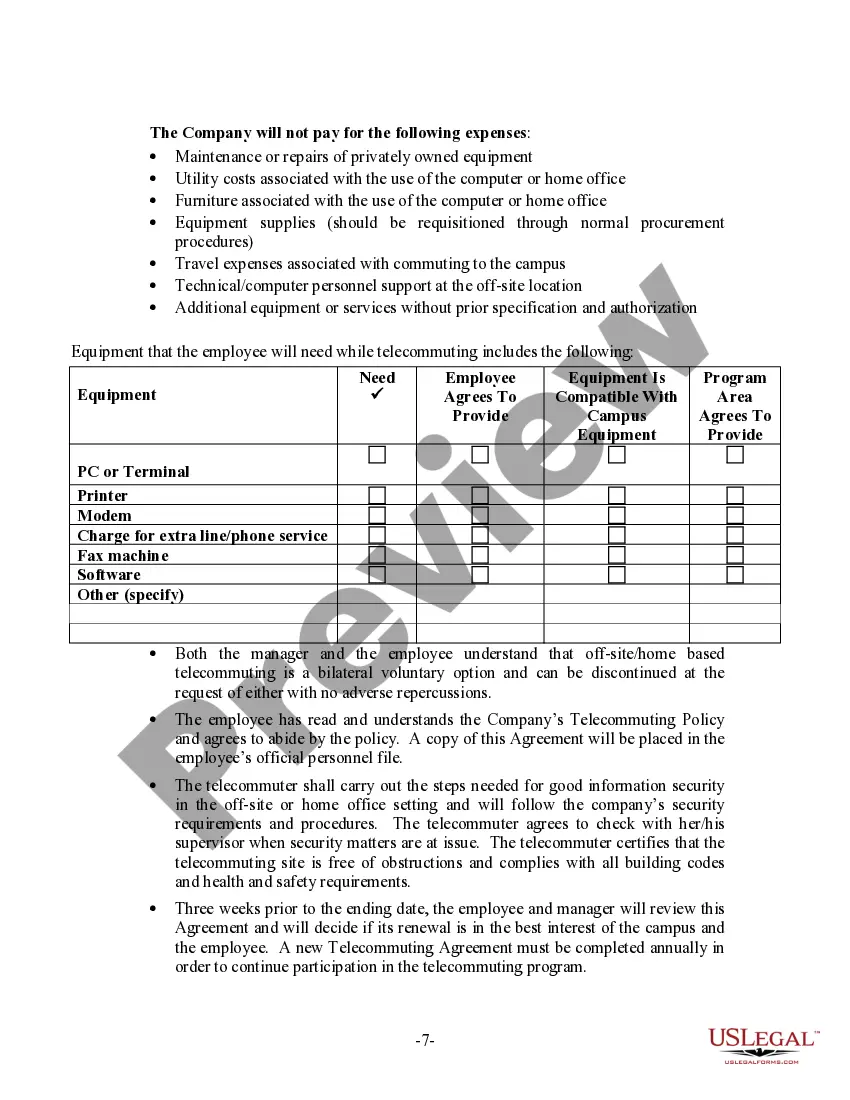

Telecommuting allows employees to work at home, on the road or in a satellite location for all or part of their workweek. Company Name considers telecommuting to be a viable, flexible work option when both the employee and the job are suited to such an arrangement.

As defined by the U.S. Internal Revenue Service (IRS), "convenience of employer" generally means that an employer has not provided an employee with the necessary resources for an employee to work remotely, such as a physical office or technology, which requires the worker to provide for their own home office equipment.

Under New York's convenience of the employer rule, the employer is required to withhold New York state income tax from all wages paid to the employee if the reason the employee is working from home outside of the state is for the employee's own convenience.

New York-Based Employees Who Work Remotely Out-of-State Are Subject to New York Income Tax. New York State taxes New York residents on worldwide income and nonresidents only on New York source income.

As a non-resident, you only pay tax on New York source income, which includes earnings from work physically performed in New York State, and income from real property. You are not liable for city tax.

Under the Convenience of Employer Rule, employees working for a business located in one state, but who perform their work from a remote location (i.e., from another state), are subject to the tax laws of their employer's state.

We are pleased to announce that the New York State Governor's Office of Employee Relations (GOER) has approved an extension of the SUNY-wide telecommuting program. The extension runs to June 30, 2022, for M/C employees and all bargaining units, except for PEF. The extension for PEF employees runs to March 31, 2022.

Extension of Pilot Telecommuting Program We are pleased to announce that the Pilot Telecommuting Program has been extended until March 21, 2022 for PEF-represented employees and until June 30, 2022 for all others.