The Ohio Cash Flow Statement is a financial report that provides a detailed overview of the inflow and outflow of cash within a specific period for an organization or business entity operating in the state of Ohio. This statement is essential for gauging the financial health and sustainability of a company by documenting its cash generating activities and the utilization of those funds. The Ohio Cash Flow Statement consists of three main sections: operating activities, investing activities, and financing activities. Each section focuses on different aspects of cash flow to provide a holistic view of a company's financial performance. The first section, operating activities, depicts the cash inflows and outflows resulting from the core operational activities of the business. It encompasses cash received from sales revenue, cash paid to suppliers and employees, and other operating expenses. Operating activities are essential for understanding the cash generation capabilities of a business and its ability to sustain its operations. The investing activities section of the Ohio Cash Flow Statement focuses on the cash flow associated with the purchase or sale of long-term assets, such as property, plant, and equipment. It also includes cash flows from investments in securities or other companies, providing insights into the company's growth and expansion plans. The third and final section, financing activities, highlights the inflow and outflow of cash resulting from financing sources. This includes cash received from issuing debt or equity, repayment of borrowings, dividend payments, and other financing-related transactions. Analyzing this section helps assess the company's ability to raise funds and meet its financial obligations. Overall, the Ohio Cash Flow Statement is a crucial financial document that aids in evaluating the cash position and liquidity of a business operating in Ohio. By assessing the different sections, investors, creditors, and other stakeholders can gain a comprehensive understanding of the cash flow dynamics and financial stability of the company in question. Different types of Ohio Cash Flow Statements may include monthly, quarterly, or annual reports, depending on the reporting requirements and preferences of the company. Additionally, specialized variations can be created to focus on specific industries or sectors, such as manufacturing, healthcare, or technology. These tailored statements allow for a more detailed analysis of cash flow activities specific to the respective industry, enabling better decision-making and financial planning.

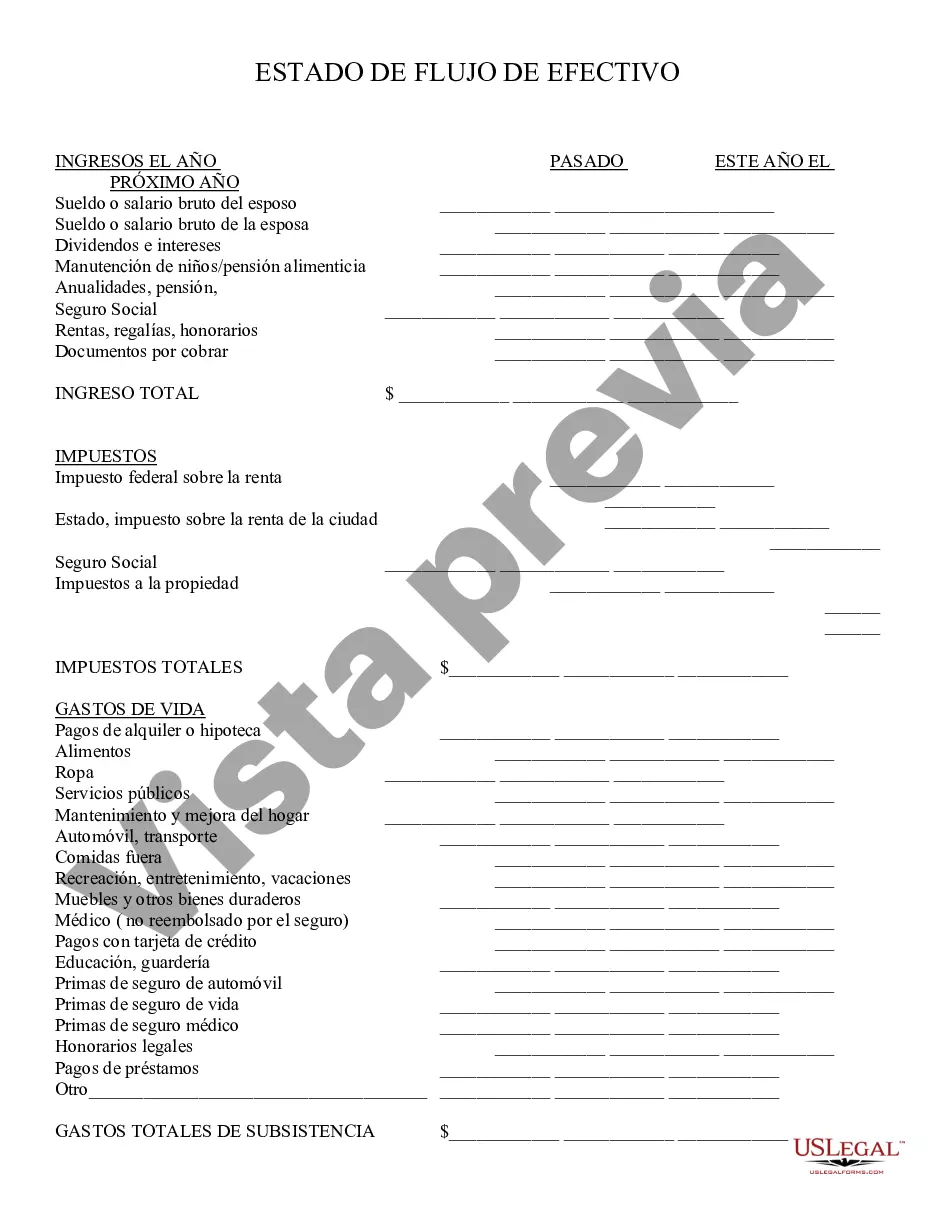

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Estado de Flujo de Efectivo - Cash Flow Statement

Description

How to fill out Ohio Estado De Flujo De Efectivo?

Have you been within a position that you need to have papers for sometimes enterprise or specific reasons nearly every working day? There are a variety of lawful file web templates available on the Internet, but locating kinds you can rely on isn`t straightforward. US Legal Forms gives a huge number of develop web templates, just like the Ohio Cash Flow Statement, that happen to be written in order to meet federal and state demands.

In case you are already acquainted with US Legal Forms internet site and get your account, basically log in. Following that, you are able to down load the Ohio Cash Flow Statement web template.

If you do not provide an account and wish to begin using US Legal Forms, follow these steps:

- Discover the develop you will need and ensure it is for that appropriate metropolis/area.

- Make use of the Review button to check the shape.

- See the explanation to ensure that you have chosen the appropriate develop.

- When the develop isn`t what you are trying to find, use the Lookup industry to obtain the develop that fits your needs and demands.

- Whenever you get the appropriate develop, click on Buy now.

- Choose the costs prepare you want, submit the specified information to create your money, and pay money for an order utilizing your PayPal or charge card.

- Choose a practical file formatting and down load your version.

Get every one of the file web templates you might have purchased in the My Forms food selection. You can aquire a more version of Ohio Cash Flow Statement any time, if possible. Just select the essential develop to down load or print the file web template.

Use US Legal Forms, by far the most considerable variety of lawful kinds, to conserve efforts and steer clear of blunders. The support gives professionally made lawful file web templates that you can use for a range of reasons. Create your account on US Legal Forms and initiate creating your daily life a little easier.