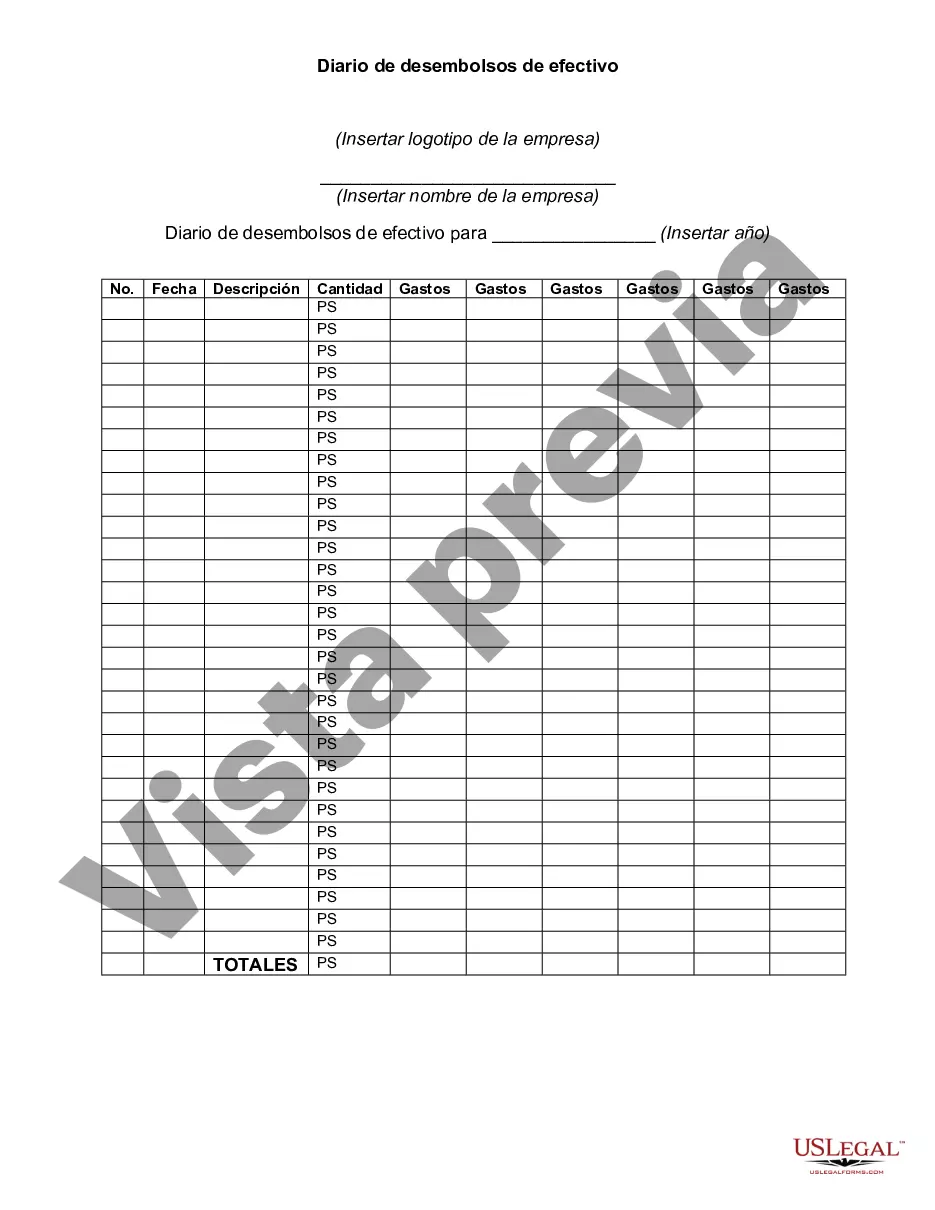

A check disbursements journal is a book used to record all payments made in cash such as for accounts payable, merchandise purchases, and operating expenses.

Ohio Check Disbursements Journal is a financial document that records all the checks disbursed by an entity in Ohio. It serves as a detailed record of check payments made by an organization, providing information on the recipient, the amount paid, and the purpose of the payment. This journal plays a crucial role in the accounting process as it helps in maintaining accurate financial records and allows for easy audit and review. The Ohio Check Disbursements Journal is typically organized in a chronological order, with each entry containing essential details such as the date of payment, check number, payee name, payment amount, and a brief description or reference to the corresponding transaction. This journal is commonly used by businesses, nonprofits, government agencies, and other entities to keep track of their outgoing payments accurately. Several types of Ohio Check Disbursements Journals can be distinguished based on the specific requirements and purposes of different organizations. Some of these types include: 1. General Check Disbursements Journal: This is the most common type, used by businesses and organizations of various types to record their regular check payments, including expenses such as payroll, utilities, rent, and supplies. 2. Payroll Check Disbursements Journal: This journal is specifically designed to record payments made to employees, including salary, wages, bonuses, and any deductions associated with payroll taxes, healthcare, or retirement plans. 3. Accounts Payable Check Disbursements Journal: This journal focuses on payments made to suppliers, vendors, and creditors for goods or services provided on credit. It helps organizations effectively manage their accounts payable and maintain transparency in financial transactions. 4. Expense Check Disbursements Journal: This type of journal is used to record specific types of expenses incurred by an organization, such as travel expenses, entertainment expenses, or any other reimbursable expenditures. It allows for better categorization and monitoring of these expenses. In conclusion, the Ohio Check Disbursements Journal is a vital tool for financial management, tracking, and auditing purposes. It ensures accurate recording of all outgoing check payments and helps organizations maintain financial transparency and control. Different types of this journal cater to specific needs, such as general payments, payroll, accounts payable, or specific expense categories.Ohio Check Disbursements Journal is a financial document that records all the checks disbursed by an entity in Ohio. It serves as a detailed record of check payments made by an organization, providing information on the recipient, the amount paid, and the purpose of the payment. This journal plays a crucial role in the accounting process as it helps in maintaining accurate financial records and allows for easy audit and review. The Ohio Check Disbursements Journal is typically organized in a chronological order, with each entry containing essential details such as the date of payment, check number, payee name, payment amount, and a brief description or reference to the corresponding transaction. This journal is commonly used by businesses, nonprofits, government agencies, and other entities to keep track of their outgoing payments accurately. Several types of Ohio Check Disbursements Journals can be distinguished based on the specific requirements and purposes of different organizations. Some of these types include: 1. General Check Disbursements Journal: This is the most common type, used by businesses and organizations of various types to record their regular check payments, including expenses such as payroll, utilities, rent, and supplies. 2. Payroll Check Disbursements Journal: This journal is specifically designed to record payments made to employees, including salary, wages, bonuses, and any deductions associated with payroll taxes, healthcare, or retirement plans. 3. Accounts Payable Check Disbursements Journal: This journal focuses on payments made to suppliers, vendors, and creditors for goods or services provided on credit. It helps organizations effectively manage their accounts payable and maintain transparency in financial transactions. 4. Expense Check Disbursements Journal: This type of journal is used to record specific types of expenses incurred by an organization, such as travel expenses, entertainment expenses, or any other reimbursable expenditures. It allows for better categorization and monitoring of these expenses. In conclusion, the Ohio Check Disbursements Journal is a vital tool for financial management, tracking, and auditing purposes. It ensures accurate recording of all outgoing check payments and helps organizations maintain financial transparency and control. Different types of this journal cater to specific needs, such as general payments, payroll, accounts payable, or specific expense categories.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.