An angel investor or angel (also known as a business angel or informal investor) is an affluent individual who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity. New start-up companies often turn to the private equity market for seed money because the formal equity market is reluctant to fund risky undertakings. In addition to their willingness to invest in a start-up, angel investors may bring other assets to the partnership. They are often a source of encouragement; they may be mentors in how best to guide a new business through the start-up phase and they are often willing to do this while staying out of the day-to-day management of the business.

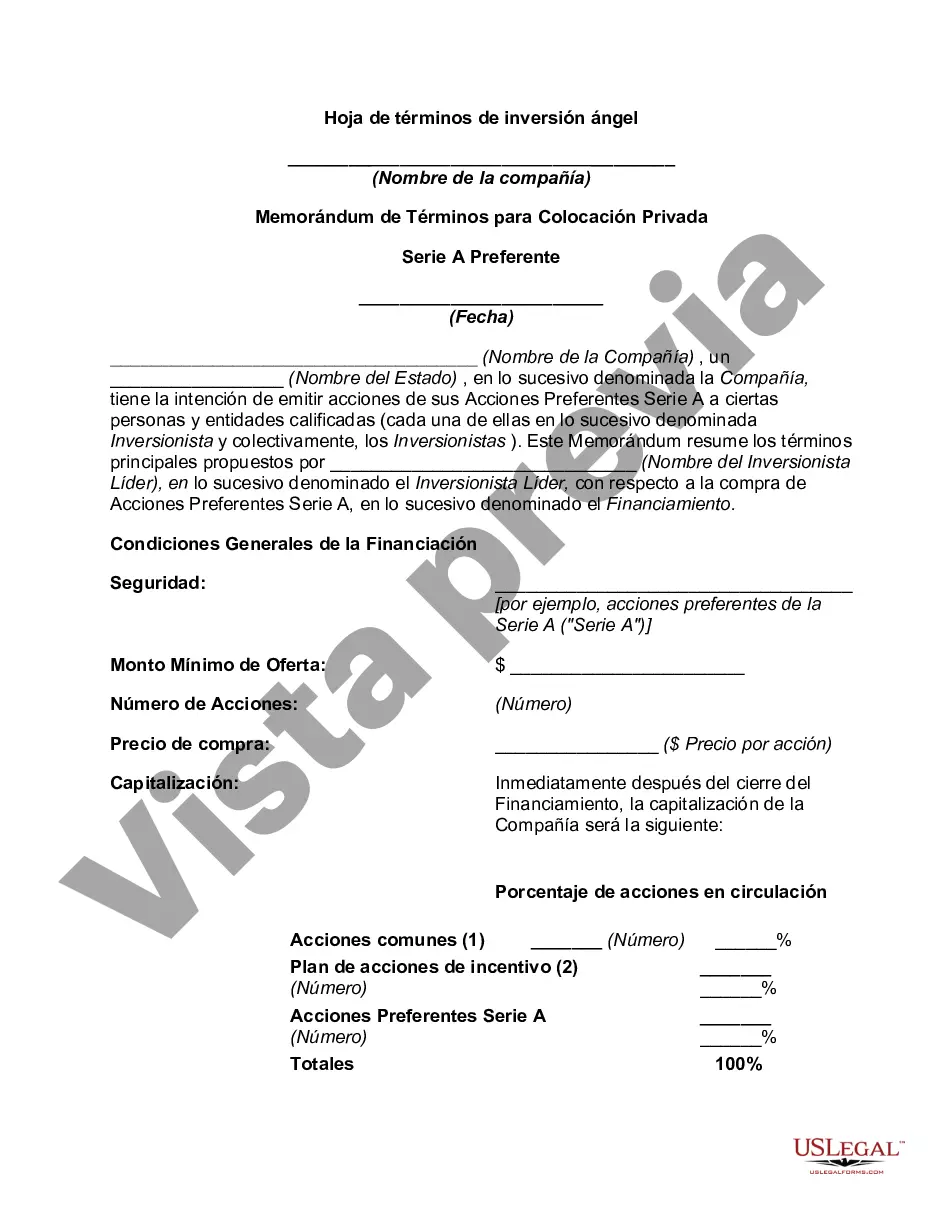

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made.

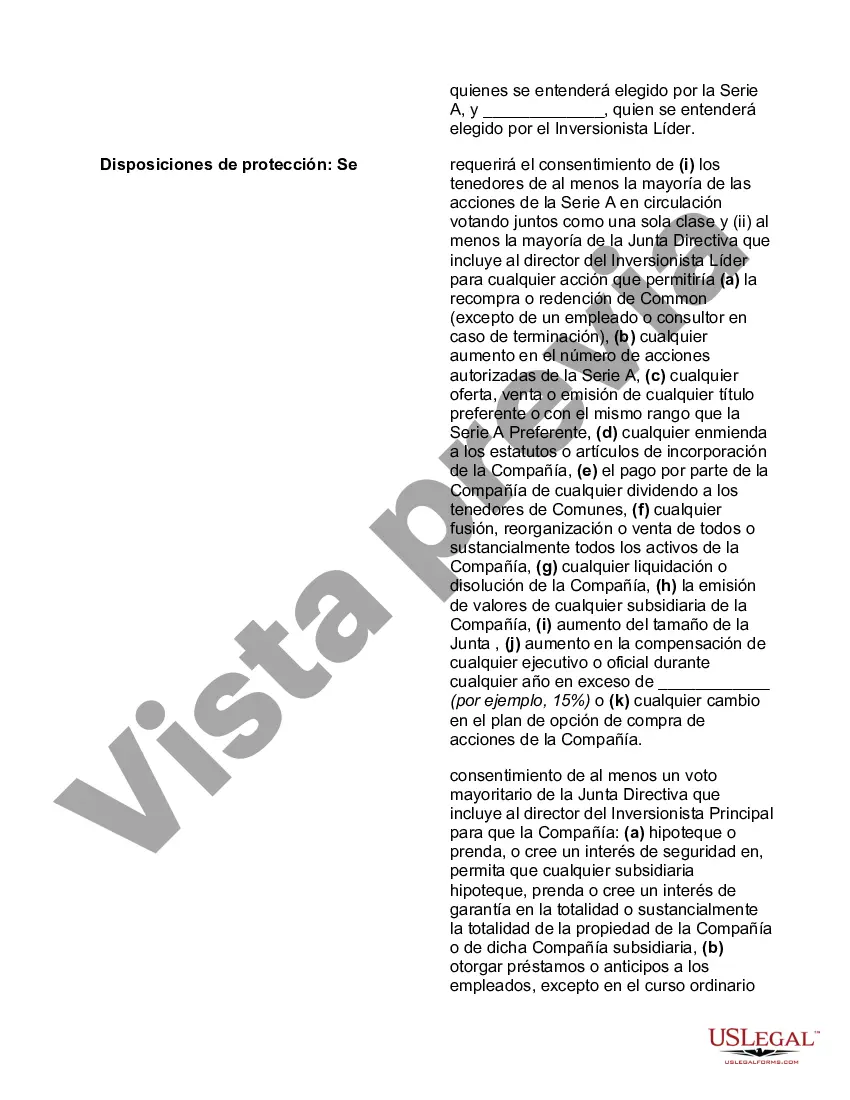

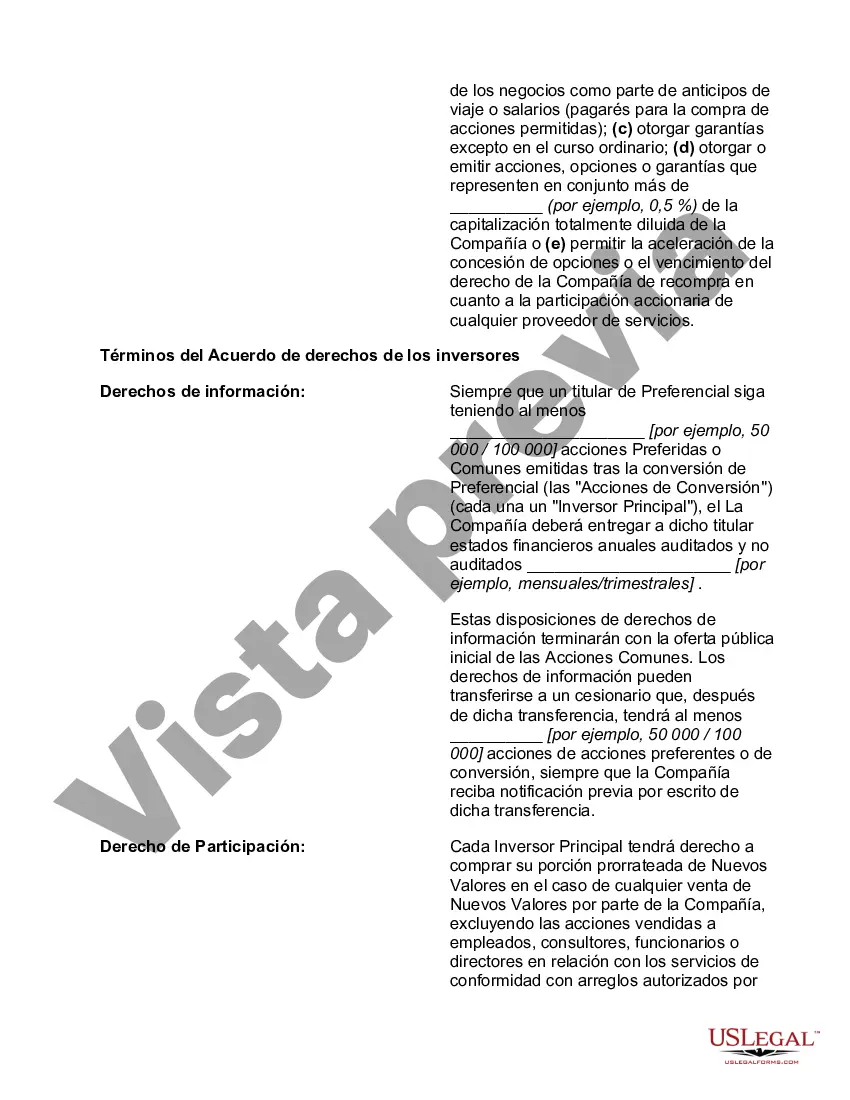

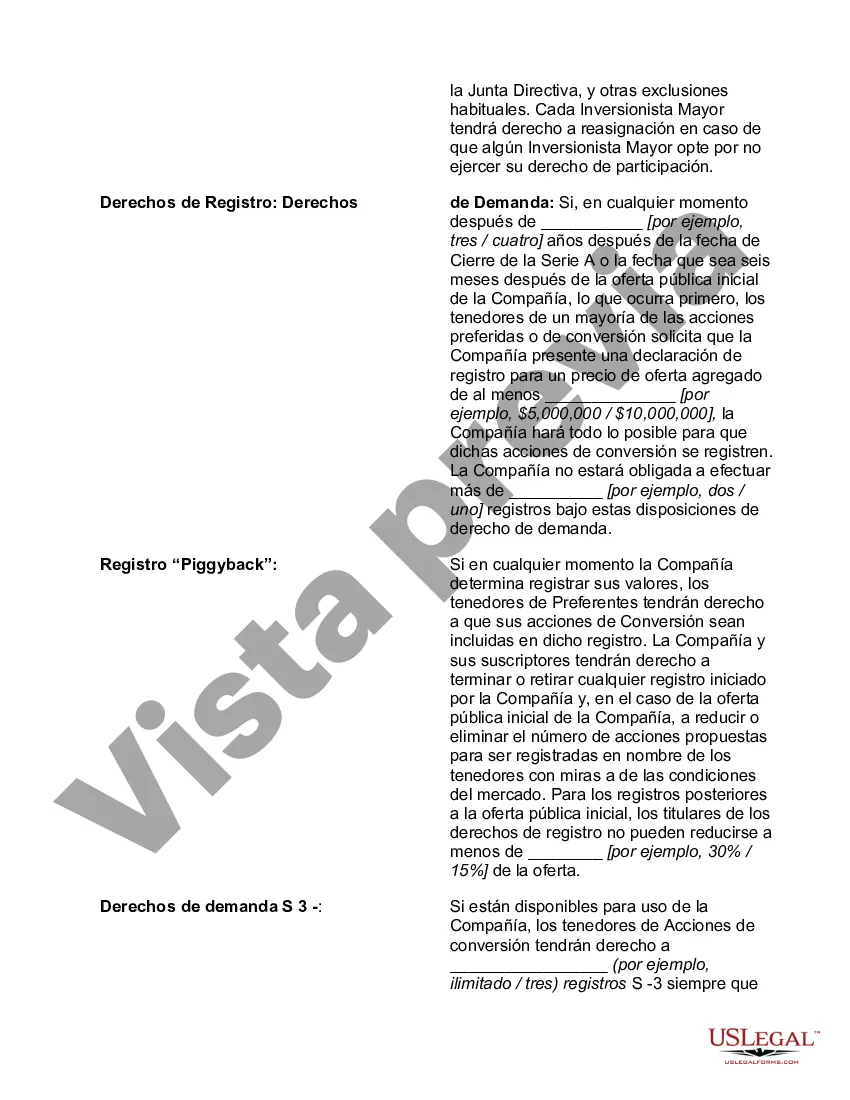

The Ohio Angel Investment Term Sheet is a legal document that outlines the terms and conditions under which angel investors provide funding to startups in Ohio. It serves as a framework for negotiation and lays out the key terms that both the investor and the startup agree upon before finalizing the investment deal. The term sheet typically includes various important sections, such as: 1. Valuation: This section determines the pre-money valuation of the startup, i.e., the worth of the company before the investment. It helps set the percentage of ownership that the angel investor will receive in exchange for their investment. 2. Investment Amount: The term sheet specifies the amount of funding the angel investor is willing to provide to the startup. This funding can be in the form of equity financing or convertible debt. 3. Equity Type: If the funding is in the form of equity financing, the term sheet defines the type of equity the investor will receive (e.g., preferred stock) and any specific rights or privileges associated with that equity. 4. Investor Rights: The term sheet outlines the rights that the angel investor will have in the startup, such as board representation, voting rights, information rights, and liquidation preferences. These rights aim to protect the investor's interests and ensure they have a say in key company decisions. 5. Board Representation: If the angel investor is entitled to a seat on the startup's board of directors, the term sheet specifies the number of board seats they will have and any additional voting rights or veto powers. 6. Anti-Dilution Protection: This provision protects the investor's ownership stake from being diluted in the future. It outlines the circumstances under which the investor is entitled to receive additional shares or financing to maintain their ownership percentage. 7. Vesting: If the investment is accompanied by the presence of key individuals, such as founders or key employees, the term sheet may include vesting provisions. These provisions ensure that the individuals receive their shares gradually over a specified period rather than all at once, incentivizing their ongoing commitment to the startup's success. 8. Exit Strategy: The term sheet may include provisions regarding exit options, such as initial public offerings (IPOs), acquisitions, or other liquidity events. It outlines the rights and obligations of both the investor and the startup in the event of a successful exit. It is important to note that while there may be variations in specific terms and provisions, the Ohio Angel Investment Term Sheet generally follows a structure similar to the one described above. Different types of term sheets may exist based on the nature and requirements of the specific startup and investor involved.The Ohio Angel Investment Term Sheet is a legal document that outlines the terms and conditions under which angel investors provide funding to startups in Ohio. It serves as a framework for negotiation and lays out the key terms that both the investor and the startup agree upon before finalizing the investment deal. The term sheet typically includes various important sections, such as: 1. Valuation: This section determines the pre-money valuation of the startup, i.e., the worth of the company before the investment. It helps set the percentage of ownership that the angel investor will receive in exchange for their investment. 2. Investment Amount: The term sheet specifies the amount of funding the angel investor is willing to provide to the startup. This funding can be in the form of equity financing or convertible debt. 3. Equity Type: If the funding is in the form of equity financing, the term sheet defines the type of equity the investor will receive (e.g., preferred stock) and any specific rights or privileges associated with that equity. 4. Investor Rights: The term sheet outlines the rights that the angel investor will have in the startup, such as board representation, voting rights, information rights, and liquidation preferences. These rights aim to protect the investor's interests and ensure they have a say in key company decisions. 5. Board Representation: If the angel investor is entitled to a seat on the startup's board of directors, the term sheet specifies the number of board seats they will have and any additional voting rights or veto powers. 6. Anti-Dilution Protection: This provision protects the investor's ownership stake from being diluted in the future. It outlines the circumstances under which the investor is entitled to receive additional shares or financing to maintain their ownership percentage. 7. Vesting: If the investment is accompanied by the presence of key individuals, such as founders or key employees, the term sheet may include vesting provisions. These provisions ensure that the individuals receive their shares gradually over a specified period rather than all at once, incentivizing their ongoing commitment to the startup's success. 8. Exit Strategy: The term sheet may include provisions regarding exit options, such as initial public offerings (IPOs), acquisitions, or other liquidity events. It outlines the rights and obligations of both the investor and the startup in the event of a successful exit. It is important to note that while there may be variations in specific terms and provisions, the Ohio Angel Investment Term Sheet generally follows a structure similar to the one described above. Different types of term sheets may exist based on the nature and requirements of the specific startup and investor involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.