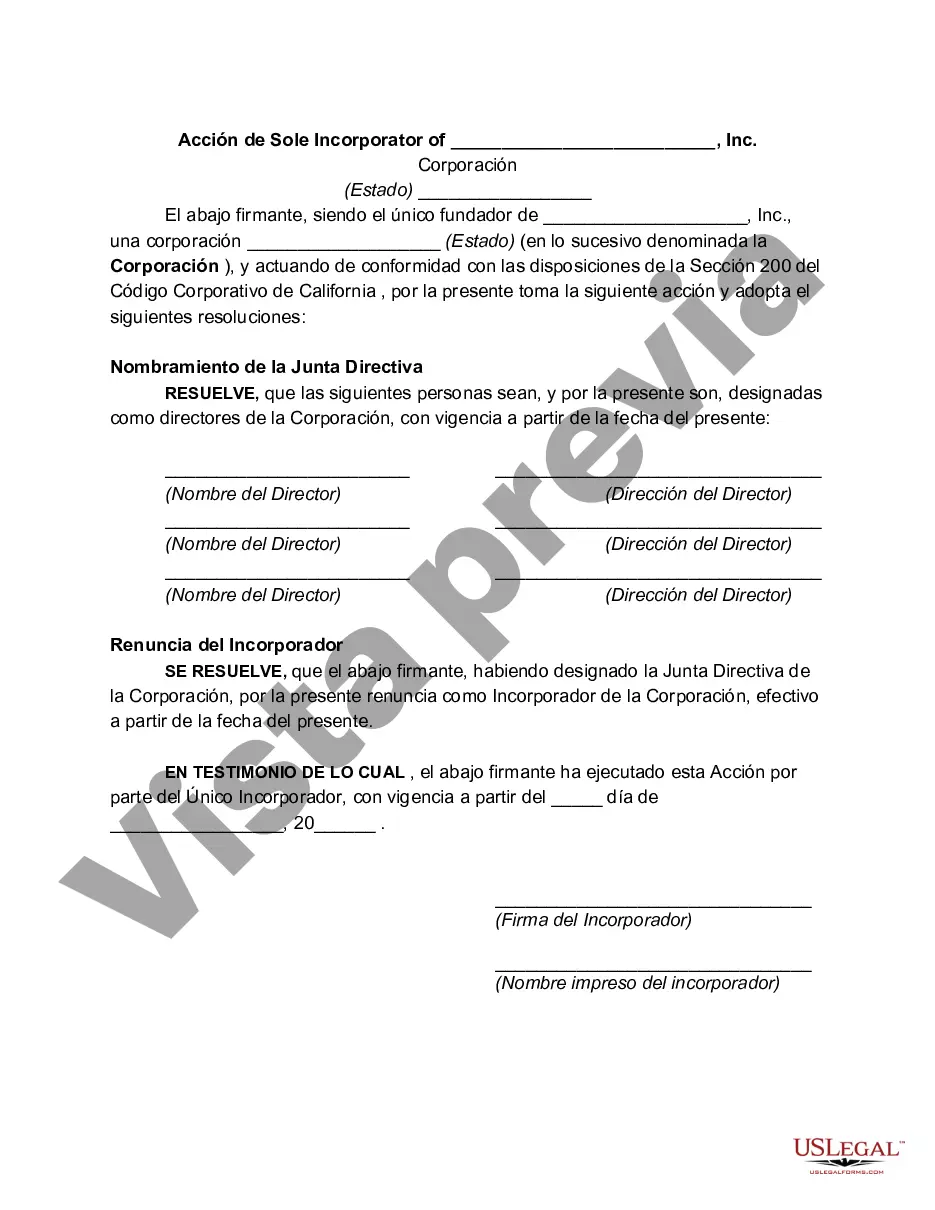

This multistate form relates to Section 200 of the California Corporate Code that provides in part as follows:

(a) One or more natural persons, partnerships, associations or corporations, domestic or foreign, may form a corporation under this division by executing and filing articles of incorporation.

(b) If initial directors are named in the articles, each director named in the articles shall sign and acknowledge the articles; if initial directors are not named in the articles, the articles shall be signed by one or more persons described in subdivision (a) who thereupon are the incorporators of the corporation.

(c) The corporate existence begins upon the filing of the articles and continues perpetually, unless otherwise expressly provided by law or in the articles.

Ohio Action by Sole Incorporated of Corporation refers to the legal process in the state of Ohio by which a single person, known as the "sole incorporated," takes the necessary steps to form a corporation. This process involves several important actions and requirements that must be fulfilled by the sole incorporated to establish a legally recognized and functioning corporation in Ohio. One key aspect of Ohio Action by Sole Incorporated of Corporation is the filing of necessary paperwork with the Ohio Secretary of State's office. The sole incorporated must prepare and file the articles of incorporation, which is a legal document that outlines the basic details of the corporation, such as its name, purpose, and registered agent. The articles of incorporation must comply with the Ohio Revised Code and include specific information mandated by the state. Furthermore, the sole incorporated must appoint initial directors for the corporation. These individuals will oversee the corporation's activities and make important decisions on behalf of the company. The sole incorporated typically has the authority to name the initial directors in the articles of incorporation or a separate document filed with the state. Additionally, the sole incorporated is responsible for adopting bylaws, which are the rules and regulations governing the internal affairs of the corporation. Bylaws typically cover matters such as shareholder meetings, board of director elections, and officer roles and responsibilities. The bylaws ensure the corporation operates in a transparent and structured manner. To fully establish the corporation, the sole incorporated must also obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS). The EIN is used for tax purposes and is mandatory for any corporation planning to hire employees or conduct business activities that require federal tax filings. It is important to note that Ohio Action by Sole Incorporated of Corporation can differ based on the specific type or structure of the corporation being formed. Common types of corporations in Ohio include C Corporations, S Corporations, and Professional Corporations. Each type has unique legal and tax considerations that should be addressed accordingly during the incorporation process. In summary, Ohio Action by Sole Incorporated of Corporation is a legal process in Ohio that enables a sole incorporated to form and establish a corporation. This involves filing the articles of incorporation, appointing initial directors, adopting bylaws, and obtaining an EIN. It is crucial for the sole incorporated to follow the relevant laws, regulations, and requirements of the state of Ohio to ensure a smooth and legally compliant incorporation process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.