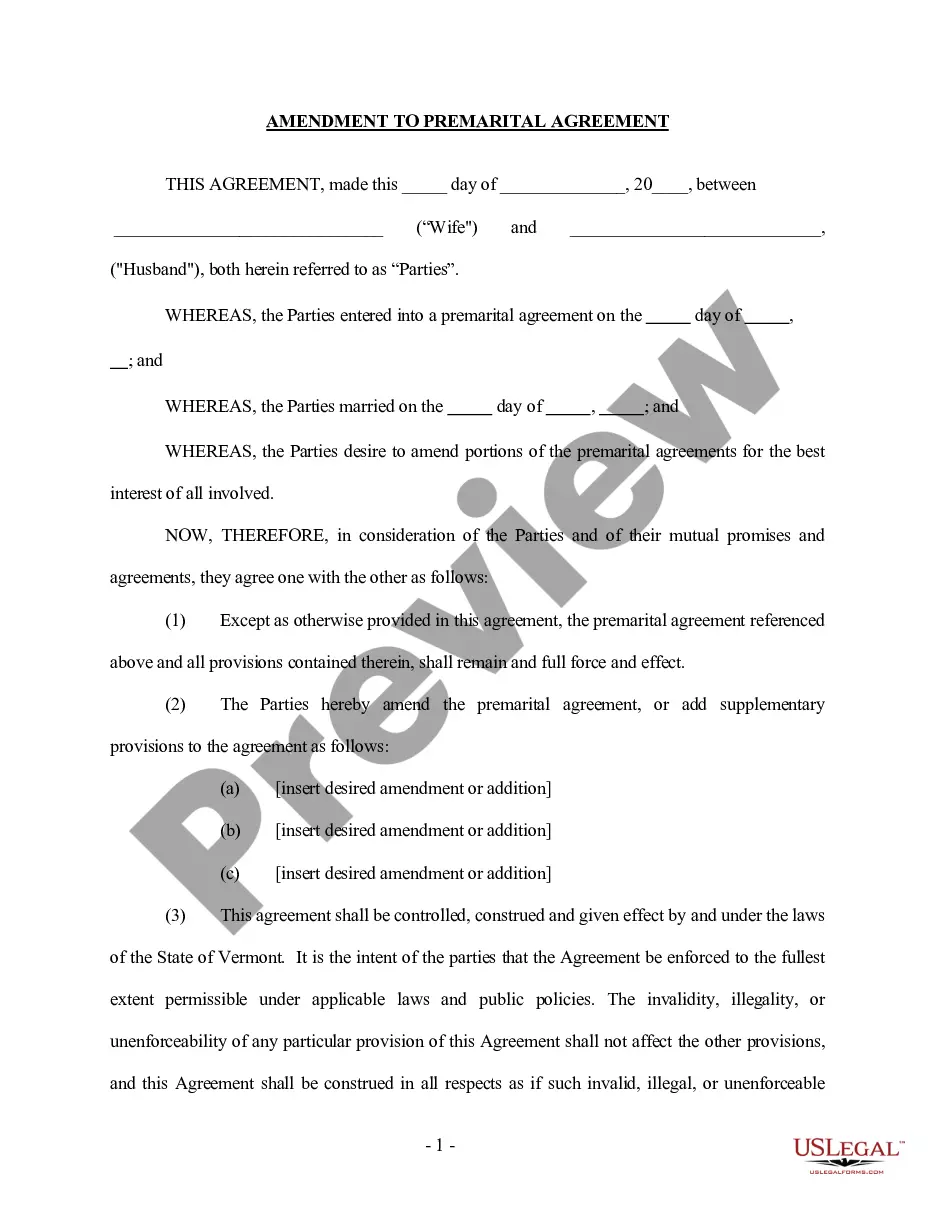

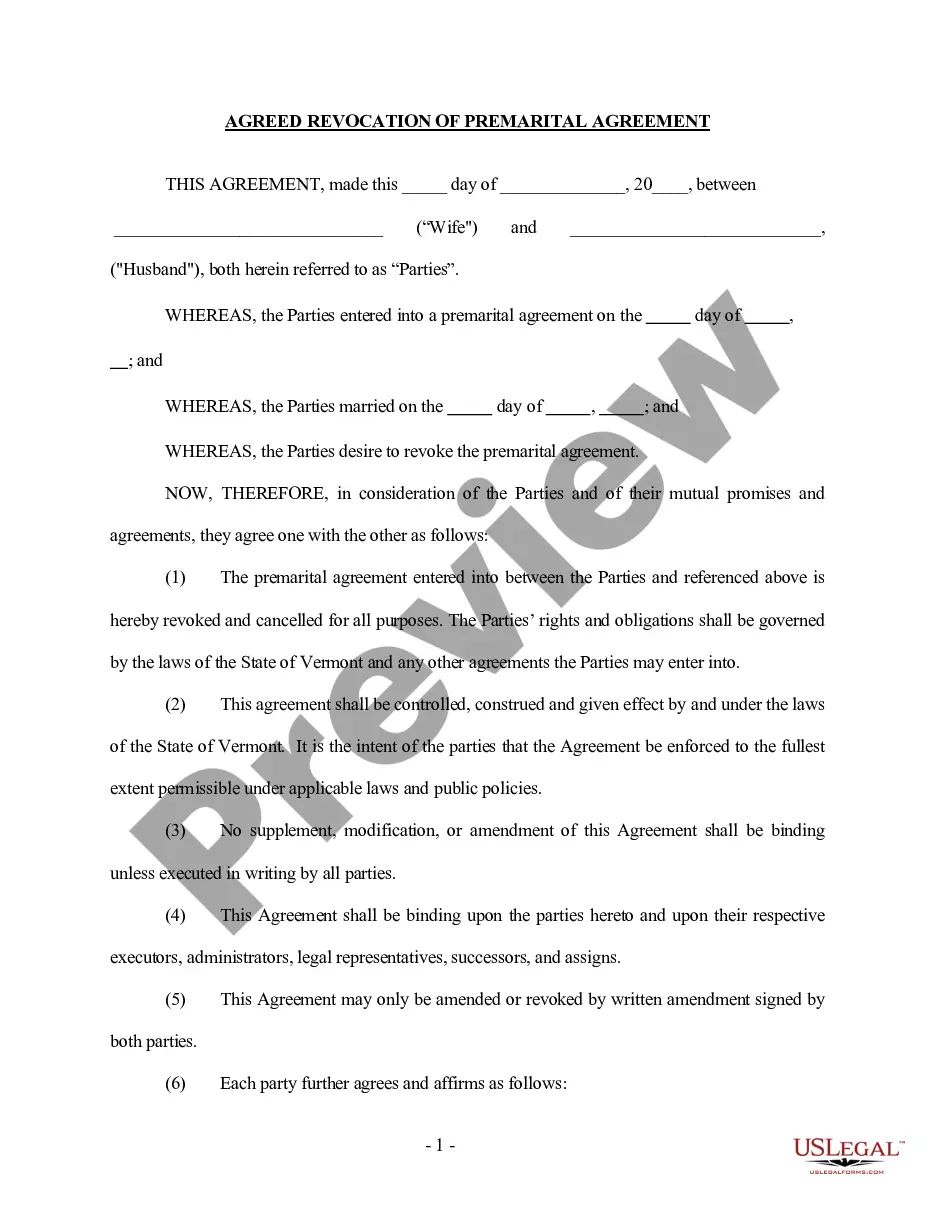

New York Change in Mailing Address for Certain Real Estate Transfer Tax Forms if Using a Private Delivery Service is a process that requires the taxpayer to send their real estate transfer tax forms to a specific address if they are using a private delivery service. This process applies to all taxpayers who are filing a Real Property Transfer Tax Form TP-584, TP-584-RPTT, or TP-584-RPTT-E. The taxpayer must use the designated address for the particular form being filed and include the appropriate delivery service code. The New York Change in Mailing Address for Certain Real Estate Transfer Tax Forms if Using a Private Delivery Service has two different types of forms: TP-584, and TP-584-RPTT-E. For TP-584 forms, the forms must be mailed to the following address: NYS TAX DEPARTMENT ATTN: RP-584 FILING UNIT W A HARRIMAN CAMPUS ALBANY NY 12227-0801 The taxpayer must use the appropriate delivery service code for their private delivery service, such as FedEx or UPS. The taxpayer must also include their name, address, and phone number on the form. For TP-584-RPTT-E forms, the forms must be mailed to the following address: NYS TAX DEPARTMENT ATTN: RP-584-RPTT-E FILING UNIT W A HARRIMAN CAMPUS ALBANY NY 12227-0801 The taxpayer must use the appropriate delivery service code for their private delivery service, such as FedEx or UPS. The taxpayer must also include their name, address, and phone number on the form. In summary, New York Change in Mailing Address for Certain Real Estate Transfer Tax Forms if Using a Private Delivery Service is a process that requires taxpayers to send their real estate transfer tax forms to the designated address if they are using a private delivery service. There are two different types of forms, TP-584 and TP-584-RPTT-E, which require different addresses. The taxpayer must include the appropriate delivery service code and their name, address, and phone number on the form.

New York Change in Mailing Address for Certain Real Estate Transfer Tax Forms if Using a Private Delivery Service

Description

How to fill out New York Change In Mailing Address For Certain Real Estate Transfer Tax Forms If Using A Private Delivery Service?

How much time and resources do you often spend on composing formal documentation? There’s a greater way to get such forms than hiring legal experts or spending hours searching the web for a suitable template. US Legal Forms is the top online library that offers professionally designed and verified state-specific legal documents for any purpose, like the New York Change in Mailing Address for Certain Real Estate Transfer Tax Forms if Using a Private Delivery Service.

To obtain and prepare an appropriate New York Change in Mailing Address for Certain Real Estate Transfer Tax Forms if Using a Private Delivery Service template, adhere to these easy steps:

- Examine the form content to ensure it meets your state requirements. To do so, read the form description or use the Preview option.

- If your legal template doesn’t meet your requirements, find a different one using the search bar at the top of the page.

- If you are already registered with our service, log in and download the New York Change in Mailing Address for Certain Real Estate Transfer Tax Forms if Using a Private Delivery Service. Otherwise, proceed to the next steps.

- Click Buy now once you find the correct document. Opt for the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is absolutely safe for that.

- Download your New York Change in Mailing Address for Certain Real Estate Transfer Tax Forms if Using a Private Delivery Service on your device and fill it out on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously purchased documents that you securely keep in your profile in the My Forms tab. Get them anytime and re-complete your paperwork as frequently as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most reliable web services. Join us today!

Form popularity

FAQ

Tax Department email addresses @tax.ny.gov. @tax.state.ny.gov.

Send your written notification to: NYS Tax Department, Registration and Bond Unit, W A Harriman Campus, Albany NY 12227-2993.

If enclosing a payment (check or money order), mail your NYS income tax return to: STATE PROCESSING CENTER. PO BOX 15555. ALBANY, NY 12212-5555.

If the deed or document isn't being recorded, file Form TP-584 or TP-584-NYC and pay any tax due directly to the Tax Department no later than the 15th day after the delivery of the document. Mail Form TP-584 or TP-584-NYC with any attachments and payment to the address indicated on the form.

To change your physical or mailing address, complete Form DTF-96, Report of Address Change for Business Tax Accounts. To change any other business tax account information (as well as your address), file Form DTF-95, Business Tax Account Update.

If you use any private delivery service, whether it is a designated service or not, send the forms covered by these instructions to: JPMorgan Chase, NYS Tax Processing ? Estimated Tax, 33 Lewis Rd., Binghamton NY 13905-1040.

Form TP-584 must be used to comply with the filing requirements of the real estate transfer tax (Tax Law Article 31); the tax on mortgages (Tax Law Article 11), as it applies to the Credit Line Mortgage Certificate; and the exemption from estimated personal income tax (Tax Law Article 22), as it applies to the sale or

Telephone assistance is available from a.m. to p.m. (eastern time), Monday through Friday. Fax-on-demand forms: Forms are available 24 hours a day, 1 800 748-3676 7 days a week.