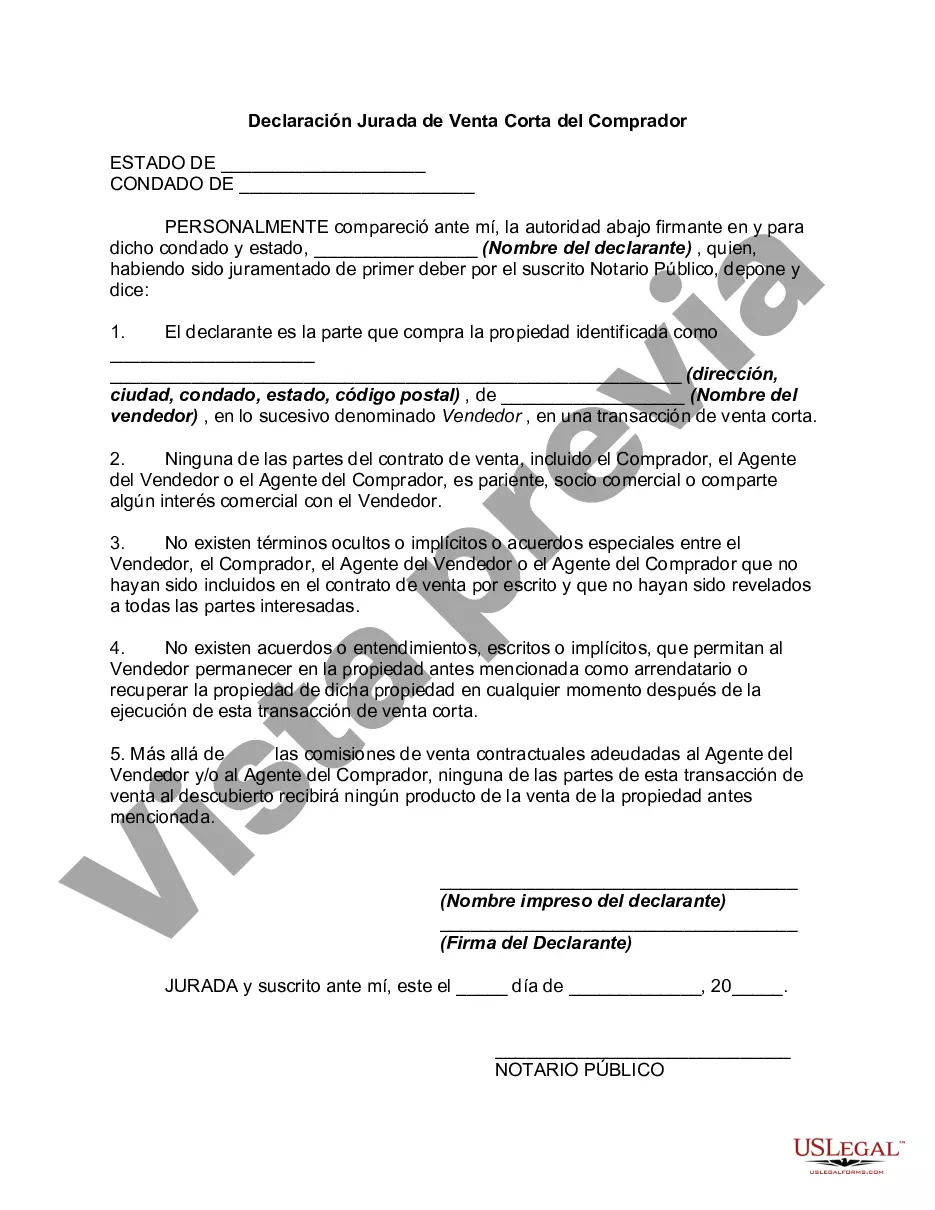

The Ohio Short Sale Affidavit of Buyer is a legal document that is used in the process of a short sale transaction in the state of Ohio. A short sale is a real estate transaction in which a property is sold for less than the amount owed on the mortgage, and it requires the approval of both the lender and the buyer. The Ohio Short Sale Affidavit of Buyer is typically used to verify the buyer's qualifications and intentions in purchasing the property. The affidavit contains important information such as the buyer's name, address, contact details, and financial information. It also requires the buyer to affirm that they have reviewed all the documentation related to the short sale, including the seller's financial statements, property appraisal, and any other relevant documents. This affidavit serves as a declaration by the buyer that they are entering into the short sale transaction in good faith, without any hidden agendas, and that they have fully understood the process and implications of the short sale. By signing this affidavit, the buyer is acknowledging their responsibility to complete the transaction as agreed upon. In Ohio, there may be different types of Short Sale Affidavits of Buyer, depending on the requirements of the lender or the parties involved in the transaction. These may include variations that address specific clauses or conditions related to the short sale process. Some examples of named variations of the Ohio Short Sale Affidavit of Buyer include: 1. Ohio Short Sale Affidavit of Buyer for FHA Loans: This affidavit may include additional clauses or provisions required by the Federal Housing Administration (FHA) for short sales involving FHA-insured mortgages. 2. Ohio Short Sale Affidavit of Buyer for VA Loans: This affidavit may include specific provisions and certifications mandated by the Department of Veterans Affairs (VA) for short sales involving VA-guaranteed mortgages. 3. Ohio Short Sale Affidavit of Buyer for Conventional Loans: This affidavit may be customized to meet the requirements set by conventional lenders or private institutions for short sales involving non-government-backed mortgages. It is important for buyers in Ohio to consult with their real estate agent, attorney, or lender to ensure they are using the appropriate version of the Short Sale Affidavit of Buyer that meets the specific needs of their transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Declaración Jurada de Venta Corta del Comprador - Short Sale Affidavit of Buyer

Description

How to fill out Ohio Declaración Jurada De Venta Corta Del Comprador?

It is possible to commit several hours on the web looking for the legitimate document design that meets the federal and state needs you want. US Legal Forms provides a huge number of legitimate kinds which can be evaluated by pros. You can actually acquire or produce the Ohio Short Sale Affidavit of Buyer from our services.

If you currently have a US Legal Forms bank account, it is possible to log in and click the Download option. Next, it is possible to full, change, produce, or signal the Ohio Short Sale Affidavit of Buyer. Each legitimate document design you acquire is yours for a long time. To have another version associated with a bought form, check out the My Forms tab and click the corresponding option.

Should you use the US Legal Forms website initially, keep to the simple recommendations beneath:

- Initially, make certain you have chosen the proper document design for the county/city of your choosing. Look at the form description to ensure you have chosen the right form. If available, use the Review option to search from the document design also.

- In order to find another variation of your form, use the Search industry to discover the design that suits you and needs.

- When you have discovered the design you want, simply click Buy now to carry on.

- Pick the pricing program you want, enter your references, and sign up for a merchant account on US Legal Forms.

- Comprehensive the purchase. You should use your charge card or PayPal bank account to cover the legitimate form.

- Pick the format of your document and acquire it to the gadget.

- Make changes to the document if needed. It is possible to full, change and signal and produce Ohio Short Sale Affidavit of Buyer.

Download and produce a huge number of document templates while using US Legal Forms site, that provides the largest selection of legitimate kinds. Use skilled and condition-certain templates to tackle your organization or person demands.