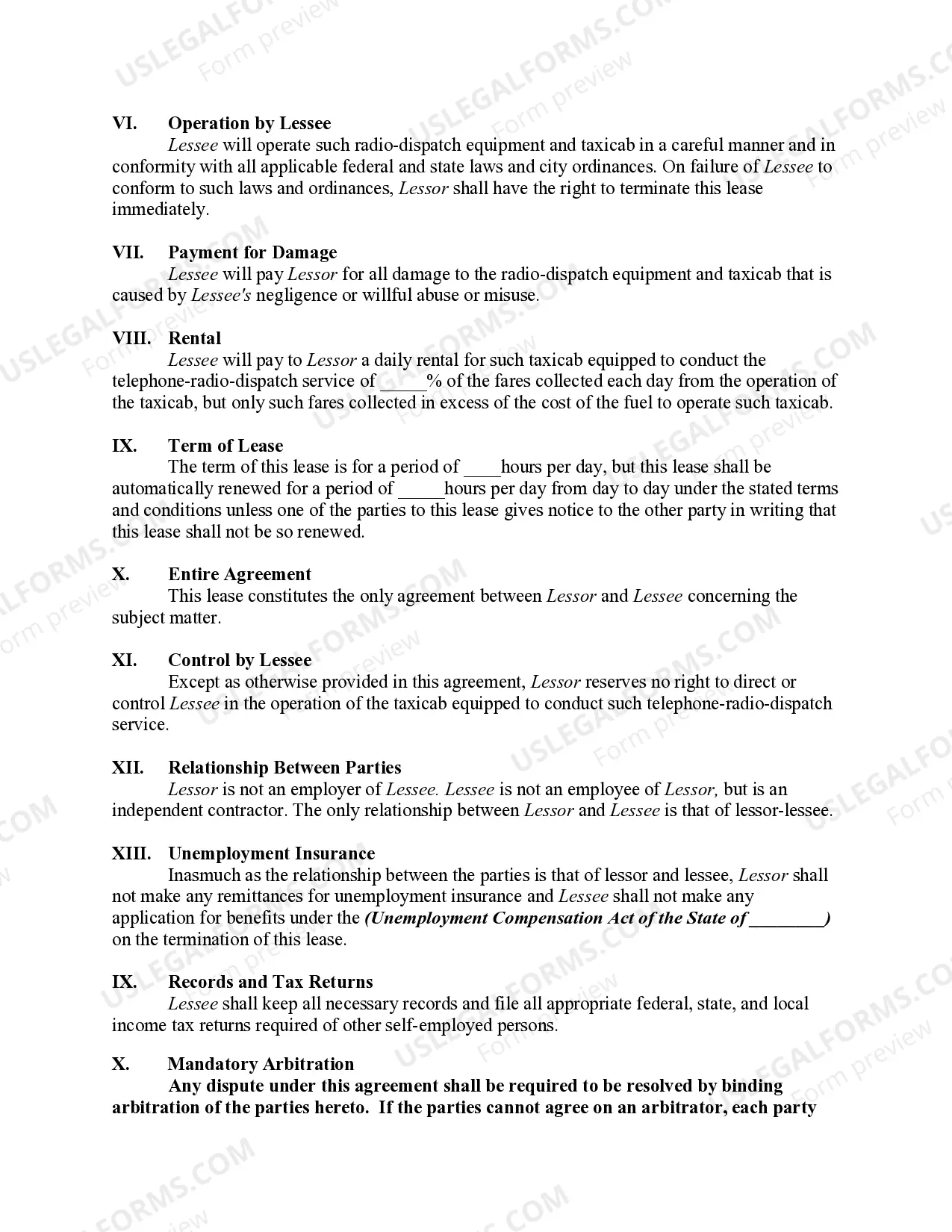

Ohio Lease of Taxicab

Description

How to fill out Lease Of Taxicab?

It is feasible to spend hours online attempting to locate the valid document template that meets the federal and state standards you desire.

US Legal Forms offers numerous valid forms that have been assessed by professionals.

You can easily download or print the Ohio Lease of Taxicab from my services.

Should you wish to find another version of the form, utilize the Search field to locate the template that meets your needs and specifications.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- After this, you can complete, modify, print, or sign the Ohio Lease of Taxicab.

- Each valid document template you purchase is yours permanently.

- To obtain another copy of the acquired form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the region/city of your choice.

- Review the form details to make sure you have chosen the correct form.

Form popularity

FAQ

Yes, Ohio does require a chauffeur's license to drive certain types of vehicles, including taxicabs. This license permits individuals to operate vehicles designed to transport passengers for hire. Obtaining this license is part of the Ohio Lease of Taxicab requirements, ensuring that drivers meet safety and legal standards. If you need assistance navigating the process, uslegalforms can provide you with the necessary documentation and support.

To obtain a taxi license in Ohio, you must first meet your local municipality's requirements, which often include submitting an application, passing a background check, and providing proof of insurance. After clearing these steps, you will receive your taxi license if you meet all criteria. This license is essential for operating under the Ohio Lease of Taxicab regulations. For an organized approach, consider using uslegalforms to streamline your application process.

In Ohio, attending a truck driving school is not strictly required to obtain a Commercial Driver's License (CDL). However, completing an approved training program can significantly enhance your skills and increase your chances of passing the required exams. Once you have your CDL, you can then apply for a taxi license, furthering your journey in the Ohio Lease of Taxicab sector. For additional guidance, uslegalforms offers valuable templates and resources.

The time it takes to obtain a license in Ohio can vary based on several factors, including the type of license you need. Generally, for a taxi license, the process may take a few weeks once all necessary documentation is submitted. It is important to ensure you have all the required paperwork in order to minimize delays. To learn more about the Ohio Lease of Taxicab process, you can use resources from uslegalforms.

The sales tax on a truck in Ohio typically starts at 5.75%, with potential additional local taxes depending on the municipality. When purchasing a truck, it is essential to consider these factors to budget for total costs accurately. Understanding the sales tax implications can also assist you in managing expenses related to leasing a taxicab in Ohio effectively. Always consult state tax regulations or a professional for the most current information.

Semi-trucks are not automatically tax exempt in Ohio. Generally, they are subject to the same sales tax regulations applicable to other vehicles. However, specific situations may arise where exemptions apply, particularly for trucks used in certain industries or under specific conditions. It is advisable to review your tax obligations related to an Ohio lease of taxicab to determine if your semi-truck qualifies for any exemptions.

Certain organizations and purchases can qualify for a sales tax exemption in Ohio. For instance, non-profits and government entities often enjoy sales tax exemptions. Additionally, specific items, like items for resale, may not be subject to sales tax. Understanding these exemptions can be beneficial when planning financial obligations around an Ohio lease of taxicab.

To obtain a taxi license in Ohio, you need to meet various requirements set by the Ohio Department of Public Safety. Typically, this process involves providing identification, completing a background check, and passing a driving test. Additionally, having a valid lease of taxicab can streamline your licensing process, ensuring compliance with local regulations. Ensure that you also check any city-specific rules for taxi operation.