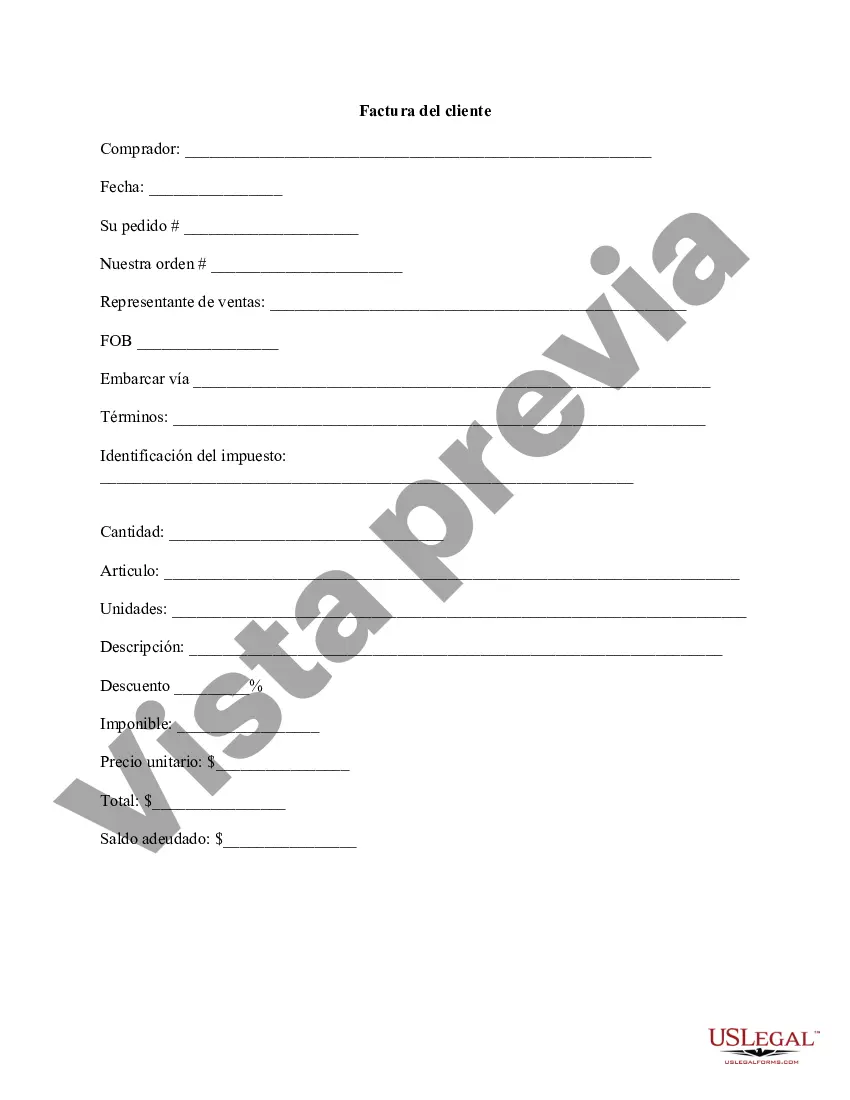

The Ohio Customer Invoice is a detailed document that outlines the specific charges and fees associated with a customer's purchase in the state of Ohio. It serves as an official record of the transaction and provides important information for both the buyer and the seller. The key components of an Ohio Customer Invoice include: 1. Billing Information: The invoice starts with the customer's name, address, and contact details, followed by the seller's information. This section is crucial for accurate record-keeping and communication. 2. Invoice Number: A unique identifier provided by the seller to easily reference and track the invoice. It helps both parties to quickly locate and resolve any issues related to the transaction. 3. Invoice Date: The date of the invoice issuance, which helps in determining payment deadlines and tracking the fulfillment of the purchase. 4. Itemized List: A comprehensive breakdown of the products or services provided by the seller. Each line item includes a description, quantity, unit price, and total cost. This section ensures transparency and clarity regarding the charges incurred by the customer. 5. Subtotal: The total sum of all the individual line items before any taxes, discounts, or additional fees are applied. It provides an overview of the cumulative charges. 6. Taxes: Ohio is subject to various taxes such as sales tax and use tax. This section of the invoice specifies the applicable tax rates and calculates the corresponding amounts based on the taxable items. 7. Discounts/Credits: If any discounts or promotional offers are applied to the customer's purchase, they are listed in this section. These reductions in price can be in the form of percentage discounts, fixed discounts, or special deals. 8. Additional Fees: Any extra charges associated with the transaction, such as shipping fees, handling fees, or service charges, are detailed in this section. It ensures transparency and helps the customer understand the final cost of their purchase. 9. Total Amount Due: The grand total that the customer is required to pay. This includes the subtotal, taxes, discounts, and additional fees. It serves as a clear statement of the payable amount. Different types of Ohio Customer Invoice can vary depending on the nature of the business or industry. For instance: 1. Retail Invoices: These are commonly used in brick-and-mortar stores or online retail businesses, providing a breakdown of products purchased by customers. 2. Service Invoices: Service-based businesses, such as consultants, contractors, or freelancers, issue invoices that outline the services rendered, along with the relevant charges. 3. Wholesale Invoices: Wholesalers or distributors often deal with large quantities of goods and transactions. Their invoices are tailored accordingly, with a focus on bulk purchases and pricing. 4. Recurring Invoices: Some businesses provide regular products/services to customers on a subscription or recurring basis. These invoices are generated periodically (e.g., monthly or annually) to facilitate ongoing payments. In summary, an Ohio Customer Invoice is a detailed document that itemizes the charges incurred by a customer for a purchase made in Ohio. It includes billing information, invoice number, date, itemized list, subtotal, taxes, discounts, additional fees, and the total amount due. More specifically, different types of Ohio Customer Invoice can include retail, service, wholesale, and recurring invoices, each catering to specific business types or transactional patterns.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Factura del cliente - Customer Invoice

Description

How to fill out Ohio Factura Del Cliente?

Finding the right legal document web template can be quite a battle. Of course, there are a lot of layouts accessible on the Internet, but how will you get the legal develop you require? Make use of the US Legal Forms site. The service gives 1000s of layouts, including the Ohio Customer Invoice, which can be used for organization and personal requires. Each of the kinds are examined by pros and satisfy federal and state demands.

If you are currently registered, log in in your accounts and click the Acquire option to find the Ohio Customer Invoice. Use your accounts to appear through the legal kinds you have ordered formerly. Visit the My Forms tab of your respective accounts and get yet another version of your document you require.

If you are a new end user of US Legal Forms, listed below are straightforward recommendations for you to comply with:

- Initial, make certain you have chosen the proper develop to your area/county. You may check out the shape utilizing the Preview option and browse the shape description to guarantee it is the best for you.

- If the develop does not satisfy your requirements, use the Seach field to obtain the right develop.

- Once you are sure that the shape is proper, click the Buy now option to find the develop.

- Select the prices strategy you desire and type in the required information. Build your accounts and buy your order making use of your PayPal accounts or charge card.

- Opt for the document structure and obtain the legal document web template in your product.

- Complete, edit and produce and sign the obtained Ohio Customer Invoice.

US Legal Forms will be the largest local library of legal kinds that you can see different document layouts. Make use of the service to obtain skillfully-created paperwork that comply with state demands.