The Ohio Lease or Rental of Computer Equipment refers to a legal document that outlines the terms and conditions for leasing or renting computer equipment in the state of Ohio. This type of agreement is widely used by individuals, businesses, and organizations who require temporary use of computer equipment without the need for making a long-term investment. The lease or rental agreement includes specific details such as the duration of the lease period, the rental fee, and the responsibilities of both the lessor (the equipment owner) and the lessee (the one renting or leasing the equipment). There are various types of Ohio Lease or Rental of Computer Equipment, each catering to different needs and preferences. Some common types include: 1. Fixed-term Lease: This type of lease specifies a predetermined lease period, usually ranging from a few months to a few years. The lessee pays a fixed rental fee for the entire lease duration. 2. Month-to-Month Lease: Here, the lease agreement is not fixed for a specific term, and the lessee continues to rent the computer equipment on a month-to-month basis until either party provides a written notice to terminate the agreement. 3. Equipment Rental Agreement: This type of agreement is more flexible and typically utilized for short-term computer equipment rentals. It is often used for events, trade shows, or temporary projects that require computer equipment for a specific duration. 4. Finance Lease: This lease agreement has more similarities to a loan agreement, where the lessee agrees to make fixed payments over a specified term to ultimately gain ownership of the computer equipment. When drafting an Ohio Lease or Rental of Computer Equipment, certain essential elements should be included. These elements typically consist of: 1. Identification of the parties involved, including the names and addresses of the lessor and lessee. 2. A detailed description of the computer equipment being leased, including the manufacturer, model, serial number, and any relevant specifications. 3. The duration of the lease agreement, specifying the start and end date of the lease period. 4. Payment terms, including the rental fee amount, frequency of payments (e.g., monthly), and acceptable payment methods. 5. Any security deposit requirements and the conditions for its return at the end of the lease. 6. Provisions related to maintenance, repairs, and insurance responsibilities during the lease period. 7. Information on potential penalties or consequences for breaching the terms of the agreement. 8. Terms regarding the return of the equipment at the end of the lease period, including any conditions for acceptable wear and tear. 9. Signatures of both parties to indicate their agreement to abide by the terms and conditions outlined in the lease agreement. It is important to note that while this description provides a general understanding of the Ohio Lease or Rental of Computer Equipment, it is vital to consult with a legal professional or review specific Ohio laws and regulations to ensure compliance with state-specific requirements.

Ohio Lease or Rental of Computer Equipment

Description

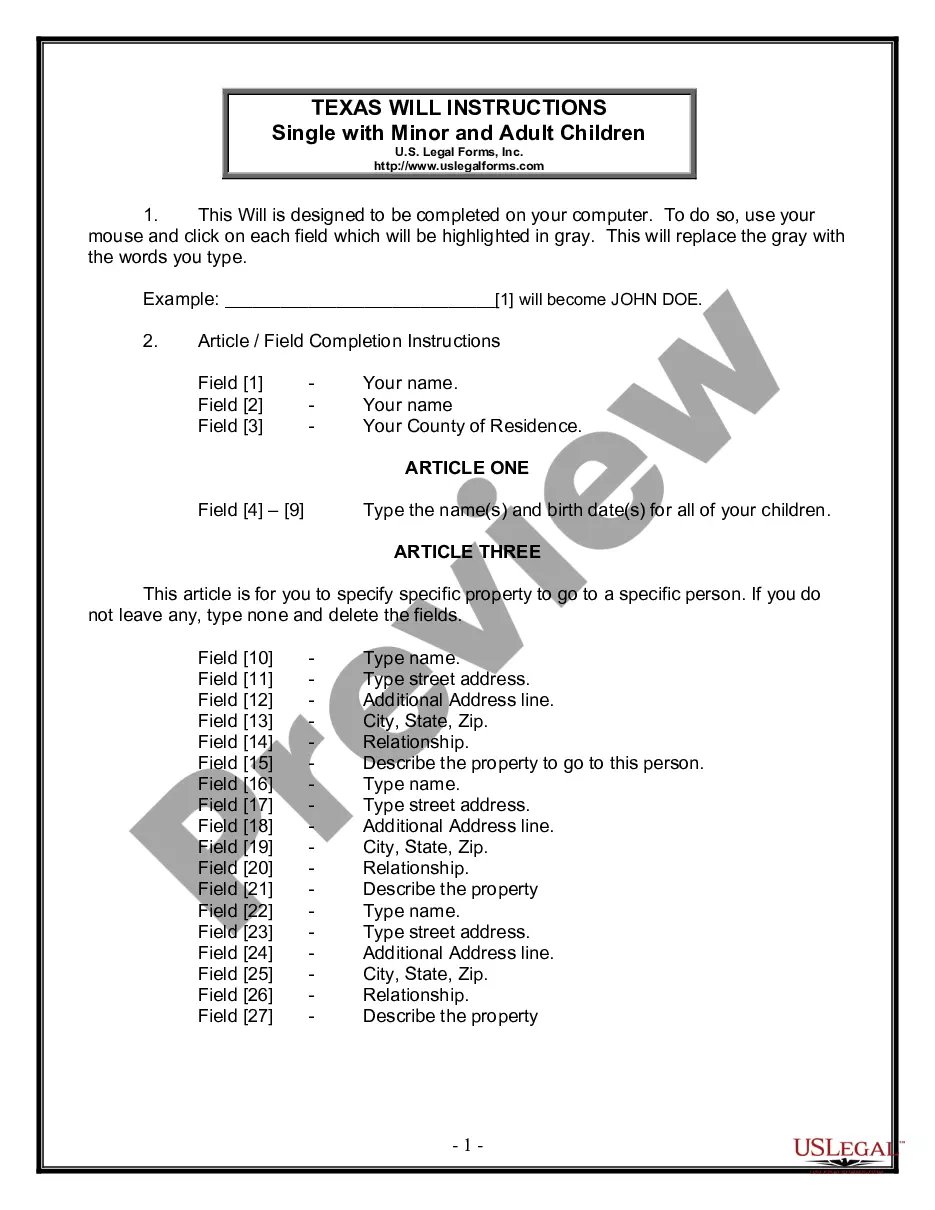

How to fill out Lease Or Rental Of Computer Equipment?

Uncovering the correct legal document template could be a challenge.

Clearly, there are numerous templates available online, but how can you find the legal form you require.

Take advantage of the US Legal Forms website. The platform offers thousands of templates, including the Ohio Lease or Rental of Computer Equipment, which you can utilize for both business and personal purposes.

If the form does not fulfill your needs, utilize the Search field to find the correct form.

- All of the forms are verified by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Obtain button to download the Ohio Lease or Rental of Computer Equipment.

- Use your account to browse the legal forms you have previously acquired.

- Visit the My documents section of your account and obtain another copy of the form you need.

- If you are a new user of US Legal Forms, here are straightforward instructions you should follow.

- First, ensure that you have selected the appropriate form for your city/state. You can preview the form using the Preview option and review the details to confirm that it meets your requirements.

Form popularity

FAQ

Renting a computer can offer considerable advantages for both individuals and businesses. It provides access to high-quality equipment without the long-term commitment of ownership. Additionally, leasing often includes maintenance and support, making it easier to manage your technology. An Ohio Lease or Rental of Computer Equipment can be a worthwhile investment for those who need flexibility in their operations.

Equipment rental in Ohio is typically taxable. This includes rentals of computer equipment, falling under the Ohio Lease or Rental of Computer Equipment category. Businesses must ensure they comply with reporting and sales tax obligations associated with such rentals. Utilizing the services of USLegalForms can help you gather the necessary documentation and stay compliant with Ohio tax laws.

Computer services in Ohio may be taxable depending on the specific service rendered. For instance, if a service includes the sale of software or hardware, it becomes taxable. Individuals and businesses participating in an Ohio Lease or Rental of Computer Equipment should be vigilant about these tax rules to avoid penalties. At USLegalForms, you can find important legal forms and guides to navigate these tax implications.

Yes, in Ohio, software as a service is typically subject to sales tax, as it is viewed as the sale of a service and tangible personal property. Engaging in an Ohio Lease or Rental of Computer Equipment further complicates matters, as the taxation might vary by specific offerings bundled with the service. Careful evaluation and understanding of these guidelines are essential for compliance, and resources from USLegalForms can help clarify these tax obligations.

Computer consulting services in Ohio can be taxable depending on the nature of the service provided. If the consulting involves tangible personal property, such as providing software with the service, it may be subject to tax. If you’re considering an Ohio Lease or Rental of Computer Equipment, ensuring clarity on these tax responsibilities is crucial. USLegalForms can assist in finding accurate documentation for your consulting agreements.

In Ohio, internet services are generally exempt from sales tax. This exemption extends to businesses renting computer equipment under an Ohio Lease or Rental of Computer Equipment agreement. However, certain additional services related to internet access may be taxable. It's wise to stay informed about these distinctions, and USLegalForms can help you find the right documents to support your business needs.

Software as a service (SaaS) has specific tax implications in Ohio. Generally, SaaS is considered taxable, as it's classified under services and tangible personal property. If you engage in an Ohio Lease or Rental of Computer Equipment, understand the nuances of these tax laws to ensure proper reporting. Resources available on USLegalForms can provide further clarification.

In Ohio, leased equipment under an Ohio Lease or Rental of Computer Equipment classification is typically treated as an expense rather than an asset. This means that businesses can deduct lease payments on their tax returns, which can lead to significant tax benefits. It's essential to keep accurate records and consult a tax professional to ensure compliance with state regulations. USLegalForms offers resources and guidance to navigate these requirements effectively.

Equipment rentals, including computer equipment, are generally not tax exempt in Ohio unless specific criteria are met. Certain industries or government-related activities may provide exemptions, but it's vital to ensure proper documentation and compliance. The Ohio Lease or Rental of Computer Equipment should be evaluated for tax implications. If you need more information, U.S. Legal Forms can help clarify your obligations.

Businesses in Ohio may claim tax exemption under specific conditions, such as purchases made for resale or certain non-profit organizations. Additionally, government entities or educational institutions may qualify for exemptions on the Ohio Lease or Rental of Computer Equipment. It is crucial to understand the rules surrounding these exemptions to ensure compliance. For any questions, U.S. Legal Forms provides valuable insights into tax regulations.