An Ohio Living Trust — Irrevocable is a legal tool available for residents of Ohio to manage their assets and property during their lifetime and ensure a seamless transfer of wealth to their chosen beneficiaries upon their death. This type of trust serves as an effective estate planning tool as it offers various benefits and protections. An irrevocable living trust is a legally binding agreement that takes effect during the granter's lifetime and cannot be altered or revoked without the consent of all involved parties — including thgranteror, trustee, and beneficiaries. Once the trust is established, the granter relinquishes control over the assets placed within it, providing important asset protection and potential tax advantages. Here are some relevant keywords to understand the concept of an Ohio Living Trust — Irrevocable: 1. Ohio Living Trust: A trust established by an individual (known as the granter) to hold property and assets for the benefit of one or more beneficiaries while the granter is alive. This type of trust is governed by Ohio state law. 2. Irrevocable Trust: In an irrevocable trust, the granter surrenders their rights to the assets held within the trust, making it unchangeable without the consent of all parties involved. This ensures the granter's assets are shielded from potential creditors and other financial risks. 3. Estate Planning: The process of organizing and structuring one's assets to ensure their efficient transfer to intended beneficiaries upon death. An irrevocable living trust can be an integral part of an individual's comprehensive estate plan. 4. Asset Protection: By placing assets within an irrevocable living trust, granters gain protection against potential claims from creditors or legal judgments. This trust structure separates personal assets from potential liabilities and can help preserve family wealth for future generations. 5. Tax Advantages: Ohio irrevocable living trusts may offer potential tax advantages, such as reducing estate taxes and capital gains taxes. This can facilitate the smooth transfer of wealth while minimizing the tax burden on beneficiaries. Some variations of Ohio Living Trust — Irrevocable include: 1. Medicaid Irrevocable Trust: This specific type of irrevocable trust helps individuals qualify for Medicaid benefits while preserving their assets. It ensures the granter's assets are not considered during the Medicaid eligibility assessment. 2. Life Insurance Trust: Often utilized to exclude life insurance proceeds from the taxable estate, this irrevocable trust allows policyholders to maintain control over their life insurance policies while still providing for their loved ones. 3. Charitable Remainder Trust: This trust allows the granter to contribute assets to a charitable organization while retaining income streams for a set period or the duration of the granter's life. This type of trust provides potential tax deductions and the satisfaction of supporting a favored charity. In conclusion, an Ohio Living Trust — Irrevocable is a legal tool that allows individuals in Ohio to protect their assets, enjoy potential tax advantages, and ensure a smooth transfer of wealth to their beneficiaries. Understanding the various types of irrevocable trusts available can help individuals tailor their estate plans to meet their specific goals and needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Fideicomiso en Vida - Irrevocable - Living Trust - Irrevocable

Description

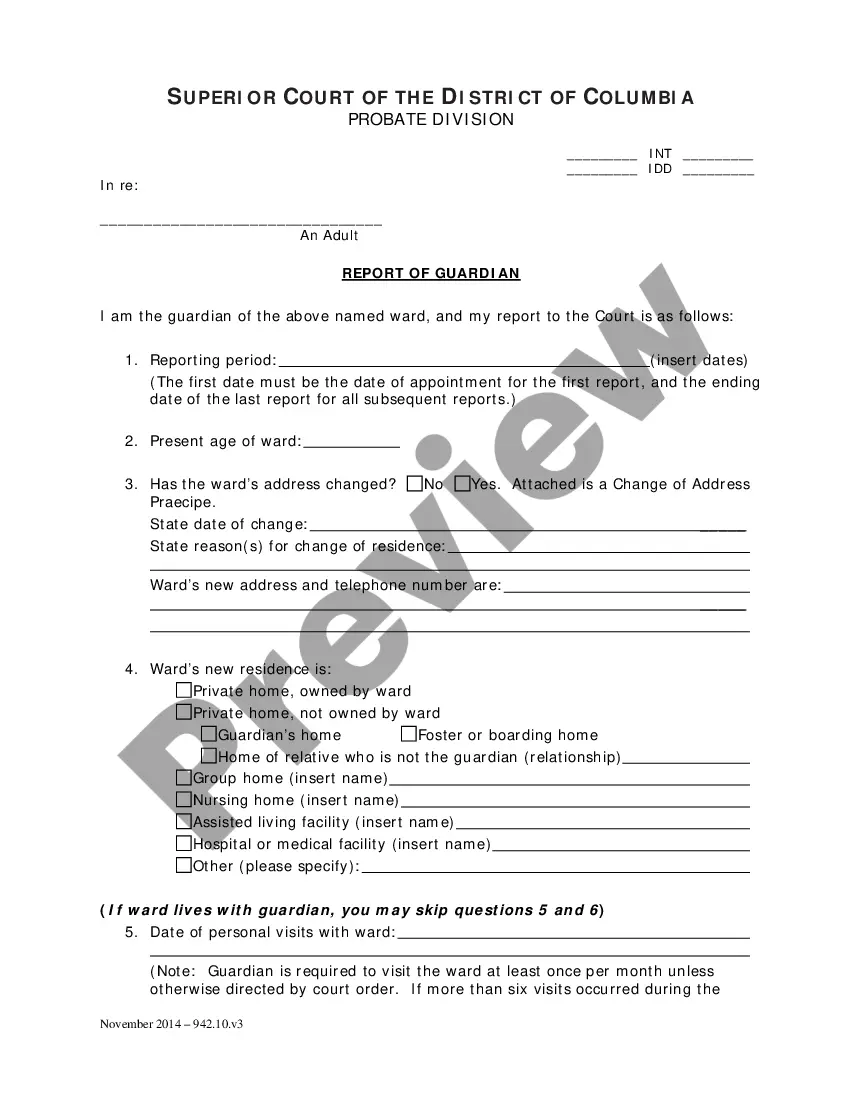

How to fill out Ohio Fideicomiso En Vida - Irrevocable?

If you want to comprehensive, down load, or print out authorized file web templates, use US Legal Forms, the most important assortment of authorized types, which can be found online. Take advantage of the site`s simple and handy look for to find the documents you want. Different web templates for business and personal reasons are categorized by categories and states, or search phrases. Use US Legal Forms to find the Ohio Living Trust - Irrevocable in just a couple of clicks.

When you are already a US Legal Forms consumer, log in to the bank account and then click the Down load switch to get the Ohio Living Trust - Irrevocable. You can even entry types you earlier acquired inside the My Forms tab of your bank account.

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the shape to the appropriate area/region.

- Step 2. Make use of the Review method to examine the form`s information. Never forget about to see the explanation.

- Step 3. When you are unhappy using the develop, make use of the Search field on top of the display screen to discover other versions of the authorized develop web template.

- Step 4. Upon having found the shape you want, go through the Get now switch. Choose the rates strategy you choose and add your qualifications to sign up for an bank account.

- Step 5. Procedure the transaction. You should use your Мisa or Ьastercard or PayPal bank account to accomplish the transaction.

- Step 6. Find the file format of the authorized develop and down load it on the device.

- Step 7. Full, revise and print out or indicator the Ohio Living Trust - Irrevocable.

Every single authorized file web template you get is yours eternally. You possess acces to each develop you acquired inside your acccount. Go through the My Forms section and choose a develop to print out or down load yet again.

Remain competitive and down load, and print out the Ohio Living Trust - Irrevocable with US Legal Forms. There are many professional and status-certain types you can use for the business or personal needs.