The Ohio Limited Liability Partnership Agreement is a legal document that outlines the terms and conditions of a partnership operating in Ohio. It is designed to protect the rights and interests of the partners while establishing a framework for the partnership's operations and management. This agreement is crucial for businesses planning to operate as a limited liability partnership (LLP) in Ohio, as it defines the legal relationship between partners and ensures compliance with state regulations. The Ohio Limited Liability Partnership Agreement typically includes provisions related to the partnership's purpose, capital contributions, profit and loss distribution, decision-making authority, withdrawal or addition of partners, dispute resolution, and dissolution procedures. It also addresses liability protection, which is a defining characteristic of Laps — partners are shielded from personal liability for the partnership's debts and obligations, with limited exceptions. Different types of Ohio Limited Liability Partnership Agreements may exist based on the nature of the partnership or the specific requirements of the partners. For example, there are LLP agreements tailored for professional services practices like law firms, accounting firms, and healthcare practices. The Ohio Uniform Partnership Act, which governs general partnerships, also provides guidelines for Laps in the state. Therefore, the Ohio Limited Liability Partnership Agreement may vary based on the specific industry or profession the partnership operates in. Ohio LLP agreements should adhere to the guidelines and regulations set by the Ohio Secretary of State's office. Partners should ensure that the agreement contains all essential clauses to protect their interests and maintain compliance with state laws. Seeking legal counsel is highly recommended drafting or review the partnership agreement, as it ensures that all relevant legal aspects are covered and the agreement meets the unique needs of the partners. In summary, the Ohio Limited Liability Partnership Agreement is a legally binding document that governs the operations and partnership structure of an LLP in Ohio. It protects partners' interests, provides liability protection, and establishes guidelines for decision-making, profit sharing, and dispute resolution. The agreement can vary based on the type of partnership or the industry it pertains to, making it essential for partners to consult with legal professionals to ensure compliance with state regulations and the inclusion of necessary clauses.

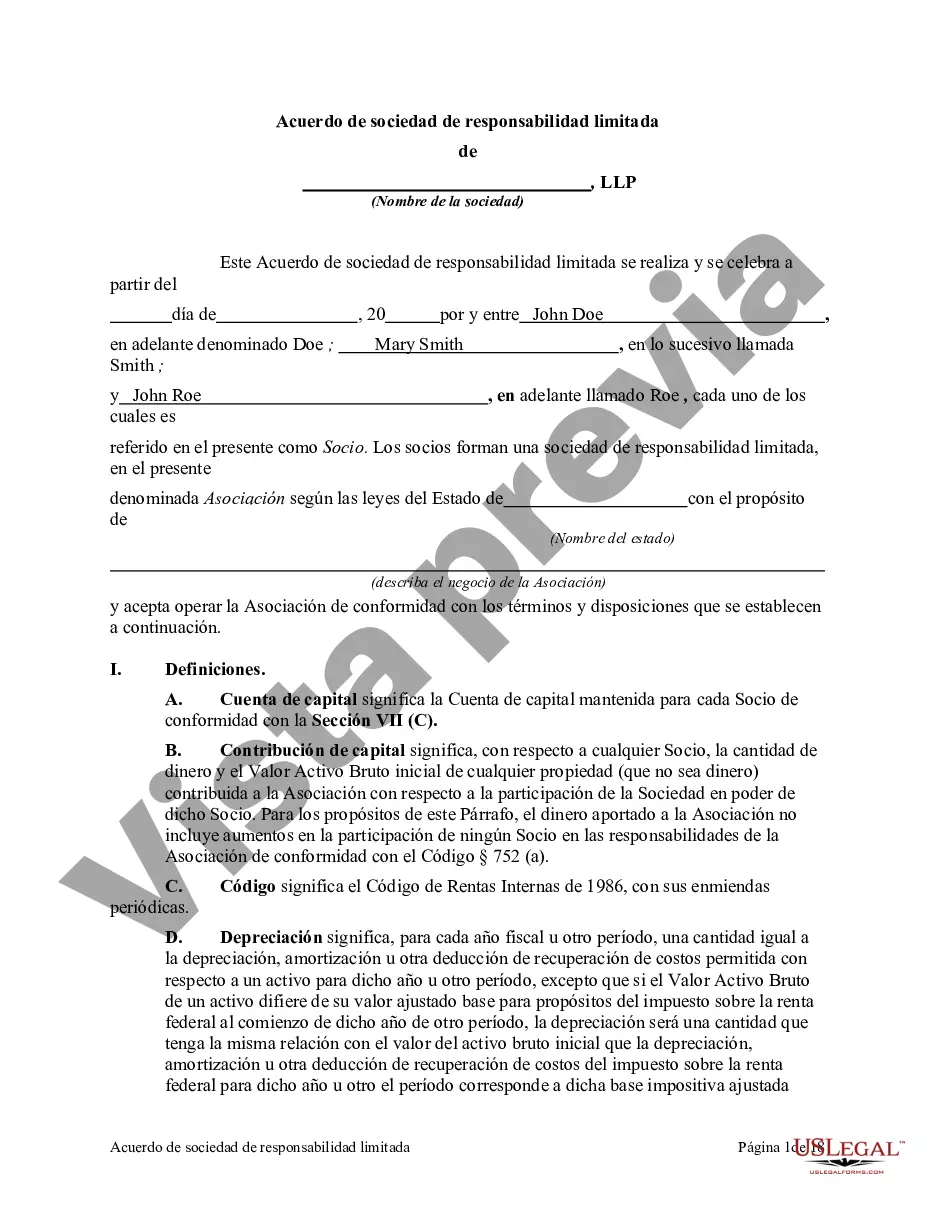

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Acuerdo de sociedad de responsabilidad limitada - Limited Liability Partnership Agreement

Description

How to fill out Ohio Acuerdo De Sociedad De Responsabilidad Limitada?

Are you in the place the place you will need papers for either enterprise or person functions just about every working day? There are plenty of legitimate papers web templates accessible on the Internet, but getting versions you can trust is not simple. US Legal Forms offers a large number of kind web templates, such as the Ohio Limited Liability Partnership Agreement, that are composed in order to meet federal and state needs.

When you are already acquainted with US Legal Forms site and get a free account, basically log in. Afterward, you are able to down load the Ohio Limited Liability Partnership Agreement template.

Should you not provide an bank account and need to begin to use US Legal Forms, follow these steps:

- Get the kind you want and ensure it is for the proper metropolis/area.

- Use the Preview switch to examine the shape.

- See the explanation to ensure that you have selected the right kind.

- If the kind is not what you`re searching for, utilize the Lookup industry to obtain the kind that fits your needs and needs.

- If you discover the proper kind, just click Acquire now.

- Opt for the pricing strategy you need, fill out the desired information to make your account, and pay money for the transaction using your PayPal or credit card.

- Select a handy file structure and down load your duplicate.

Discover each of the papers web templates you might have bought in the My Forms food list. You may get a more duplicate of Ohio Limited Liability Partnership Agreement any time, if necessary. Just click the necessary kind to down load or produce the papers template.

Use US Legal Forms, by far the most extensive selection of legitimate types, to conserve efforts and steer clear of errors. The assistance offers professionally manufactured legitimate papers web templates which you can use for an array of functions. Generate a free account on US Legal Forms and commence making your way of life a little easier.