A Corporate Resolution for Single Member LLC in Ohio is a legal document used to outline and authorize important decisions and actions taken by a single-member limited liability company (LLC). It serves as a formal record of the decisions made and is often required by banks, lenders, business partners, or other interested parties. Keywords: Ohio, Corporate Resolution, Single Member LLC, legal document, decisions, actions, record There might not be different types of Ohio Corporate Resolutions specifically tailored for single-member LCS. However, the content of the resolution can vary depending on the specific decisions or actions being authorized. Some common types of Ohio Corporate Resolutions for Single Member LLC could include, but are not limited to: 1. Appointment of Officers: This resolution establishes the appointment of officers within the LLC, such as the President, Vice President, Secretary, or Treasurer, and grants them the necessary authority to act on behalf of the company. 2. Opening Bank Accounts: If the LLC needs to open a bank account, this resolution authorizes the opening of the account, designates the authorized signatory, and grants them the necessary powers to manage the account. 3. Borrowing or Loan Agreements: In the case of borrowing money for business purposes or entering into loan agreements, this resolution authorizes the LLC to borrow funds, specifies the maximum loan amount, and designates the responsible individuals for negotiating and signing the loan agreement. 4. Real Estate Transactions: If the single-member LLC intends to purchase, sell, lease, or mortgage real estate properties, this resolution authorizes the LLC to engage in such transactions and specifies the details of the transaction, such as property description, purchase price, or lease terms. 5. Amendment of LLC Operating Agreement: This resolution grants the single-member LLC the authority to amend or modify its operating agreement (the governing document that outlines the internal operations and management structure of the company) as necessary. 6. Adoption of Business Plan or Budget: A resolution for adopting a business plan or budget authorizes the LLC's single member to approve and implement the proposed plans and budgets for the upcoming fiscal year. It is important to note that the specific content and types of resolutions may vary depending on the unique circumstances and requirements of the single-member LLC. Consulting with an attorney or legal professional experienced in Ohio business law is recommended to ensure the proper preparation and execution of a Corporate Resolution for Single Member LLC in Ohio.

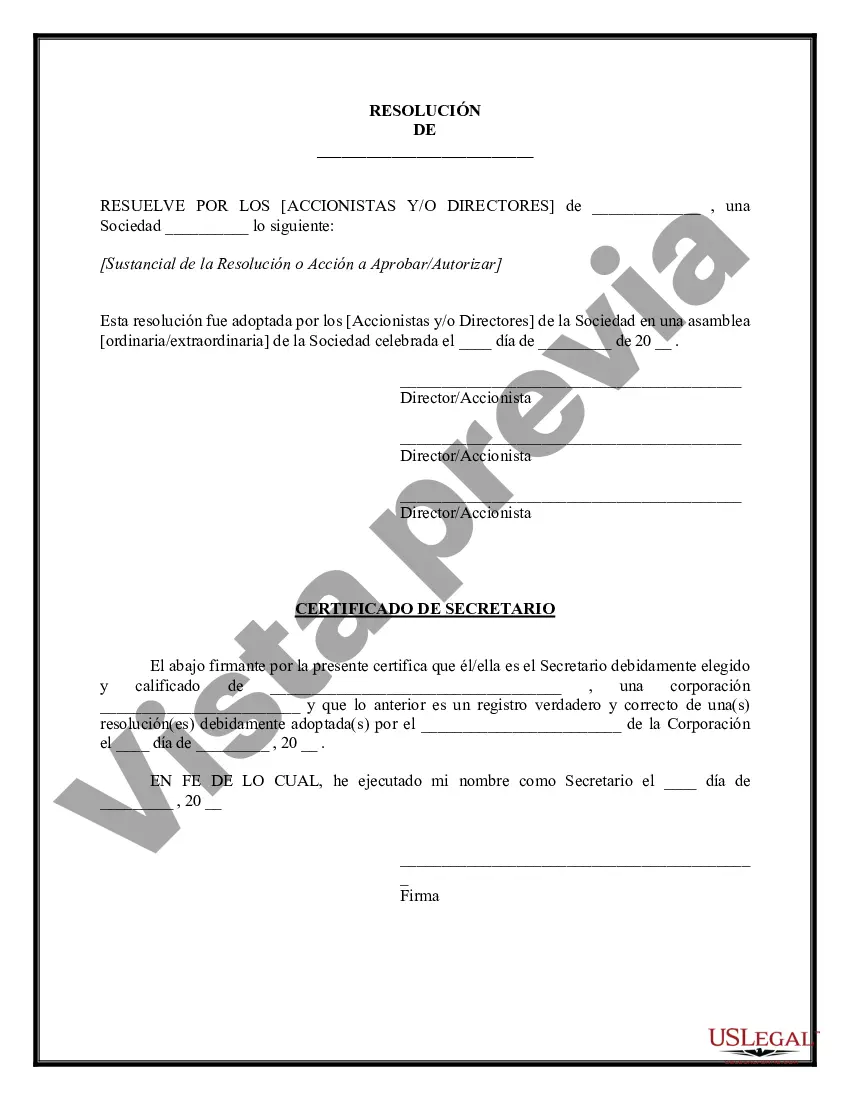

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Resolución corporativa para un solo miembro LLC - Corporate Resolution for Single Member LLC

Description

How to fill out Ohio Resolución Corporativa Para Un Solo Miembro LLC?

Are you presently inside a situation the place you need paperwork for both organization or specific functions virtually every day time? There are a variety of legal document themes available on the net, but getting kinds you can depend on is not easy. US Legal Forms delivers thousands of kind themes, just like the Ohio Corporate Resolution for Single Member LLC, which can be published in order to meet state and federal requirements.

In case you are currently familiar with US Legal Forms website and possess your account, just log in. Next, you can down load the Ohio Corporate Resolution for Single Member LLC design.

Should you not have an profile and need to begin to use US Legal Forms, adopt these measures:

- Obtain the kind you want and make sure it is to the proper metropolis/county.

- Make use of the Review switch to check the form.

- Look at the outline to ensure that you have chosen the right kind.

- In case the kind is not what you`re searching for, use the Lookup discipline to get the kind that suits you and requirements.

- If you obtain the proper kind, click on Buy now.

- Choose the costs prepare you would like, fill out the specified information and facts to create your money, and pay money for the transaction utilizing your PayPal or credit card.

- Select a practical document structure and down load your copy.

Locate all of the document themes you possess purchased in the My Forms food selection. You can aquire a further copy of Ohio Corporate Resolution for Single Member LLC any time, if required. Just click on the required kind to down load or printing the document design.

Use US Legal Forms, probably the most substantial assortment of legal varieties, to save lots of some time and prevent faults. The support delivers expertly manufactured legal document themes that you can use for a variety of functions. Make your account on US Legal Forms and initiate creating your lifestyle easier.