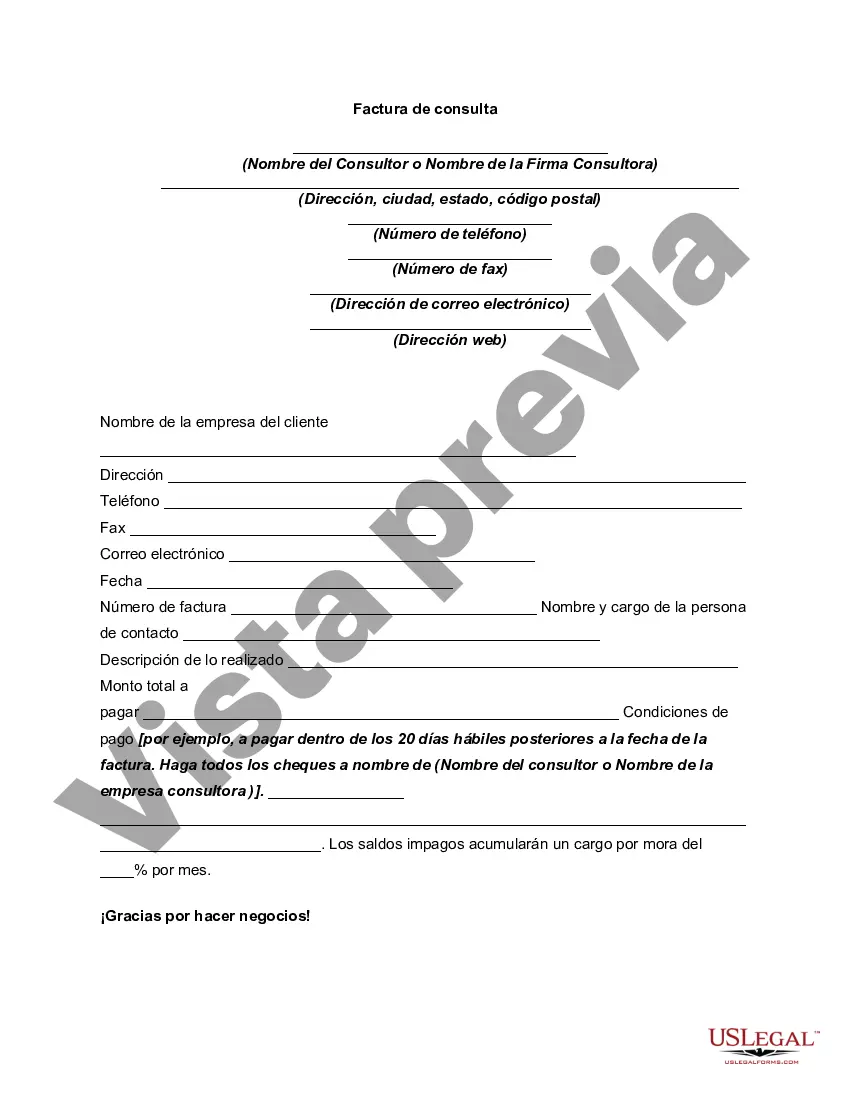

An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Ohio Consulting Invoice is a professional document used by consulting firms in the state of Ohio to request payment for their services. It serves as a formal record of the services rendered, the amount owed, and the payment terms agreed upon by the consultant and the client. This invoice ensures transparency and provides a clear breakdown of the services provided, enabling seamless coordination between the consulting firm and the client. The Ohio Consulting Invoice typically includes the following key information: 1. Consultant Details: The invoice begins with the contact information of the consulting firm or consultant, including their name, address, phone number, and email address. 2. Client Details: The invoice also includes the client's information, such as their name, company name, address, phone number, and email address. This ensures that the invoice is directed to the correct recipient and helps maintain accurate records for future reference. 3. Invoice Number/Date: Each invoice is assigned a unique identification number and includes the date of issue. This helps in easy tracking, organization, and reference for both parties involved. 4. Description of Services: The invoice provides a detailed description of the consulting services rendered, including the nature of the tasks performed, the duration of the project, and any additional relevant information. It is important to be specific and concise in outlining the services to avoid confusion and disputes. 5. Hourly Rate/Project Rate: The Ohio Consulting Invoice specifies the agreed-upon rate for the services provided. Consultants often charge either an hourly rate or a fixed project rate, depending on the nature of the work. It is crucial to clearly mention the applicable rate to ensure accurate billing. 6. Total Amount Due: This section includes the subtotal of services rendered, any applicable taxes, and the final total amount due. It also mentions any discounts applied, if applicable. 7. Payment Terms: The invoice outlines the payment terms agreed upon by the consulting firm and the client. This may include the due date, preferred payment method, and any late payment penalties or interest charges. 8. Payment Details: The invoice provides information on how the client can make payment, such as bank account details, online payment options, or mailing address for checks. Types of Ohio Consulting Invoices: 1. Hourly Consulting Invoice: This type of invoice is used when consultants charge their clients based on the number of hours spent on a project. It includes an itemized list of hours worked, the hourly rate, and the total amount due. 2. Fixed-Price Consulting Invoice: This invoice is used when consultants charge a flat fee for a specific project. It includes a detailed description of the services provided, the agreed-upon fixed price, and the total amount due. 3. Retainer Consulting Invoice: Consultants often work under a retainer agreement. In this case, the invoice indicates the retainer amount paid by the client, deducts any fees already invoiced, and specifies the remaining balance due. In conclusion, the Ohio Consulting Invoice is a crucial document for consultants and clients in Ohio, providing a detailed breakdown of services rendered, payment terms, and the total amount due. It ensures transparency, facilitates smooth financial transactions, and serves as an official record of the business relationship between the consulting firm and the client.Ohio Consulting Invoice is a professional document used by consulting firms in the state of Ohio to request payment for their services. It serves as a formal record of the services rendered, the amount owed, and the payment terms agreed upon by the consultant and the client. This invoice ensures transparency and provides a clear breakdown of the services provided, enabling seamless coordination between the consulting firm and the client. The Ohio Consulting Invoice typically includes the following key information: 1. Consultant Details: The invoice begins with the contact information of the consulting firm or consultant, including their name, address, phone number, and email address. 2. Client Details: The invoice also includes the client's information, such as their name, company name, address, phone number, and email address. This ensures that the invoice is directed to the correct recipient and helps maintain accurate records for future reference. 3. Invoice Number/Date: Each invoice is assigned a unique identification number and includes the date of issue. This helps in easy tracking, organization, and reference for both parties involved. 4. Description of Services: The invoice provides a detailed description of the consulting services rendered, including the nature of the tasks performed, the duration of the project, and any additional relevant information. It is important to be specific and concise in outlining the services to avoid confusion and disputes. 5. Hourly Rate/Project Rate: The Ohio Consulting Invoice specifies the agreed-upon rate for the services provided. Consultants often charge either an hourly rate or a fixed project rate, depending on the nature of the work. It is crucial to clearly mention the applicable rate to ensure accurate billing. 6. Total Amount Due: This section includes the subtotal of services rendered, any applicable taxes, and the final total amount due. It also mentions any discounts applied, if applicable. 7. Payment Terms: The invoice outlines the payment terms agreed upon by the consulting firm and the client. This may include the due date, preferred payment method, and any late payment penalties or interest charges. 8. Payment Details: The invoice provides information on how the client can make payment, such as bank account details, online payment options, or mailing address for checks. Types of Ohio Consulting Invoices: 1. Hourly Consulting Invoice: This type of invoice is used when consultants charge their clients based on the number of hours spent on a project. It includes an itemized list of hours worked, the hourly rate, and the total amount due. 2. Fixed-Price Consulting Invoice: This invoice is used when consultants charge a flat fee for a specific project. It includes a detailed description of the services provided, the agreed-upon fixed price, and the total amount due. 3. Retainer Consulting Invoice: Consultants often work under a retainer agreement. In this case, the invoice indicates the retainer amount paid by the client, deducts any fees already invoiced, and specifies the remaining balance due. In conclusion, the Ohio Consulting Invoice is a crucial document for consultants and clients in Ohio, providing a detailed breakdown of services rendered, payment terms, and the total amount due. It ensures transparency, facilitates smooth financial transactions, and serves as an official record of the business relationship between the consulting firm and the client.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.