Ohio Receipt and Withdrawal from Partnership refers to the legal procedures involved when a partner joins or leaves a partnership in the state of Ohio. These processes are crucial for maintaining accurate records and ensuring the smooth functioning of partnerships. It is essential to understand the various types of Ohio Receipt and Withdrawal from Partnership to navigate the legal complexities effectively. 1. Definition of Receipt and Withdrawal from Partnership: Receipt and withdrawal from partnership are two distinct procedures that involve the addition and subtraction of partners in a partnership. Receipt refers to the process of admitting a new partner into an existing partnership, while withdrawal refers to the departure of a partner from the partnership. 2. Ohio Revised Code: The Ohio Revised Code outlines the statutory regulations and guidelines that govern the receipt and withdrawal from partnership in the state of Ohio. It provides a framework for the legal procedures and requirements involved in such partnership changes. 3. Partnership Agreement: In Ohio, partnerships often have a partnership agreement, which is a written document outlining the rights, obligations, and procedures within the partnership. The partnership agreement may include specific provisions regarding receipt and withdrawal of partners, including any additional requirements beyond what is mandated by state law. 4. Admission of a New Partner: When a partnership decides to admit a new partner, various steps must be followed. These may include obtaining the consent of existing partners, evaluating the new partner's qualifications and potential contribution to the partnership, and updating relevant legal documents to reflect the change. The new partner may need to sign a partnership agreement and fulfill any financial obligations associated with partnership admission. 5. Withdrawal of a Partner: When a partner wishes to withdraw from a partnership in Ohio, the partnership must follow specific procedures to ensure a smooth transition. This may involve reviewing the partnership agreement to understand the withdrawal provisions, addressing financial settlements, and updating legal documents to reflect the change in partnership structure. Types of Ohio Receipt and Withdrawal from Partnership: 1. General Partner Admission/Withdrawal: This refers to the process of admitting or withdrawing a general partner, who typically has management responsibilities and shares liability for the partnership's debts and obligations. 2. Limited Partner Admission/Withdrawal: Limited partners participate in a partnership's profits but have limited liability for the partnership's debts. Admission or withdrawal of limited partners may have specific requirements outlined in the partnership agreement or under state law. 3. Silent Partner Admission/Withdrawal: Silent partners, also known as sleeping or dormant partners, are individuals who invest capital in the partnership but have no active role in management. Admission or withdrawal of silent partners may be subject to specific provisions within the partnership agreement. 4. Partial Partner Buyout/Sellout: This refers to the process of one or more partners buying out the shares or interests of another partner, either partially or completely. The partnership agreement may contain provisions outlining the terms and conditions for a buyout/sellout, including valuation methods for the partner's share. In conclusion, Ohio Receipt and Withdrawal from Partnership involve the legal procedures for admitting or withdrawing partners in a partnership. Understanding the specific requirements and provisions outlined in the Ohio Revised Code and partnership agreement is crucial. Different types of Ohio Receipt and Withdrawal from Partnership include general partner admission/withdrawal, limited partner admission/withdrawal, silent partner admission/withdrawal, and partial partner buyout/sellout.

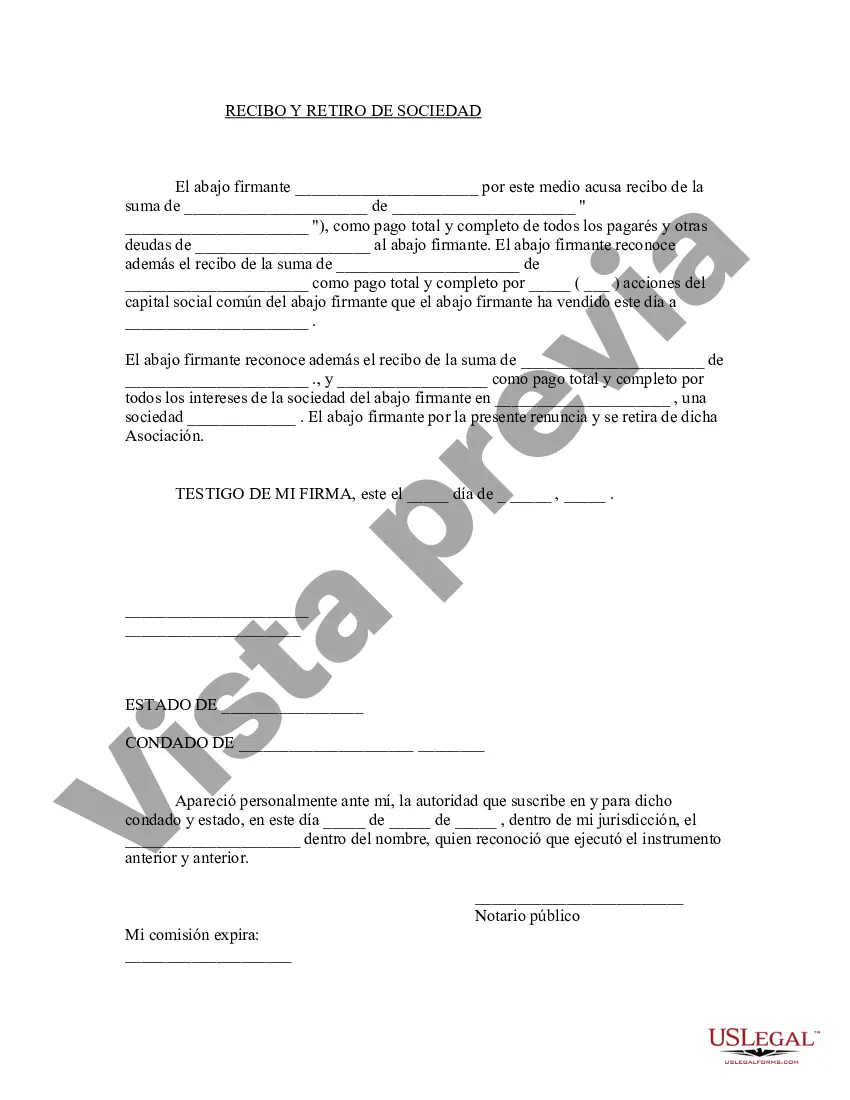

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Recepción y retiro de la sociedad - Receipt and Withdrawal from Partnership

Description

How to fill out Ohio Recepción Y Retiro De La Sociedad?

Are you currently in a position the place you need paperwork for either business or person functions almost every time? There are a lot of authorized file layouts available on the Internet, but discovering types you can rely on is not simple. US Legal Forms provides a large number of form layouts, just like the Ohio Receipt and Withdrawal from Partnership, which are created to satisfy federal and state requirements.

If you are presently familiar with US Legal Forms web site and possess a free account, merely log in. Next, you are able to download the Ohio Receipt and Withdrawal from Partnership design.

If you do not provide an accounts and need to begin to use US Legal Forms, adopt these measures:

- Discover the form you need and ensure it is for your correct town/area.

- Make use of the Preview switch to check the form.

- Browse the information to actually have chosen the appropriate form.

- If the form is not what you are trying to find, take advantage of the Lookup discipline to get the form that fits your needs and requirements.

- Whenever you obtain the correct form, simply click Buy now.

- Select the pricing strategy you desire, fill in the required info to generate your money, and purchase your order with your PayPal or credit card.

- Select a handy document structure and download your copy.

Find every one of the file layouts you might have bought in the My Forms food list. You can aquire a extra copy of Ohio Receipt and Withdrawal from Partnership at any time, if required. Just click on the required form to download or printing the file design.

Use US Legal Forms, probably the most substantial variety of authorized types, to conserve efforts and avoid mistakes. The support provides appropriately manufactured authorized file layouts which can be used for a range of functions. Create a free account on US Legal Forms and begin creating your lifestyle easier.