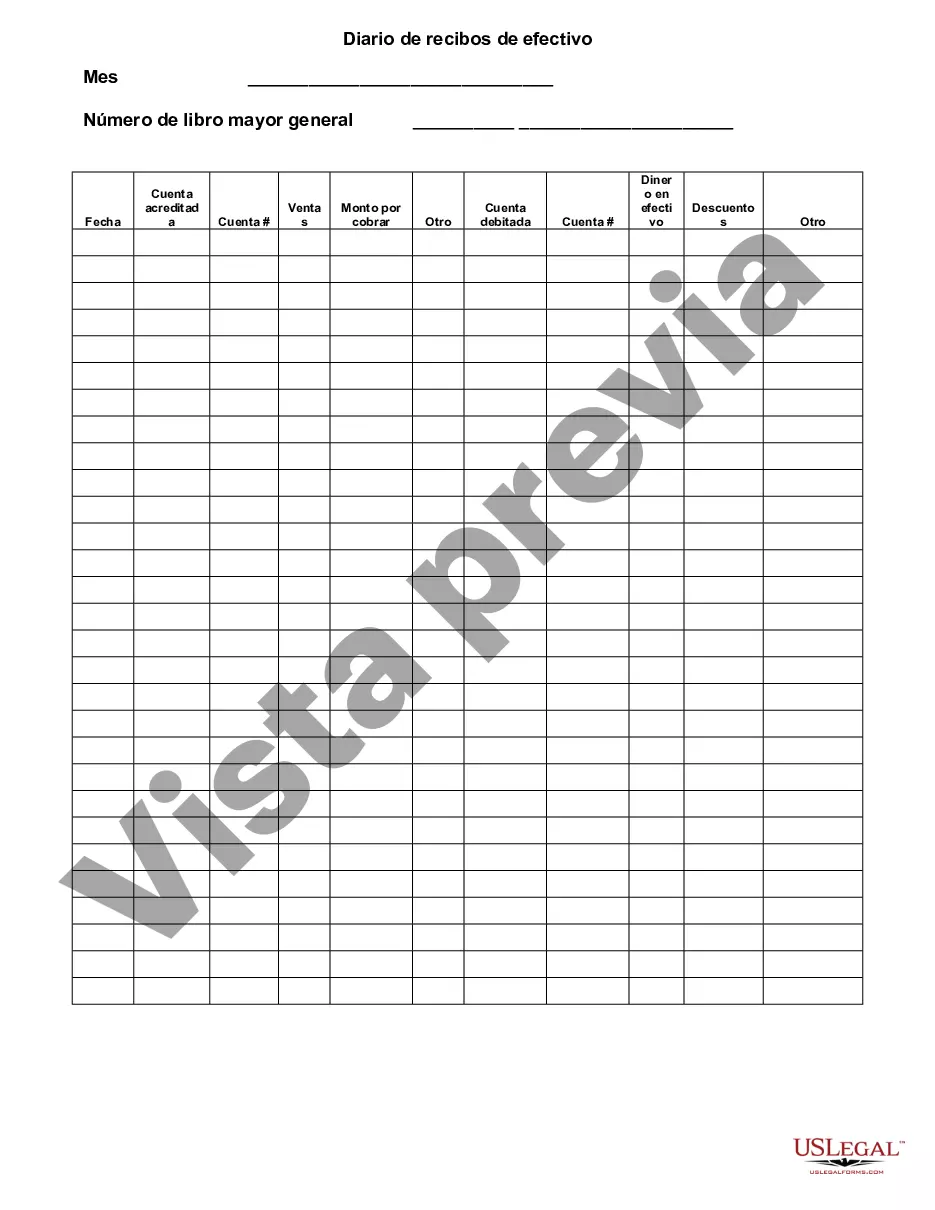

The Ohio Cash Receipts Journal is a financial document used by businesses in Ohio to record all cash inflows, including sales revenue, loans, and other sources of cash. It serves as a detailed record of all cash transactions, ensuring accurate bookkeeping and financial reporting. This journal is specifically designed to comply with the accounting regulations and requirements in the state of Ohio, making it an essential tool for businesses operating within this jurisdiction. It follows the Generally Accepted Accounting Principles (GAAP) and any additional guidelines set forth by the Ohio Department of Taxation. The Ohio Cash Receipts Journal includes various relevant keywords such as: 1. Cash inflows: All forms of cash entering the business, including cash sales, customer payments, loans, and interest income. 2. Sales revenue: The amount received from the sale of goods or services, whether in cash, check, or electronic payments. 3. Loan receipts: Cash received from borrowing funds, both short-term and long-term loans. 4. Source of cash: All relevant sources contributing to a business's cash inflows, such as banks, credit card companies, or investors. 5. Bookkeeping: The practice of maintaining accurate financial records, including the Ohio Cash Receipts Journal, to monitor cash flow and ensure financial stability. 6. Financial reporting: The process of preparing and presenting a company's financial statements, which are derived from the information recorded in the Ohio Cash Receipts Journal. 7. Generally Accepted Accounting Principles (GAAP): The standard accounting rules and principles used by businesses to record, summarize, and report financial transactions. There are no specific types of Ohio Cash Receipts Journal as it generally refers to the standard journal used by businesses in Ohio. However, depending on the size and complexity of a business, variations or customized formats may exist to better suit their specific needs and preferences. In conclusion, the Ohio Cash Receipts Journal is a vital tool for Ohio businesses to maintain accurate records of all cash inflows. It ensures compliance with state accounting regulations and aids in preparing financial statements. By using this journal, businesses can effectively manage their cash flow and make informed financial decisions to drive growth and profitability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Diario de recibos de efectivo - Cash Receipts Journal

Description

How to fill out Ohio Diario De Recibos De Efectivo?

Are you in a place the place you will need papers for either organization or person purposes virtually every time? There are a lot of legal papers web templates available on the net, but getting types you can depend on is not straightforward. US Legal Forms provides a large number of develop web templates, much like the Ohio Cash Receipts Journal, that happen to be written in order to meet federal and state specifications.

In case you are previously informed about US Legal Forms website and get a free account, basically log in. Afterward, it is possible to download the Ohio Cash Receipts Journal template.

If you do not come with an account and wish to start using US Legal Forms, follow these steps:

- Discover the develop you will need and ensure it is to the correct metropolis/state.

- Make use of the Review switch to review the shape.

- See the description to ensure that you have chosen the proper develop.

- In case the develop is not what you are searching for, use the Lookup area to find the develop that fits your needs and specifications.

- If you discover the correct develop, click Purchase now.

- Choose the rates strategy you want, fill out the specified information and facts to make your money, and pay money for the order using your PayPal or credit card.

- Pick a practical file structure and download your duplicate.

Discover all the papers web templates you have purchased in the My Forms menus. You can aquire a extra duplicate of Ohio Cash Receipts Journal at any time, if possible. Just click the necessary develop to download or print out the papers template.

Use US Legal Forms, probably the most comprehensive selection of legal forms, to conserve efforts and stay away from mistakes. The services provides skillfully produced legal papers web templates which you can use for a variety of purposes. Make a free account on US Legal Forms and start making your lifestyle easier.