Ohio Simple Promissory Note for Family Loan is a legal document that outlines the terms and conditions of a loan agreement between family members in the state of Ohio. This type of promissory note is used when one family member lends money to another and wishes to have a written record of the agreement to ensure both parties are protected. The note is legally binding and serves as evidence of the loan. Keywords: Ohio, Simple Promissory Note, Family Loan, legal document, terms and conditions, loan agreement, written record, protected, evidence, lending money, family member. There are various types of Ohio Simple Promissory Notes for Family Loans, distinguished by their specific terms and requirements. Some common variations include: 1. Ohio Interest-Bearing Simple Promissory Note for Family Loan: This type of promissory note includes interest on the loan amount. The interest rate and repayment schedule must be clearly defined in the document, ensuring both parties are aware of their obligations. 2. Ohio Non-Interest-Bearing Simple Promissory Note for Family Loan: Unlike the interest-bearing option, this type of promissory note does not include any interest on the loan amount. The repayment schedule is still outlined, but without the additional interest charges. 3. Ohio Secured Simple Promissory Note for Family Loan: In this case, the promissory note is secured by collateral, such as property or assets. This provides an added layer of security for the lender, as the collateral can be used to recoup the loan amount in the event of default. 4. Ohio Unsecured Simple Promissory Note for Family Loan: Unlike the secured option, this type of promissory note does not require any collateral. However, it is crucial for both parties to understand that if the borrower defaults, recovering the loan amount could be more challenging. 5. Ohio Lump-Sum Simple Promissory Note for Family Loan: This version requires repayment of the loan in one single payment, rather than through installments. The agreed-upon due date for the lump-sum payment must be clearly specified in the promissory note. 6. Ohio Installment Simple Promissory Note for Family Loan: This type allows the borrower to repay the loan in regular, predetermined installments. Each installment's due date and amount should be clearly outlined to avoid any confusion between the lender and borrower. Remember, it is advisable to consult with a legal professional to ensure the Ohio Simple Promissory Note for Family Loan accurately reflects the terms agreed upon by both parties and adheres to Ohio state laws and regulations.

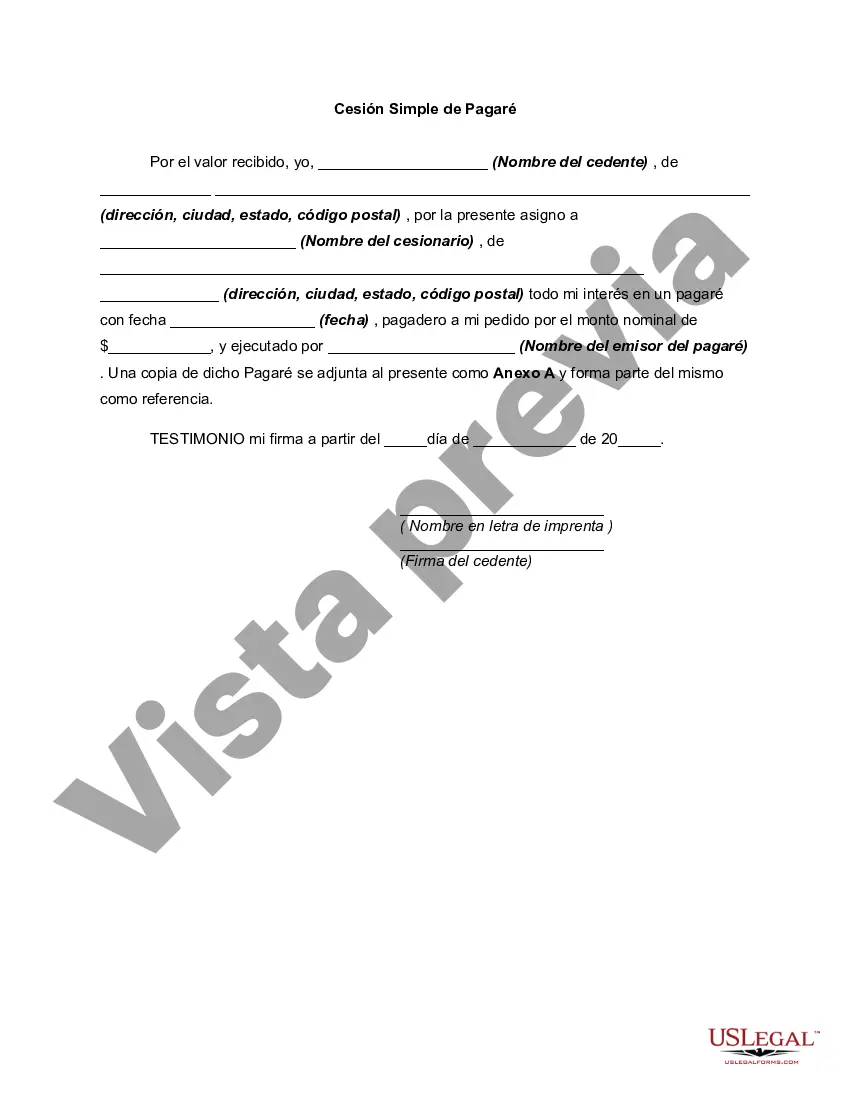

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Pagaré Simple para Préstamo Familiar - Simple Promissory Note for Family Loan

Description

How to fill out Ohio Pagaré Simple Para Préstamo Familiar?

Are you currently in a situation in which you need to have files for both business or specific reasons nearly every working day? There are a variety of authorized record templates available on the Internet, but discovering versions you can depend on is not effortless. US Legal Forms gives 1000s of form templates, such as the Ohio Simple Promissory Note for Family Loan, that happen to be written in order to meet federal and state demands.

When you are currently familiar with US Legal Forms web site and also have your account, just log in. Following that, you are able to obtain the Ohio Simple Promissory Note for Family Loan web template.

Should you not have an profile and would like to begin using US Legal Forms, adopt these measures:

- Obtain the form you need and make sure it is for your appropriate town/county.

- Utilize the Review key to examine the shape.

- Browse the information to actually have selected the proper form.

- In the event the form is not what you`re searching for, use the Lookup area to find the form that suits you and demands.

- If you get the appropriate form, just click Buy now.

- Select the rates prepare you desire, fill in the specified info to make your bank account, and buy the order using your PayPal or bank card.

- Select a handy paper structure and obtain your backup.

Find each of the record templates you may have purchased in the My Forms food list. You can obtain a further backup of Ohio Simple Promissory Note for Family Loan any time, if needed. Just select the essential form to obtain or produce the record web template.

Use US Legal Forms, by far the most extensive variety of authorized forms, to save lots of time as well as steer clear of blunders. The support gives appropriately manufactured authorized record templates which you can use for a range of reasons. Make your account on US Legal Forms and start generating your life a little easier.