When it becomes necessary for an accounting firm to terminate a client relationship, it is important to memorialize this action in a confirming letter to the client. A letter provides written evidence of when the resignation occurred and instructions to the client regarding needed follow-up on tax, accounting, and other matters about which the firm previously advised the client.

The letter should be factual. It should document when services ended, any outstanding issues regarding work in process, fees owed to the CPA firm, client records, and items requiring follow-up or completion by the client. In most situations the termination should become effective as of the date of the letter.

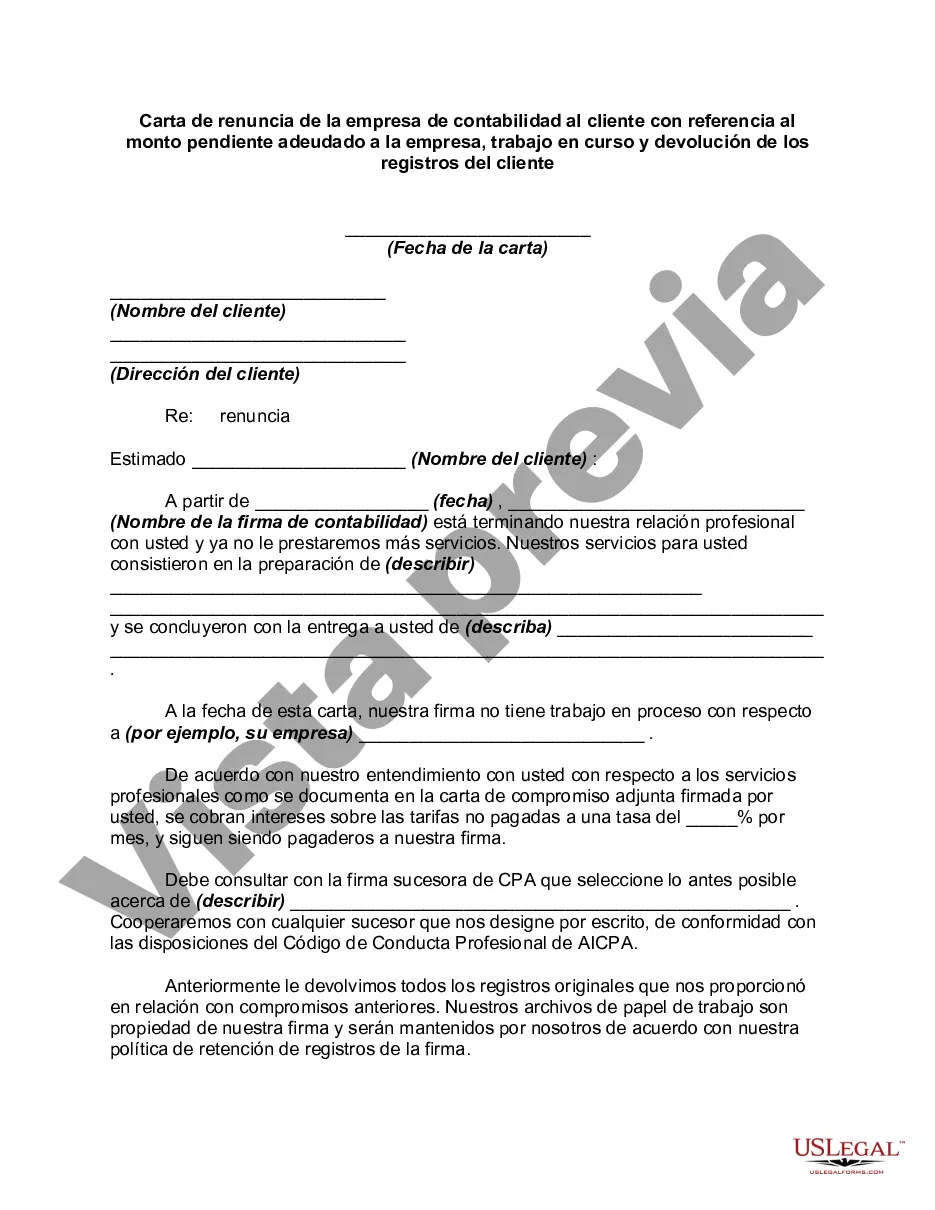

Title: Ohio Resignation Letter from Accounting Firm to Client with Reference to Outstanding Amount Owed Firm, Work in Progress, and Return of Client's Records Introduction: When an accounting firm decides to resign from a client engagement, it becomes essential to communicate this decision formally through a resignation letter. This detailed description will guide you in crafting an effective Ohio Resignation Letter from an Accounting Firm to a Client. Specifically, the letter should emphasize outstanding amounts owed to the firm, the status of work in progress, and the process for returning the client's records. Here are some key points to consider: 1. Outstanding Amount Owed Firm: Firstly, it is crucial to address any outstanding payments owed to the accounting firm by the client. Clearly state the amount due and the corresponding invoices or project references. Include payment terms, due dates, and any consequences for non-payment or delay in settling the obligation. Encourage prompt resolution and provide alternative payment methods if necessary. 2. Work in Progress: If there are any ongoing projects or work in progress, it is necessary to mention them in the resignation letter. Discuss the status of these projects, the tasks completed, and the remaining scope of work. Offer recommendations for successfully transitioning this work to a new accounting firm or a designated contact within the client's organization. 3. Returning Client's Records: Address the process for returning the client's records, such as financial statements, receipts, tax documents, and other relevant files. Specify the method for handover, whether it is through physical or digital means, and provide a deadline for the client to collect their records. It is advisable to keep copies of these records for a reasonable period to facilitate any future audits or inquiries. Types of Ohio Resignation Letters from Accounting Firm to Client with Reference to Outstanding Amount Owed Firm, Work in Progress, and Return of Client's Records: 1. Standard Resignation Letter: This type of resignation letter covers the basics of the points mentioned above. It addresses the outstanding amount owed, work in progress, and the return of client records without incorporating any specific demands or urgent matters. 2. Delinquent Payment Resignation Letter: If the outstanding amount owed to the accounting firm is substantial or becoming a critical issue, a delinquent payment resignation letter may be necessary. This letter highlights the urgency and importance of settling the unpaid invoices promptly, potentially with stricter consequences mentioned. It strengthens the stance and emphasizes the gravity of the situation. 3. Work in Progress Transfer Resignation Letter: In cases where the accounting firm is midway through crucial work, a transfer resignation letter can be used. This letter focuses on smoothly transitioning the unfinished projects to another accounting firm or a designated contact within the client's organization. It explains the steps already completed, the remaining tasks, and provides guidance for a seamless handover. Conclusion: Crafting a well-structured Ohio Resignation Letter from an Accounting Firm to a Client is vital to ensure an orderly exit from the engagement. Addressing outstanding amounts owed, work in progress, and returning the client's records with clarity and professionalism will facilitate a smooth transition while upholding the reputation of the accounting firm.Title: Ohio Resignation Letter from Accounting Firm to Client with Reference to Outstanding Amount Owed Firm, Work in Progress, and Return of Client's Records Introduction: When an accounting firm decides to resign from a client engagement, it becomes essential to communicate this decision formally through a resignation letter. This detailed description will guide you in crafting an effective Ohio Resignation Letter from an Accounting Firm to a Client. Specifically, the letter should emphasize outstanding amounts owed to the firm, the status of work in progress, and the process for returning the client's records. Here are some key points to consider: 1. Outstanding Amount Owed Firm: Firstly, it is crucial to address any outstanding payments owed to the accounting firm by the client. Clearly state the amount due and the corresponding invoices or project references. Include payment terms, due dates, and any consequences for non-payment or delay in settling the obligation. Encourage prompt resolution and provide alternative payment methods if necessary. 2. Work in Progress: If there are any ongoing projects or work in progress, it is necessary to mention them in the resignation letter. Discuss the status of these projects, the tasks completed, and the remaining scope of work. Offer recommendations for successfully transitioning this work to a new accounting firm or a designated contact within the client's organization. 3. Returning Client's Records: Address the process for returning the client's records, such as financial statements, receipts, tax documents, and other relevant files. Specify the method for handover, whether it is through physical or digital means, and provide a deadline for the client to collect their records. It is advisable to keep copies of these records for a reasonable period to facilitate any future audits or inquiries. Types of Ohio Resignation Letters from Accounting Firm to Client with Reference to Outstanding Amount Owed Firm, Work in Progress, and Return of Client's Records: 1. Standard Resignation Letter: This type of resignation letter covers the basics of the points mentioned above. It addresses the outstanding amount owed, work in progress, and the return of client records without incorporating any specific demands or urgent matters. 2. Delinquent Payment Resignation Letter: If the outstanding amount owed to the accounting firm is substantial or becoming a critical issue, a delinquent payment resignation letter may be necessary. This letter highlights the urgency and importance of settling the unpaid invoices promptly, potentially with stricter consequences mentioned. It strengthens the stance and emphasizes the gravity of the situation. 3. Work in Progress Transfer Resignation Letter: In cases where the accounting firm is midway through crucial work, a transfer resignation letter can be used. This letter focuses on smoothly transitioning the unfinished projects to another accounting firm or a designated contact within the client's organization. It explains the steps already completed, the remaining tasks, and provides guidance for a seamless handover. Conclusion: Crafting a well-structured Ohio Resignation Letter from an Accounting Firm to a Client is vital to ensure an orderly exit from the engagement. Addressing outstanding amounts owed, work in progress, and returning the client's records with clarity and professionalism will facilitate a smooth transition while upholding the reputation of the accounting firm.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.