When the parties have not clearly indicated whether or not their business constitutes a partnership, the law has determined several guidelines to aid Courts in determining whether the parties have created a partnership. The fact that the parties share profits and losses is strong evidence of a partnership.

Ohio Disclaimer of Partnership

Description

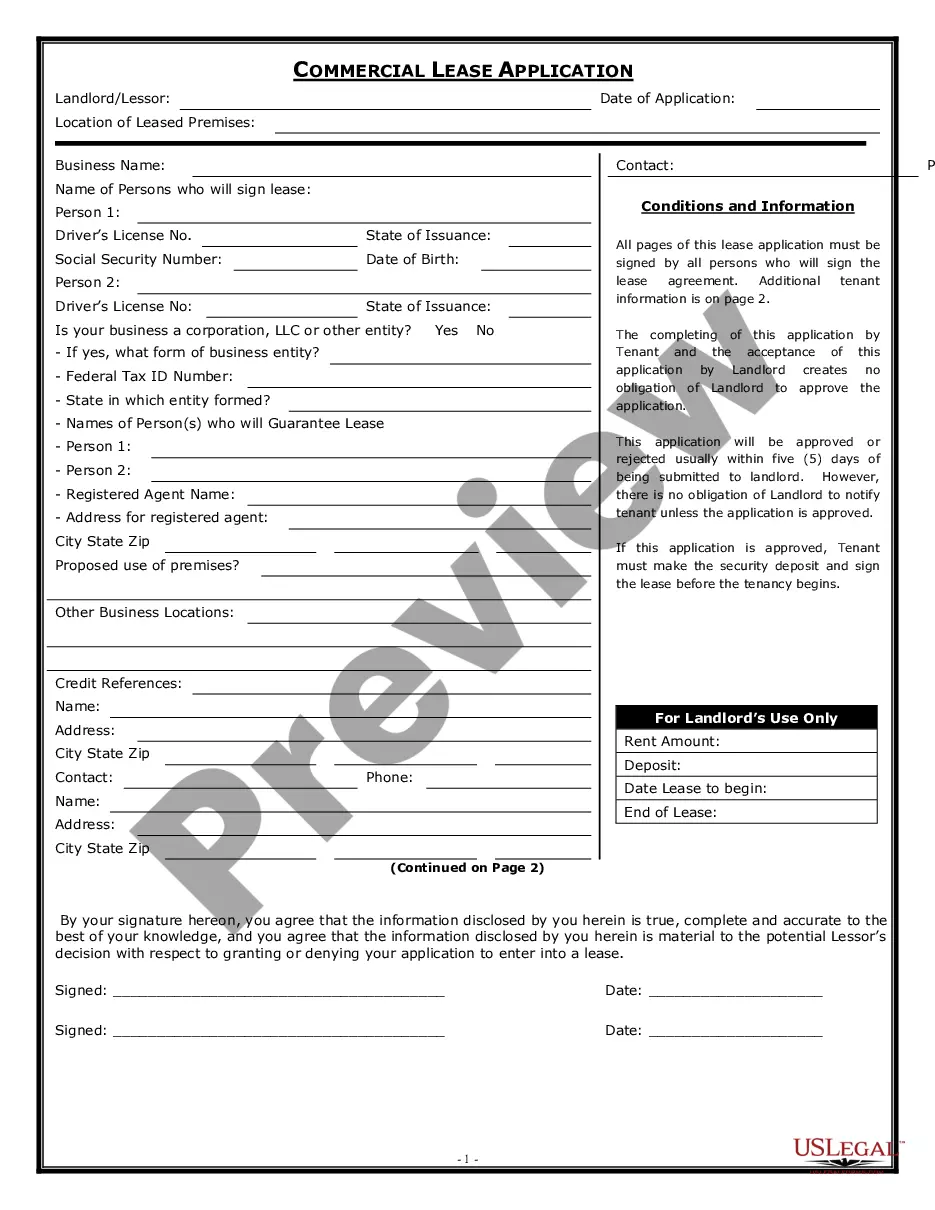

How to fill out Disclaimer Of Partnership?

Selecting the appropriate legal document template can pose certain challenges.

It goes without saying that there are numerous formats available online, but how can you acquire the legal form you need.

Make use of the US Legal Forms website. The service provides a multitude of templates, such as the Ohio Disclaimer of Partnership, which you can utilize for both business and personal purposes.

If the form does not fulfill your requirements, utilize the Search field to locate the appropriate form. Once you are confident that the form is adequate, click the Buy now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the payment using your PayPal account or credit card. Select the file format and download the legal document template to your device. Fill out, modify, print, and sign the acquired Ohio Disclaimer of Partnership. US Legal Forms is the largest repository of legal documents where you can find a variety of document formats. Utilize the service to download professionally crafted papers that comply with state regulations.

- All of the forms are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and press the Download button to retrieve the Ohio Disclaimer of Partnership.

- Use your account to browse through the legal documents you have purchased previously.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have chosen the correct form for your city/region. You can view the form using the Preview button and read the form description to confirm it is suitable for you.

Form popularity

FAQ

Yes, partnerships must file certain documents in Ohio, although the requirements can vary based on the type of partnership. Generally, general partnerships do not need to file formation documents, but limited partnerships must file a Certificate of Limited Partnership. It’s wise to include an Ohio Disclaimer of Partnership in your agreements to establish clear boundaries about roles and responsibilities, protecting all parties involved.

The primary difference between a partnership and an LLC in Ohio lies in liability and structure. A partnership shares profits and losses among partners, while an LLC offers limited liability protections to its owners. This means that with an LLC, personal assets are shielded from business debts. If you're considering an Ohio Disclaimer of Partnership, understand that it can help clarify that you do not intend to form a partnership unless explicitly stated.

Filling out a partnership form involves providing necessary details about your business structure, partners, and terms of the partnership. Ensure you clarify each partner's contributions and share of profits and losses. This step is crucial in establishing your Ohio Disclaimer of Partnership, as it helps prevent future disputes and aligns expectations among partners.

Filing requirements for a partnership in Ohio include registering your partnership with the Secretary of State if you choose to use a fictitious business name. It’s also advisable to prepare and maintain a partnership agreement that records your arrangement. Adhering to these requirements helps you affirm your Ohio Disclaimer of Partnership and keeps your business compliant with state regulations.

To fill out Ohio BMV form 3774 effectively, start by gathering necessary documentation for your vehicle and partnership. Ensure you read each section carefully, providing accurate information regarding ownership and use. Completing this form properly contributes to the clarity of your Ohio Disclaimer of Partnership, particularly when it involves vehicle ownership and responsibilities.

Filling out a partnership agreement requires you to outline the relevant terms clearly. Start with the basic information, including the partnership's name, effective date, and the names of the partners. Detail profit-sharing ratios, decision-making processes, and exit strategies. This document is essential for crafting your Ohio Disclaimer of Partnership, as it sets the stage for your partnership's operations.

In Ohio, partnerships typically need to fill out the Statement of Partnership Authority form. This document formally registers your partnership with the state and can help limit your personal liability. By completing this form, you create a solid foundation for your Ohio Disclaimer of Partnership, ensuring transparency and legal recognition.

To form a partnership in Ohio, you need at least two individuals or entities who agree to share profits and losses. It's helpful to have a clear partnership agreement that outlines each partner's roles and responsibilities. This agreement serves to establish the terms of the Ohio Disclaimer of Partnership, ensuring that all parties understand their commitments moving forward.

A general partnership in Ohio is a business arrangement where two or more individuals run a business together and share profits and liabilities. In this structure, partners have equal say and responsibility, meaning everyone is accountable for decisions. Understanding your role in a general partnership can be simplified through an Ohio Disclaimer of Partnership, which helps define each partner's obligations and rights. For any legal clarifications, reach out to a knowledgeable legal professional.

Yes, partnerships in Ohio indeed have filing requirements, particularly regarding taxation and business registration. Filing as a partnership typically involves submitting Form IT 1140 for tax purposes. Additionally, an Ohio Disclaimer of Partnership can reinforce your intended partnership structure, making it easier to fulfill any legal obligations. Consulting with a legal expert can help you navigate these requirements smoothly.