With regard to the collection part of this form agreement, the Federal Fair Debt Collection Practices Act prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. Also, certain false or misleading representations are forbidden, such as representing that the debt collector is associated with the state or federal government, stating that the debtor will go to jail if he does not pay the debt. This Act also sets out strict rules regarding communicating with the debtor.

The Ohio Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legal document that outlines the terms and conditions for the sale and purchase of accounts receivable between a seller and a buyer in Ohio. This agreement allows the seller to transfer their accounts receivable to the buyer, who agrees to collect the outstanding payments. The Ohio Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable typically includes the following key elements: 1. Parties Involved: The agreement identifies the seller and the buyer, along with their legal names and addresses. It is crucial to provide accurate details to ensure the validity of the contract. 2. Accounts Receivable Information: The agreement should provide a comprehensive list of the accounts receivable being sold, including the names of the debtors, outstanding balances, invoice numbers, and payment due dates. 3. Purchase Price and Payment Terms: One of the essential aspects of this agreement is the purchase price to be paid by the buyer to the seller for the accounts receivable. The agreement should outline the payment terms, such as the due date, amount, and method of payment. 4. Seller's Obligations: The seller is generally obligated to continue collecting the accounts receivable until they are fully paid. This includes diligent collection efforts, such as sending invoices, reminders, and following up with unpaid debtors. 5. Representations and Warranties: Both the seller and the buyer may include a section in the agreement where they make certain representations and warranties about their authority, ownership of accounts receivable, and other relevant aspects to protect their interests. 6. Confidentiality and Non-Compete Clauses: Some agreements may include confidentiality clauses to ensure that sensitive information about the accounts receivable and business operations is not disclosed. Non-compete clauses may also be added to prevent the seller from entering into a similar business and competing with the buyer. 7. Indemnification and Dispute Resolution: It is crucial to include provisions for indemnification in case of any losses or damages incurred due to the breach of the agreement. Additionally, the agreement should specify the applicable law and the preferred method of dispute resolution, such as arbitration or mediation. Different types of Ohio Agreements for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable may include variations based on specific industries or unique provisions required by the parties involved. For example, there might be specific agreements tailored to the healthcare sector, manufacturing industry, or construction businesses. These variations would address industry-specific considerations and requirements.The Ohio Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable is a legal document that outlines the terms and conditions for the sale and purchase of accounts receivable between a seller and a buyer in Ohio. This agreement allows the seller to transfer their accounts receivable to the buyer, who agrees to collect the outstanding payments. The Ohio Agreement for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable typically includes the following key elements: 1. Parties Involved: The agreement identifies the seller and the buyer, along with their legal names and addresses. It is crucial to provide accurate details to ensure the validity of the contract. 2. Accounts Receivable Information: The agreement should provide a comprehensive list of the accounts receivable being sold, including the names of the debtors, outstanding balances, invoice numbers, and payment due dates. 3. Purchase Price and Payment Terms: One of the essential aspects of this agreement is the purchase price to be paid by the buyer to the seller for the accounts receivable. The agreement should outline the payment terms, such as the due date, amount, and method of payment. 4. Seller's Obligations: The seller is generally obligated to continue collecting the accounts receivable until they are fully paid. This includes diligent collection efforts, such as sending invoices, reminders, and following up with unpaid debtors. 5. Representations and Warranties: Both the seller and the buyer may include a section in the agreement where they make certain representations and warranties about their authority, ownership of accounts receivable, and other relevant aspects to protect their interests. 6. Confidentiality and Non-Compete Clauses: Some agreements may include confidentiality clauses to ensure that sensitive information about the accounts receivable and business operations is not disclosed. Non-compete clauses may also be added to prevent the seller from entering into a similar business and competing with the buyer. 7. Indemnification and Dispute Resolution: It is crucial to include provisions for indemnification in case of any losses or damages incurred due to the breach of the agreement. Additionally, the agreement should specify the applicable law and the preferred method of dispute resolution, such as arbitration or mediation. Different types of Ohio Agreements for Sale and Purchase of Accounts Receivable of Business with Seller Agreeing to Collect the Accounts Receivable may include variations based on specific industries or unique provisions required by the parties involved. For example, there might be specific agreements tailored to the healthcare sector, manufacturing industry, or construction businesses. These variations would address industry-specific considerations and requirements.

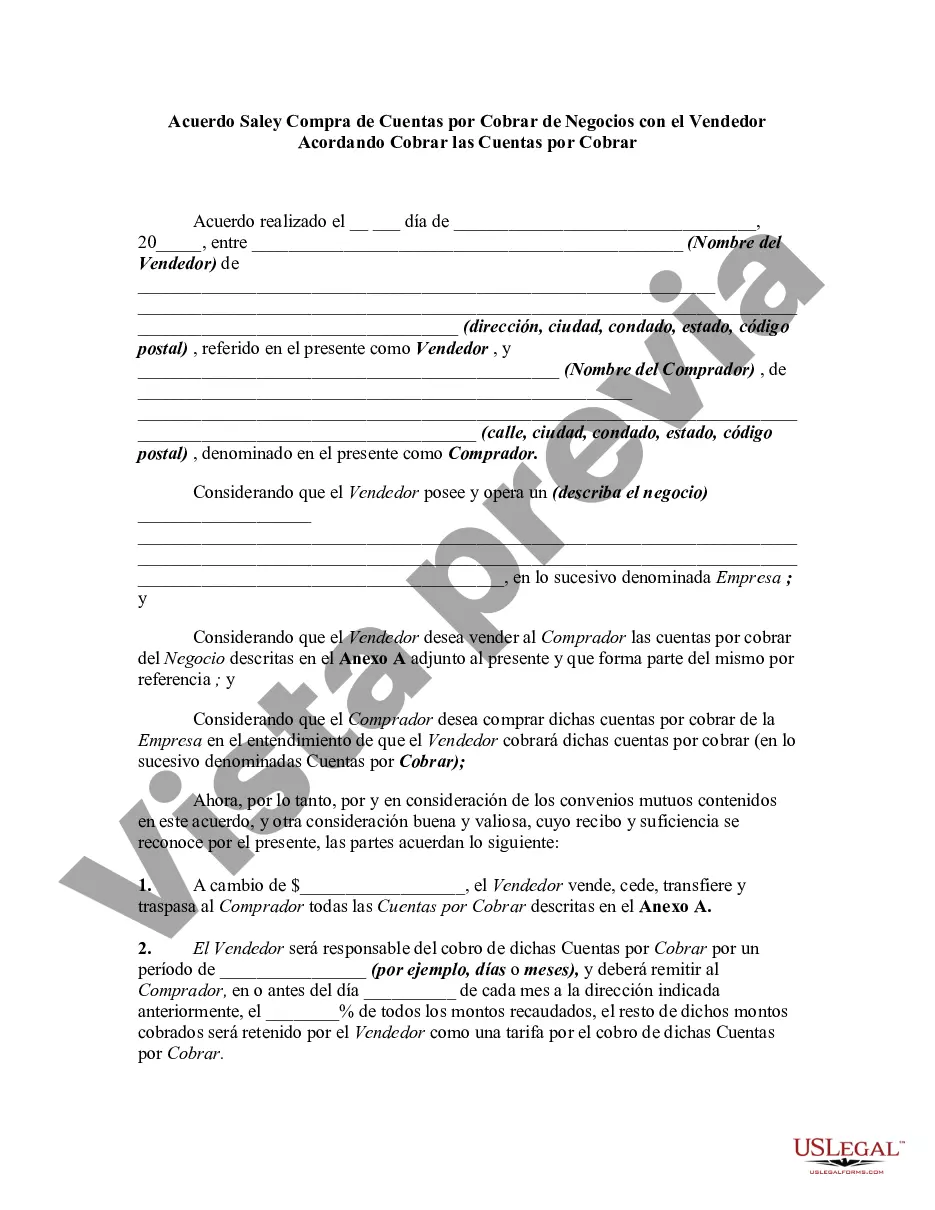

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.