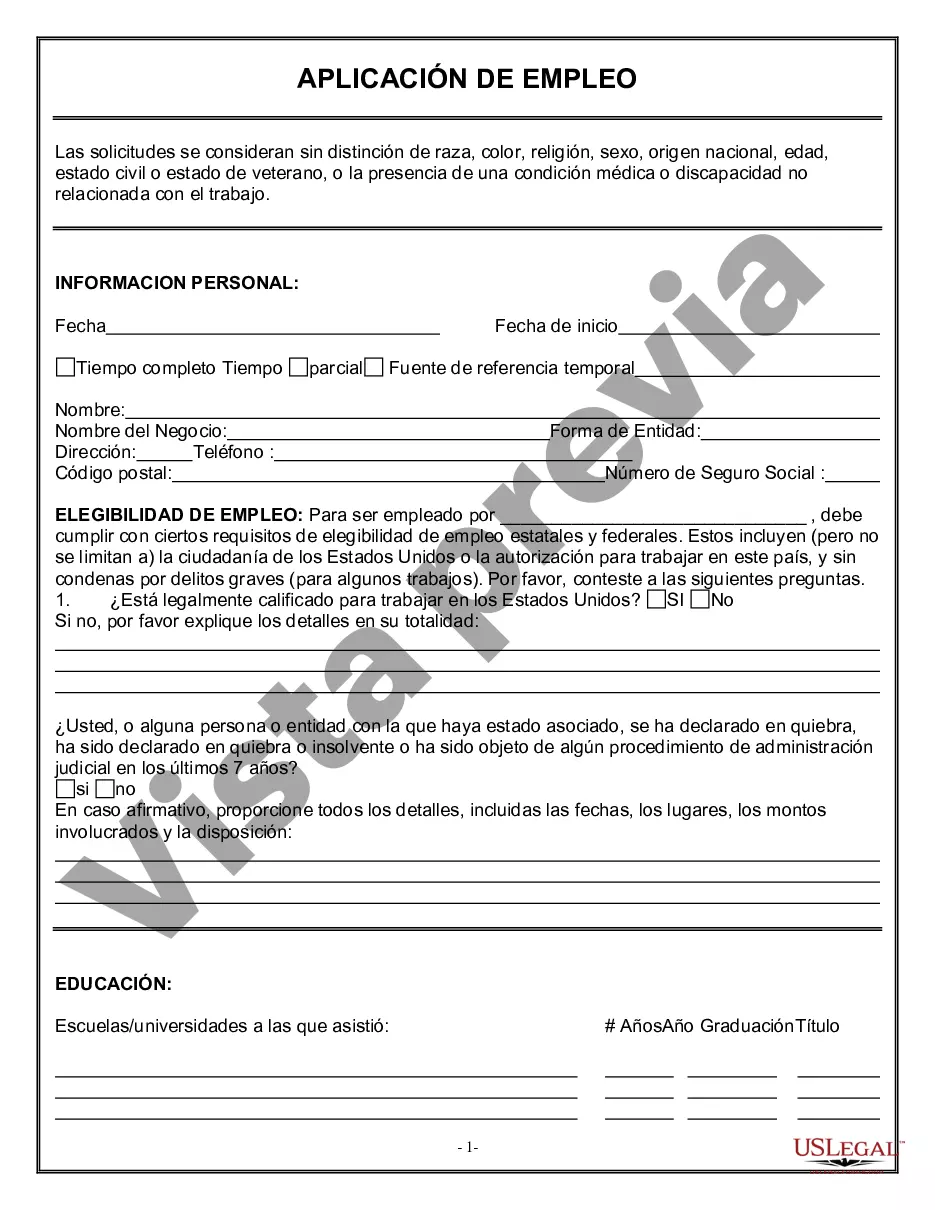

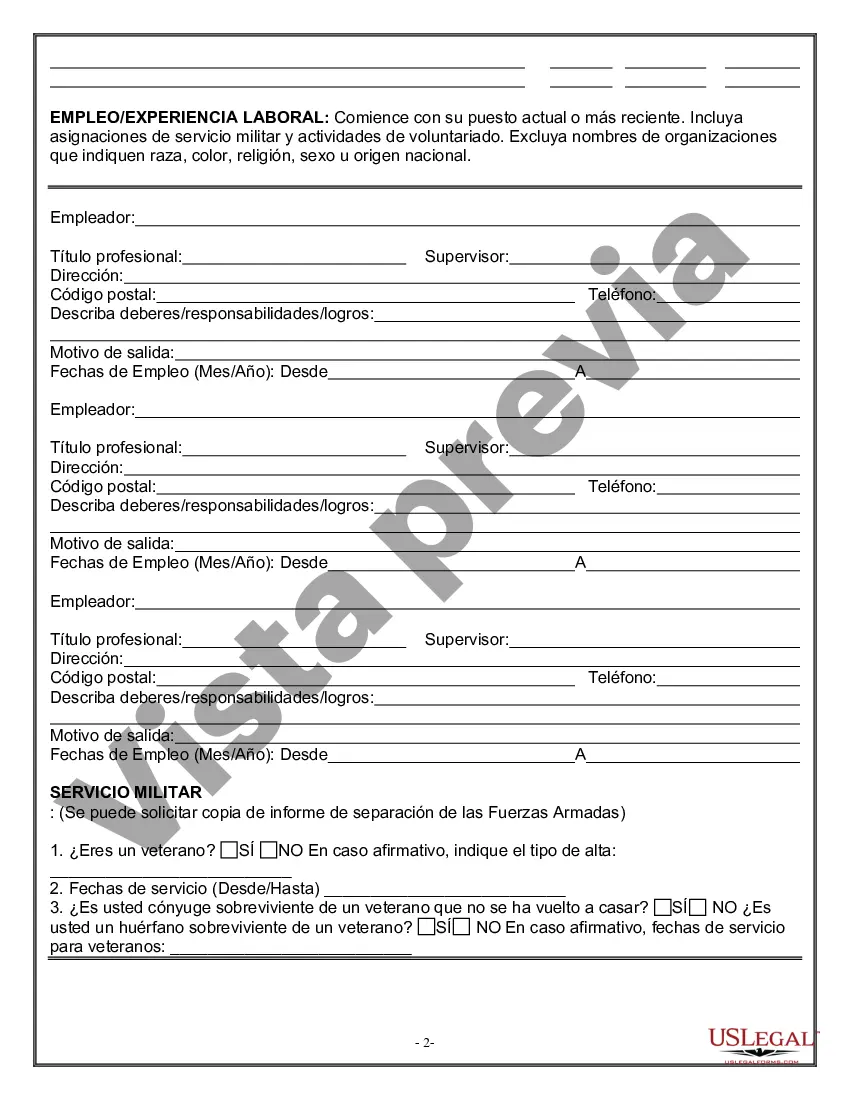

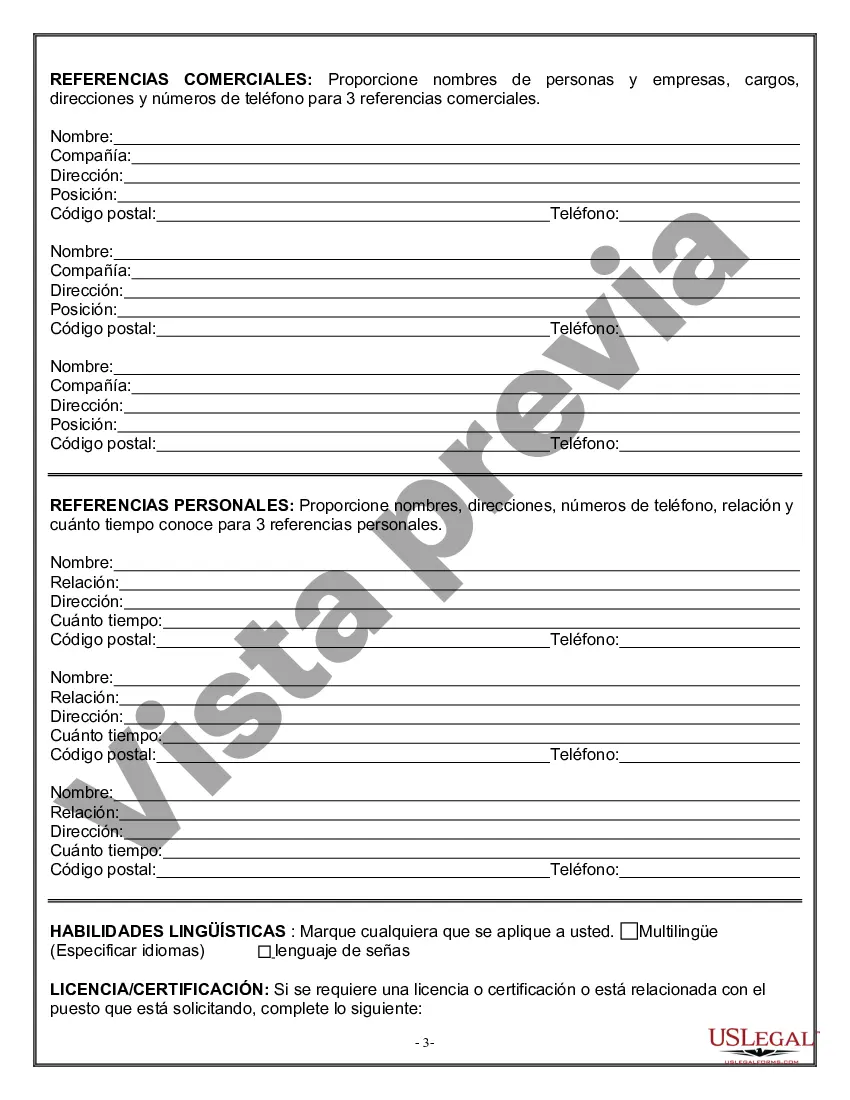

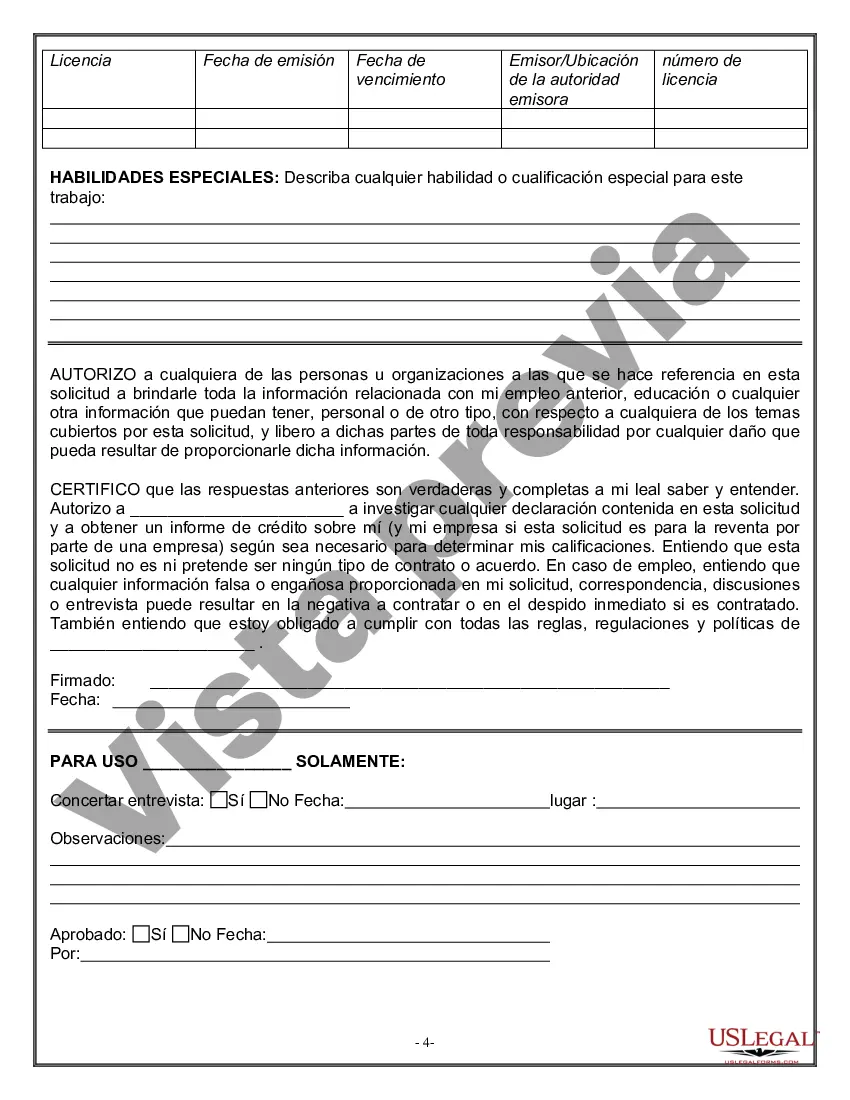

The Ohio Employment Application for Accountant is a standardized form used by the state of Ohio for individuals seeking employment in the field of accounting. This application aims to collect essential information regarding an applicant's education, work experience, skills, and qualifications related to accounting positions. The form begins with standard personal information fields, including the applicant's full name, address, contact information, and Social Security number. It may also include fields for the applicant's date of birth and driver's license number. This information is crucial for establishing the applicant's identity and verifying their eligibility for employment. Moving on, the application typically includes sections for educational background, where applicants are required to provide details about their academic achievements. This may include the name of the institution attended, major or degree obtained, graduation dates, and any relevant certifications or licenses held. The work experience section of the application prompts applicants to list their previous employers, including the company name, job title, dates of employment, and a brief description of their responsibilities and accomplishments in each role. It may also ask for the names and contact information of references who can speak to the applicant's work performance. Moreover, the Ohio Employment Application for Accountant emphasizes skills and qualifications related specifically to accounting. Applicants are typically requested to outline their proficiency in various accounting software, such as QuickBooks or Excel, as well as their familiarity with financial statement preparation, tax regulations, auditing procedures, and other accounting-related tasks. They may also be asked to provide examples of previous projects or assignments that demonstrate their accounting expertise. Depending on the organization or agency using the application, there might be additional sections. For instance, some applications may include a section for applicants to disclose any criminal history, while others may require candidates to answer specific questions related to the job requirements or professional ethics. It is worth noting that there may be variations of the Ohio Employment Application for Accountant, depending on the hiring organization or the specific job position. Different job positions within the accounting field may require applications tailored to the specific skills and qualifications necessary for that role. Examples of such specialized applications could include the Ohio Employment Application for Staff Accountant, Ohio Employment Application for Tax Accountant, or Ohio Employment Application for Auditor. Overall, the Ohio Employment Application for Accountant is a comprehensive document designed to gather all the necessary information from applicants. By closely following instructions and providing accurate, detailed responses, candidates are more likely to present themselves as qualified and suitable candidates for accounting positions in the state of Ohio.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Solicitud de Empleo para Contador - Employment Application for Accountant

Description

How to fill out Ohio Solicitud De Empleo Para Contador?

US Legal Forms - one of the greatest libraries of lawful forms in America - delivers an array of lawful file templates you are able to acquire or printing. Using the internet site, you can find a large number of forms for organization and person purposes, categorized by groups, suggests, or search phrases.You can get the most recent versions of forms much like the Ohio Employment Application for Accountant in seconds.

If you already have a subscription, log in and acquire Ohio Employment Application for Accountant from the US Legal Forms catalogue. The Down load option will appear on each and every develop you perspective. You have access to all previously delivered electronically forms within the My Forms tab of the profile.

In order to use US Legal Forms initially, listed below are easy instructions to help you get started off:

- Make sure you have chosen the proper develop to your area/state. Select the Preview option to examine the form`s content material. Browse the develop explanation to ensure that you have chosen the appropriate develop.

- In case the develop does not match your specifications, take advantage of the Search discipline on top of the display to discover the one that does.

- If you are content with the shape, affirm your choice by simply clicking the Buy now option. Then, opt for the rates plan you like and offer your qualifications to register for the profile.

- Process the deal. Make use of your bank card or PayPal profile to accomplish the deal.

- Choose the file format and acquire the shape on the device.

- Make adjustments. Fill up, modify and printing and signal the delivered electronically Ohio Employment Application for Accountant.

Every format you included with your account lacks an expiry day and is also yours for a long time. So, if you would like acquire or printing one more backup, just go to the My Forms portion and click about the develop you will need.

Get access to the Ohio Employment Application for Accountant with US Legal Forms, by far the most considerable catalogue of lawful file templates. Use a large number of skilled and status-certain templates that satisfy your business or person needs and specifications.