As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

The Ohio Report of Independent Accountants after Audit of Financial Statements is a comprehensive document that provides an in-depth analysis and evaluation of an organization's financial performance, compliance with regulations, and overall accountability. This report serves as a crucial tool for stakeholders, including investors, creditors, and government agencies, to gain insights into the financial health and transparency of the organization. The Ohio Report of Independent Accountants after Audit of Financial Statements consists of several types, each serving a specific purpose and providing valuable information. Some key types of reports include: 1. Standard Ohio Report of Independent Accountants: This report is the most common and provides a detailed analysis of an organization's financial statements, including the balance sheet, income statement, and cash flow statement. It examines the accuracy and fairness of the financial information presented and assesses the organization's compliance with applicable accounting principles and regulations. 2. Ohio Auditor of State Report: This report specifically pertains to public sector organizations in Ohio and is issued by the Ohio Auditor of State. It evaluates the financial statements of government agencies, municipalities, school districts, and other public entities, ensuring adherence to governmental accounting standards and regulations. 3. Ohio Single Audit Report: This type of report is conducted in accordance with the Single Audit Act and provides an assessment of an organization's financial statements, internal controls, and compliance with federal grant requirements. It is typically mandatory for organizations that receive federal funding or grants. 4. Ohio Compliance Report: This report focuses primarily on an organization's adherence to specific laws, regulations, or contracts. It assesses whether the organization has complied with relevant financial and operational requirements and identifies any instances of non-compliance. 5. Ohio Review Report: A review report is less detailed than an audit report and provides limited assurance on an organization's financial statements. It involves analytical procedures and inquiries rather than the comprehensive examination conducted in an audit. These various types of Ohio Reports of Independent Accountants after Audit of Financial Statements cater to the diverse needs of different organizations and stakeholders. They play a critical role in ensuring transparency, accountability, and trust in Ohio's financial systems and contribute to the overall economic integrity of the state.The Ohio Report of Independent Accountants after Audit of Financial Statements is a comprehensive document that provides an in-depth analysis and evaluation of an organization's financial performance, compliance with regulations, and overall accountability. This report serves as a crucial tool for stakeholders, including investors, creditors, and government agencies, to gain insights into the financial health and transparency of the organization. The Ohio Report of Independent Accountants after Audit of Financial Statements consists of several types, each serving a specific purpose and providing valuable information. Some key types of reports include: 1. Standard Ohio Report of Independent Accountants: This report is the most common and provides a detailed analysis of an organization's financial statements, including the balance sheet, income statement, and cash flow statement. It examines the accuracy and fairness of the financial information presented and assesses the organization's compliance with applicable accounting principles and regulations. 2. Ohio Auditor of State Report: This report specifically pertains to public sector organizations in Ohio and is issued by the Ohio Auditor of State. It evaluates the financial statements of government agencies, municipalities, school districts, and other public entities, ensuring adherence to governmental accounting standards and regulations. 3. Ohio Single Audit Report: This type of report is conducted in accordance with the Single Audit Act and provides an assessment of an organization's financial statements, internal controls, and compliance with federal grant requirements. It is typically mandatory for organizations that receive federal funding or grants. 4. Ohio Compliance Report: This report focuses primarily on an organization's adherence to specific laws, regulations, or contracts. It assesses whether the organization has complied with relevant financial and operational requirements and identifies any instances of non-compliance. 5. Ohio Review Report: A review report is less detailed than an audit report and provides limited assurance on an organization's financial statements. It involves analytical procedures and inquiries rather than the comprehensive examination conducted in an audit. These various types of Ohio Reports of Independent Accountants after Audit of Financial Statements cater to the diverse needs of different organizations and stakeholders. They play a critical role in ensuring transparency, accountability, and trust in Ohio's financial systems and contribute to the overall economic integrity of the state.

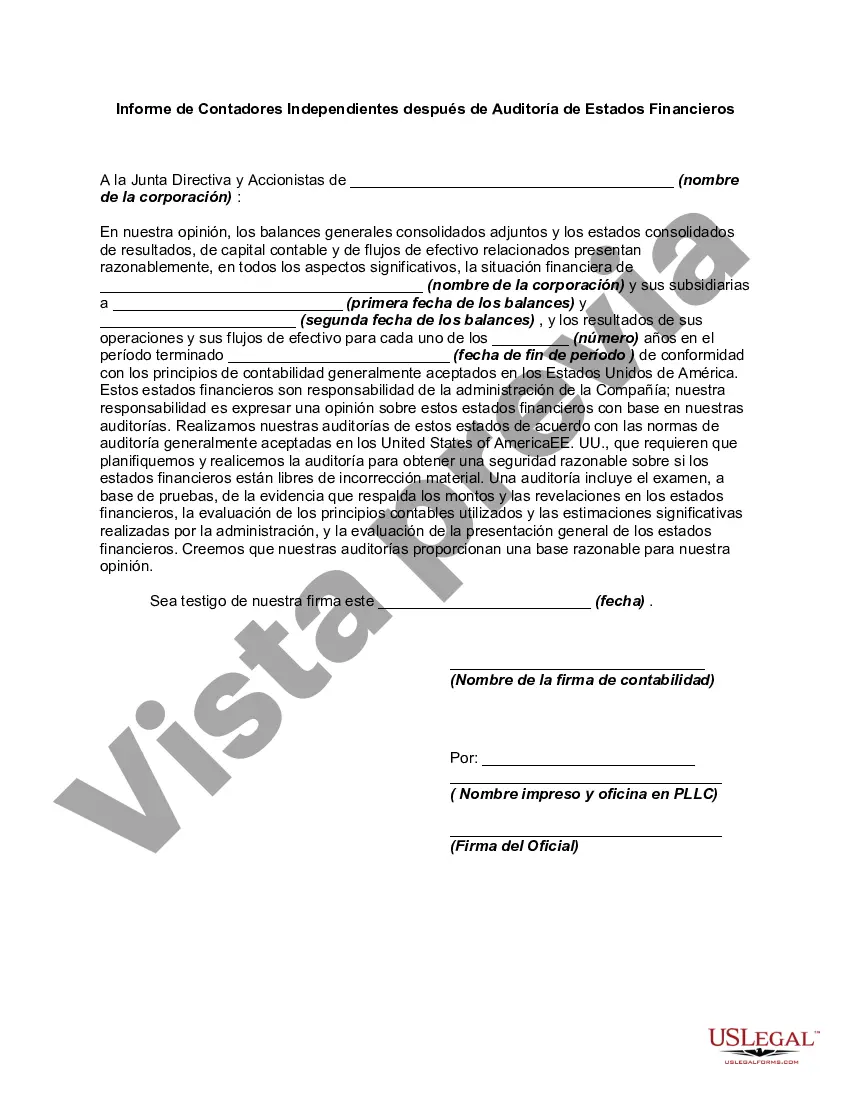

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.