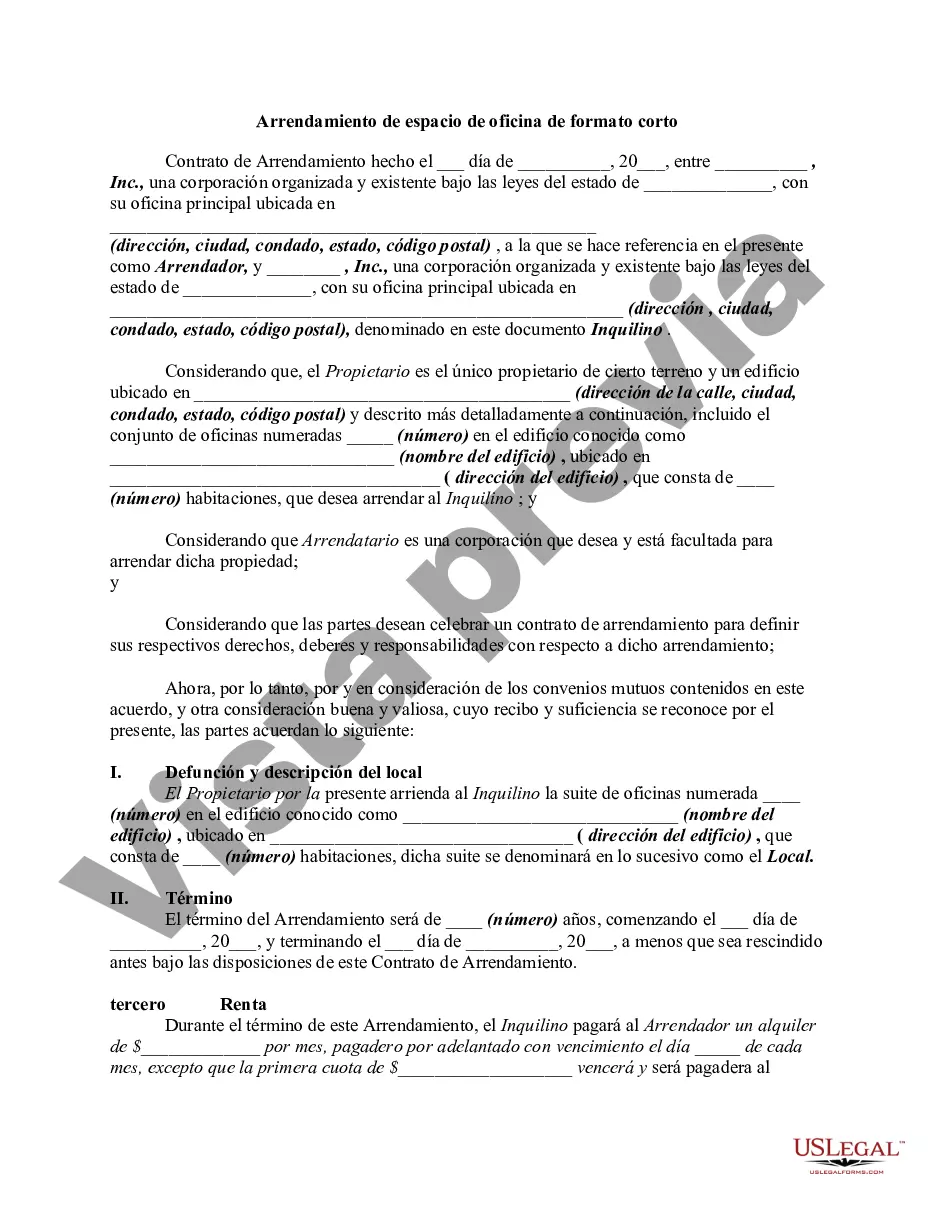

The Ohio Short Form Lease of Office Space is a legal document that outlines the terms and conditions for renting office space in the state of Ohio. This lease agreement is specifically designed for commercial real estate rental purposes, providing clear and concise language to protect the rights and obligations of both the landlord and tenant. Keywords: Ohio Short Form Lease, office space, real estate rental, commercial lease agreement, terms and conditions, landlord, tenant. The Ohio Short Form Lease of Office Space serves as a binding contract between the property owner, referred to as the landlord, and the individual or company seeking to rent the office space, referred to as the tenant. By using this agreement, both parties can establish a solid foundation for their leasing relationship. This lease agreement covers essential aspects such as the rental term duration, rental payment schedule, security deposit requirements, utilities and maintenance responsibilities, insurance requirements, and any additional provisions deemed necessary for the specific office space being rented. It ensures that all parties involved are aware of their rights, obligations, and liabilities. Different types or variations of the Ohio Short Form Lease of Office Space may exist depending on the specifics of the rental arrangement. Some common variations include: 1. Modified Gross Lease: This type of lease agreement typically requires the tenant to pay a base rent along with a portion of the property's operating expenses, such as utilities or maintenance costs. The specific terms can vary and should be clearly outlined in the agreement. 2. Full-Service Lease: In this type of lease, the tenant pays a single monthly fee that covers all expenses, including rent, utilities, maintenance, insurance, and property taxes. This arrangement provides simplicity and convenience for the tenant, as they don't have to manage individual payments for different services. 3. Net Lease: A net lease requires the tenant to pay a base rent along with additional expenses such as taxes, insurance, or maintenance costs. These expenses are typically divided between the landlord and tenant based on a predetermined formula. This type of lease allows the landlord to shift certain costs to the tenant. 4. Sublease Agreement: Sometimes, a tenant may opt to sublease the office space they leased from the landlord to another party. In such cases, the Ohio Short Form Lease can be used to establish the relationship between the original tenant (sublessor), the new tenant (sublessee), and the landlord. When using any type of lease agreement, it is crucial to consult with a legal professional to ensure compliance with Ohio state laws and regulations. Additionally, both landlords and tenants are encouraged to thoroughly review the lease terms and negotiate any necessary changes to ensure transparency and fairness in the rental arrangement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Arrendamiento de espacio de oficina en forma abreviada - Alquiler de bienes raíces - Short Form Lease of Office Space - Real Estate Rental

Description

How to fill out Ohio Arrendamiento De Espacio De Oficina En Forma Abreviada - Alquiler De Bienes Raíces?

Are you currently inside a placement that you require files for either business or specific uses virtually every day time? There are a variety of authorized record themes available on the net, but getting kinds you can trust is not effortless. US Legal Forms provides thousands of type themes, like the Ohio Short Form Lease of Office Space - Real Estate Rental, which are published in order to meet state and federal specifications.

When you are currently knowledgeable about US Legal Forms site and get an account, merely log in. After that, you are able to acquire the Ohio Short Form Lease of Office Space - Real Estate Rental design.

Unless you offer an accounts and want to start using US Legal Forms, adopt these measures:

- Obtain the type you require and ensure it is for that proper city/state.

- Take advantage of the Preview option to analyze the shape.

- Look at the outline to ensure that you have selected the proper type.

- In case the type is not what you are searching for, take advantage of the Search industry to obtain the type that fits your needs and specifications.

- If you discover the proper type, just click Get now.

- Choose the prices program you want, fill out the desired info to produce your account, and purchase the order making use of your PayPal or Visa or Mastercard.

- Choose a practical paper file format and acquire your duplicate.

Get all of the record themes you may have purchased in the My Forms food list. You can get a further duplicate of Ohio Short Form Lease of Office Space - Real Estate Rental whenever, if required. Just go through the required type to acquire or print out the record design.

Use US Legal Forms, probably the most substantial collection of authorized varieties, to conserve efforts and steer clear of mistakes. The services provides appropriately produced authorized record themes that you can use for a selection of uses. Make an account on US Legal Forms and begin making your lifestyle a little easier.