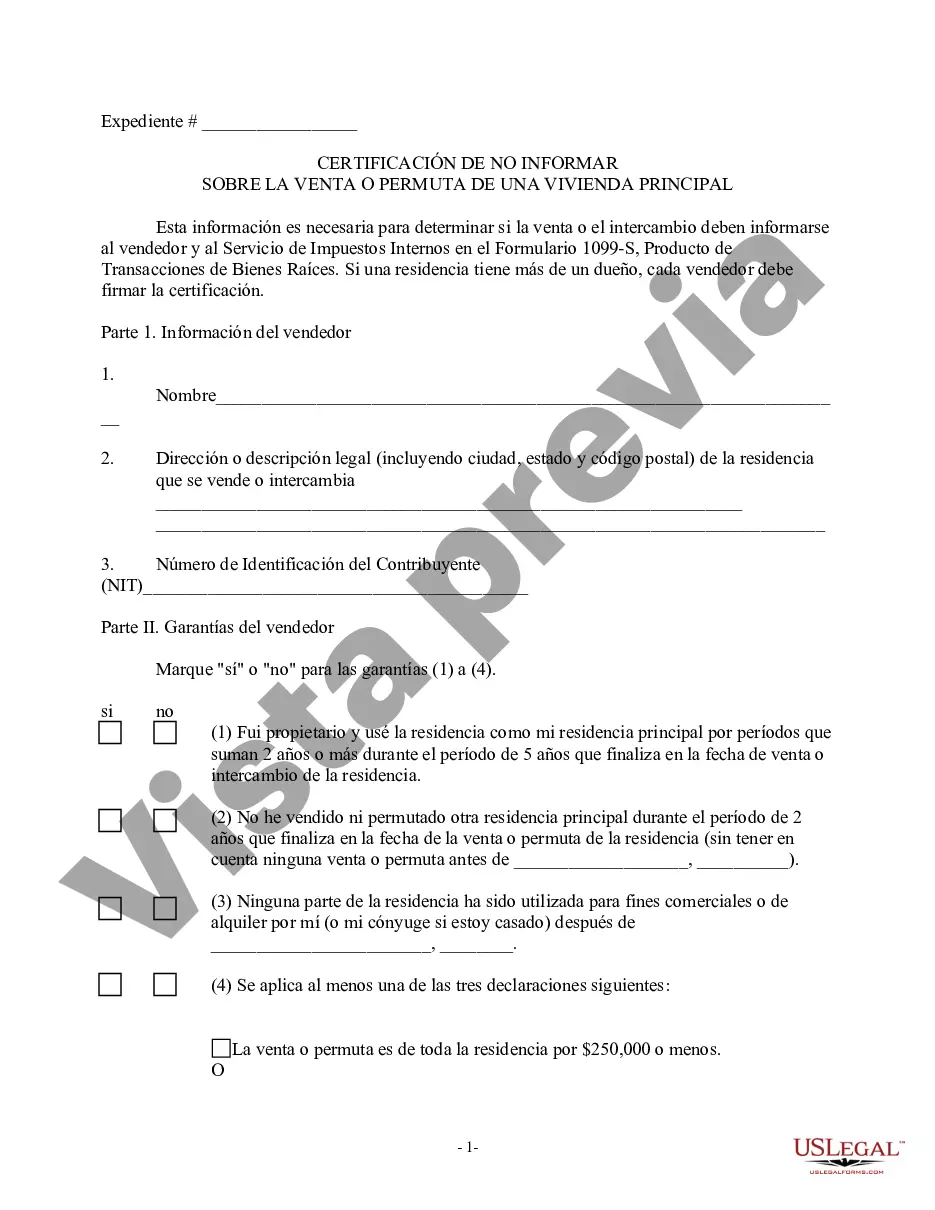

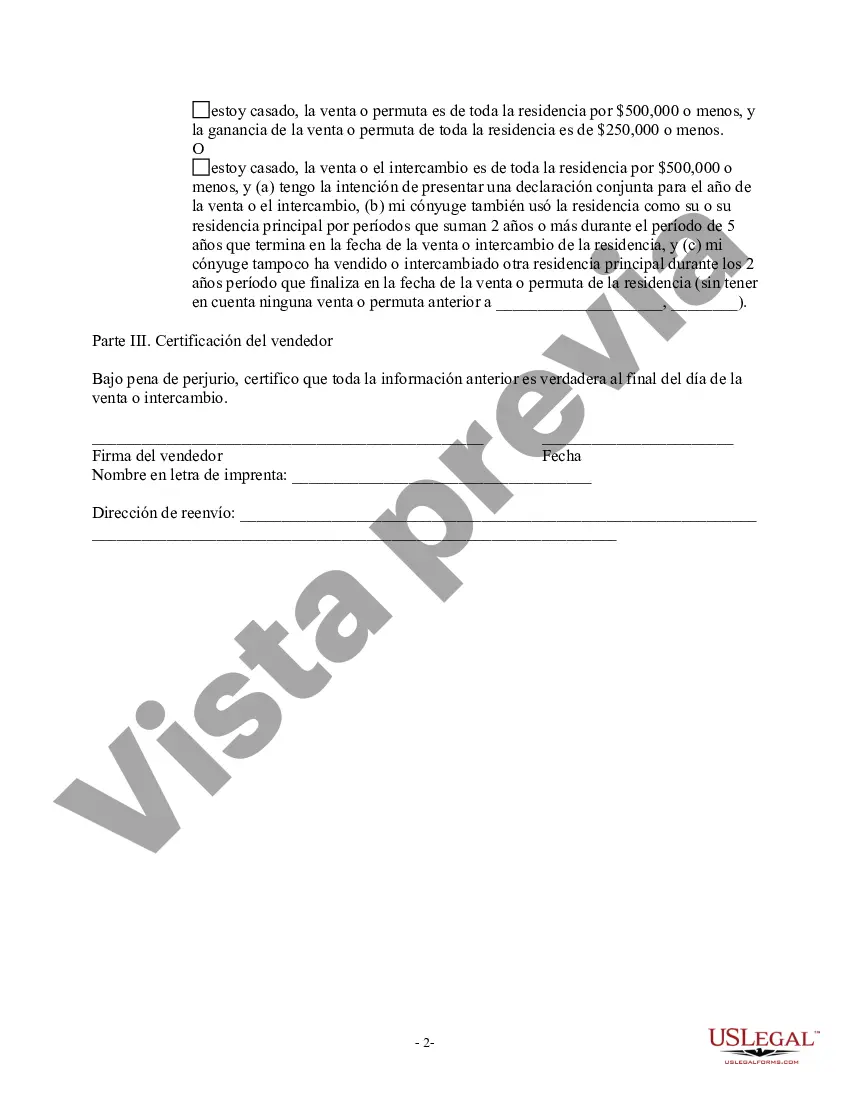

The Ohio Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption is an important document that allows qualified individuals to claim an exemption from reporting the sale or exchange of their principal residence for state tax purposes. This certificate is utilized by Ohio residents who meet specific requirements outlined by the Ohio Department of Taxation. The Ohio Department of Taxation created the Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption to ease the reporting burden on taxpayers while ensuring compliance with state tax laws. By obtaining this certificate, eligible individuals are able to exclude the gain from the sale or exchange of their principal residence from their Ohio income tax return. To qualify for the Ohio Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, applicants must meet the following criteria: 1. The property being sold or exchanged must be the taxpayer's principal residence. 2. The taxpayer must have owned and lived in the property for at least two out of the five years preceding the sale or exchange. 3. The property must not be subject to any disqualifications, such as rental or business use. 4. The taxpayer must not have claimed a similar exemption within the past two years. Obtaining the Ohio Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption involves completing and submitting Form DUE 105B to the Ohio Department of Taxation. The form requires the taxpayer to provide specific details about the property, including its address, purchase price, and sale price. Additionally, the taxpayer must certify that they meet all the eligibility criteria mentioned above. It is important to note that there are currently no different types of the Ohio Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption. However, individuals may need to file separate forms for each qualifying property or for multiple sales or exchanges that occur within the same tax year. By utilizing the Ohio Certification of No Information Reporting on Sale or Exchange of Principal Residence — Tax Exemption, eligible individuals can potentially save significant time and effort in reporting their real estate transactions for state tax purposes. This exemption provides a valuable opportunity for Ohio residents to benefit from the exclusion of gain on the sale or exchange of their principal residence, promoting homeownership and financial stability within the state.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Certificación de No Informar sobre Venta o Permuta de Vivienda Principal - Exención de Impuestos - Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Ohio Certificación De No Informar Sobre Venta O Permuta De Vivienda Principal - Exención De Impuestos?

US Legal Forms - one of several largest libraries of legal forms in the United States - provides a variety of legal file web templates it is possible to acquire or produce. While using site, you can find a large number of forms for company and person reasons, categorized by types, states, or key phrases.You can find the most recent types of forms such as the Ohio Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption within minutes.

If you have a subscription, log in and acquire Ohio Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption from the US Legal Forms collection. The Download switch will appear on every single type you view. You have access to all earlier downloaded forms within the My Forms tab of the account.

In order to use US Legal Forms for the first time, here are simple recommendations to help you started out:

- Make sure you have picked the right type for your area/county. Select the Preview switch to review the form`s information. Look at the type explanation to actually have selected the correct type.

- When the type doesn`t match your demands, make use of the Search area near the top of the screen to discover the one which does.

- When you are pleased with the shape, verify your option by simply clicking the Purchase now switch. Then, pick the costs program you prefer and provide your references to sign up for the account.

- Method the transaction. Make use of your credit card or PayPal account to perform the transaction.

- Pick the file format and acquire the shape on your own device.

- Make modifications. Complete, change and produce and indicator the downloaded Ohio Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption.

Each template you added to your account lacks an expiry particular date and is your own permanently. So, in order to acquire or produce yet another backup, just go to the My Forms area and click on the type you need.

Get access to the Ohio Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption with US Legal Forms, by far the most comprehensive collection of legal file web templates. Use a large number of expert and status-certain web templates that fulfill your business or person requires and demands.