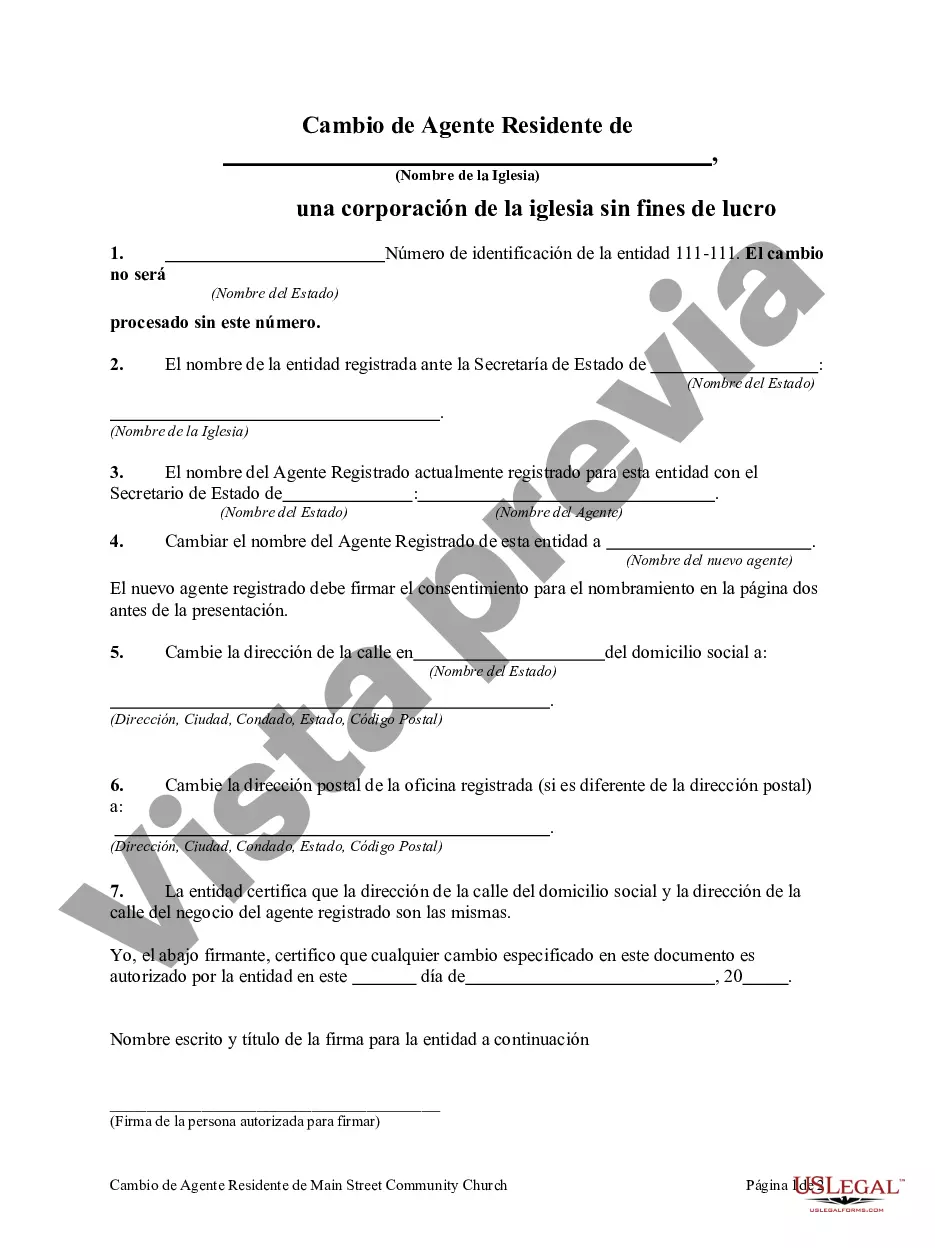

Ohio Change of Resident Agent of Non-Profit Church Corporation: A Detailed Description and Types In the state of Ohio, a Non-Profit Church Corporation must comply with specific regulations and requirements in order to operate legally and maintain its non-profit status. One of these requirements is appointing a Resident Agent or a Registered Agent, who serves as the official point of contact between the Non-Profit Church Corporation and the state. A Resident Agent acts as the intermediary for receiving legal and official documents, such as service of process (lawsuits) and important communications from the Ohio Secretary of State. This ensures that the Non-Profit Church Corporation is promptly made aware of any legal actions or responsibilities it might have. The Resident Agent must have a physical address within the state of Ohio and be available during regular business hours to receive and forward communications to the Non-Profit Church Corporation. However, circumstances may arise when a Non-Profit Church Corporation needs to change its Resident Agent. This process is known as the "Ohio Change of Resident Agent of Non-Profit Church Corporation." It involves notifying the Ohio Secretary of State and filing the necessary forms to update the information within the state records. To facilitate the Ohio Change of Resident Agent of Non-Profit Church Corporation, the following steps should be followed: 1. Select a new Resident Agent: The Non-Profit Church Corporation must appoint an individual or an entity that meets the relevant requirements stated by the Ohio Secretary of State to act as the new Resident Agent. It is crucial to choose a reliable and responsible agent who can fulfill the role effectively. 2. Obtain consent from the new Resident Agent: Before making the change official, the Non-Profit Church Corporation must obtain written consent from the chosen individual or entity, agreeing to act as the new Resident Agent for the organization. 3. Filing the appropriate forms: The Non-Profit Church Corporation must complete and file the relevant forms with the Ohio Secretary of State's office to execute the change. The forms typically include a Change of Resident Agent Form or a similar document provided by the state. 4. Paying the required fees: Along with the filing of the forms, the Non-Profit Church Corporation may be required to pay a filing fee, as determined by the Ohio Secretary of State. The fee is usually nominal and can vary depending on the specific circumstances. Once the necessary paperwork and fees are submitted, the Ohio Secretary of State will update the records of the Non-Profit Church Corporation accordingly, reflecting the change of resident agent. Different Types of Ohio Change of Resident Agent of Non-Profit Church Corporation: While the overall process of changing the Resident Agent remains the same, there may be slight variations in the procedure based on the different types of Non-Profit Church Corporations in Ohio. Some examples of these types include: 1. Religious Institutions: Non-Profit Church Corporations associated with specific religious denominations or faith-based organizations. 2. Charitable Organizations: Non-Profit Church Corporations primarily engaged in charitable activities, such as providing aid, support, or services to the community. 3. Educational Institutions: Non-Profit Church Corporations that operate educational facilities or offer educational services, such as schools, colleges, or tutoring centers. 4. Youth and Community Centers: Non-Profit Church Corporations focused on providing recreational, social, or cultural activities for the youth or community members. It is essential for each type of Non-Profit Church Corporation to adhere to the specific requirements and guidelines set by the Ohio Secretary of State when carrying out a Change of Resident Agent. In conclusion, the Ohio Change of Resident Agent of Non-Profit Church Corporation is a vital process that ensures effective communication between the state and the organization. By understanding the necessary steps involved and considering the different types of Non-Profit Church Corporations, Ohio Non-Profit Church Corporations can comply with legal requirements and maintain smooth operations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Cambio de Agente Residente de Non-Profit Church Corporation - Change of Resident Agent of Non-Profit Church Corporation

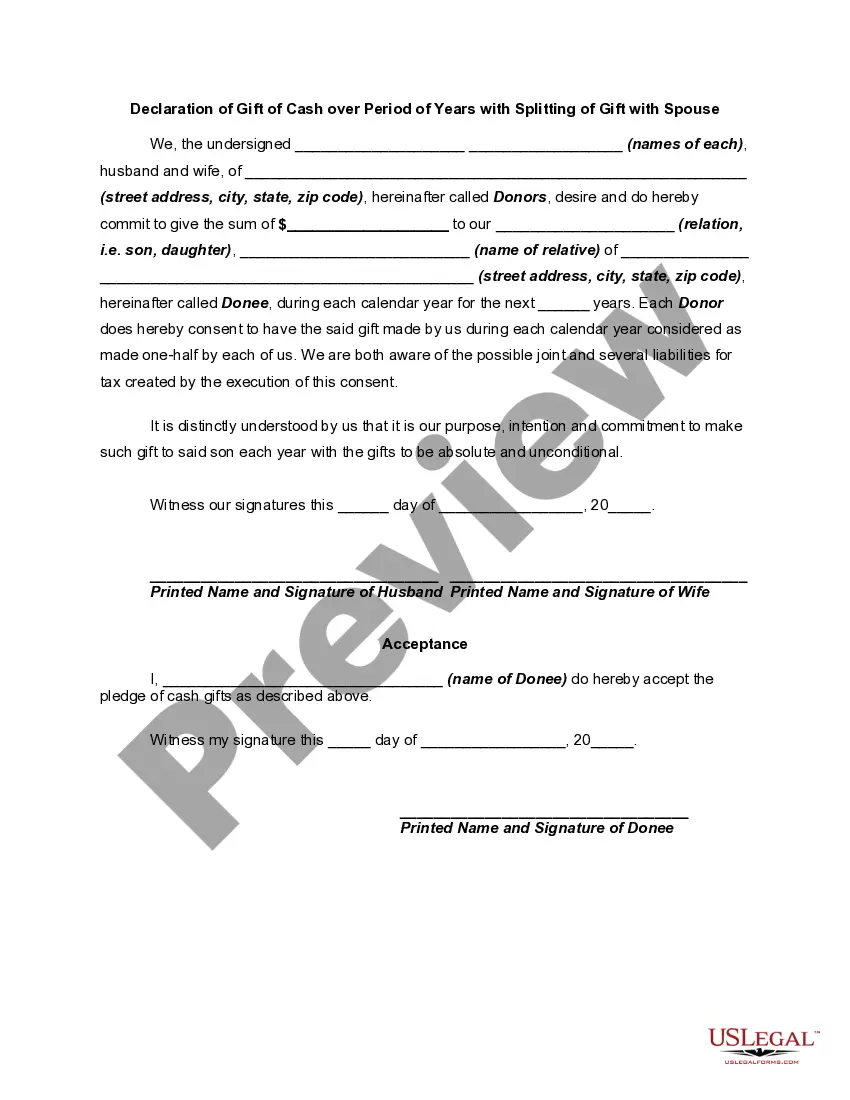

Description

How to fill out Ohio Cambio De Agente Residente De Non-Profit Church Corporation?

If you have to full, download, or printing authorized papers web templates, use US Legal Forms, the most important variety of authorized forms, that can be found on-line. Make use of the site`s easy and hassle-free research to obtain the files you require. Different web templates for business and individual functions are categorized by categories and states, or key phrases. Use US Legal Forms to obtain the Ohio Change of Resident Agent of Non-Profit Church Corporation in a number of clicks.

When you are already a US Legal Forms customer, log in in your profile and click the Down load button to find the Ohio Change of Resident Agent of Non-Profit Church Corporation. You can also gain access to forms you previously delivered electronically from the My Forms tab of your own profile.

If you are using US Legal Forms the first time, follow the instructions listed below:

- Step 1. Make sure you have selected the form for that right town/nation.

- Step 2. Take advantage of the Preview solution to look over the form`s information. Don`t neglect to read the information.

- Step 3. When you are unhappy together with the form, utilize the Search industry towards the top of the screen to locate other variations of the authorized form template.

- Step 4. Upon having identified the form you require, click the Acquire now button. Select the rates program you choose and add your qualifications to register for an profile.

- Step 5. Process the deal. You can utilize your charge card or PayPal profile to accomplish the deal.

- Step 6. Pick the formatting of the authorized form and download it on your gadget.

- Step 7. Comprehensive, change and printing or indication the Ohio Change of Resident Agent of Non-Profit Church Corporation.

Every authorized papers template you purchase is your own permanently. You possess acces to each form you delivered electronically inside your acccount. Go through the My Forms area and pick a form to printing or download again.

Compete and download, and printing the Ohio Change of Resident Agent of Non-Profit Church Corporation with US Legal Forms. There are many professional and status-particular forms you may use to your business or individual requires.