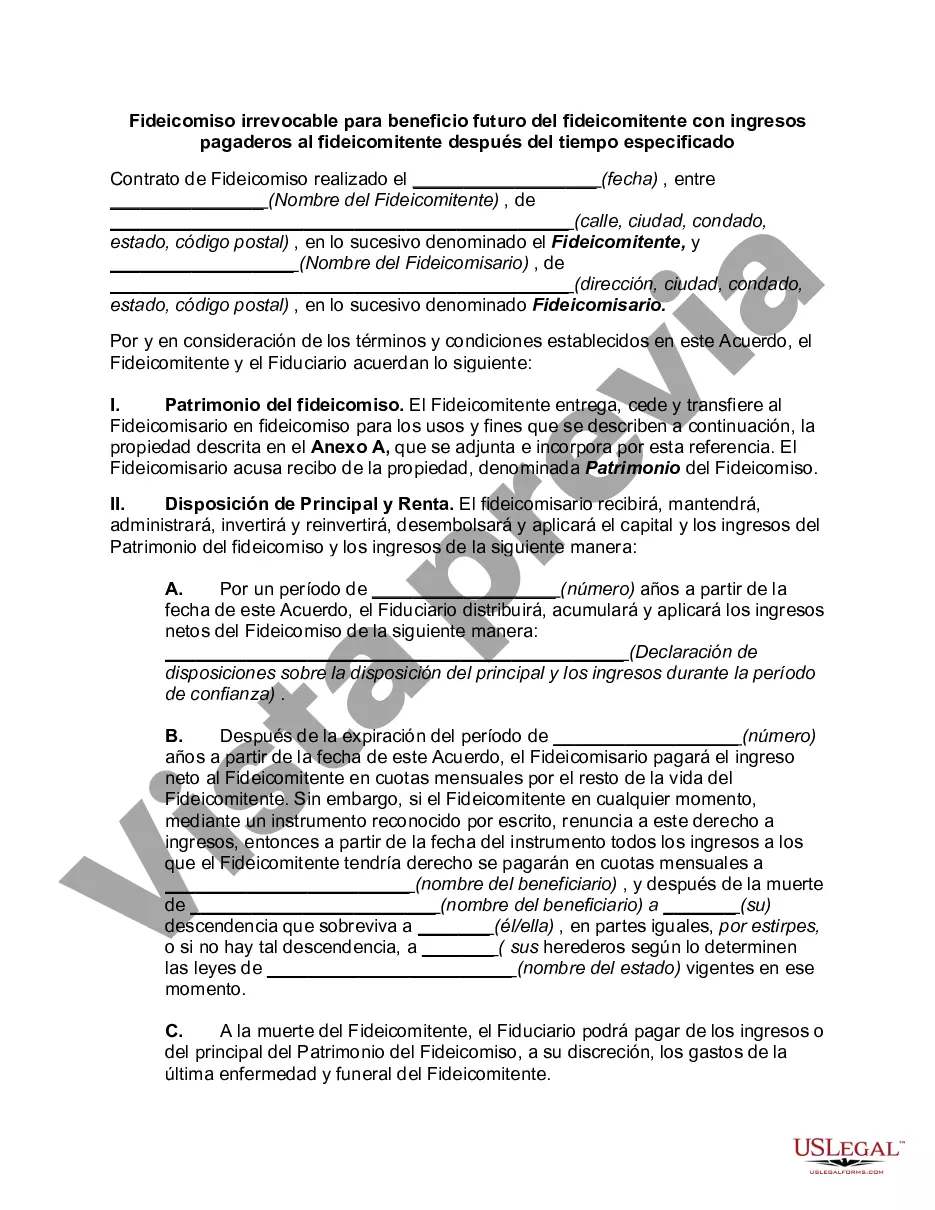

An Ohio Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a legal arrangement wherein an individual (the trust or) transfers their assets and properties into a trust for the benefit of themselves or their loved ones. This type of trust offers several advantages, including asset protection, tax planning, and estate preservation. The trust or appoints a trustee, who manages and administers the trust according to the terms set forth by the trust or. In this specific type of Irrevocable Trust, the trust or retains the right to receive income from the trust after a specified period of time, ensuring financial security and stability. The trust or may set conditions or guidelines for the distribution of income, such as regular payments or lump sum amounts. There are various types of Ohio Irrevocable Trusts for Future Benefit of Trust or with Income Payable to Trust or after Specified Time, tailored to specific needs and circumstances. Some of these include: 1. Ohio Irrevocable Income Trust: This trust allows the trust or to receive a regular income stream from the trust assets after a specified time, while also protecting the assets from various risks and creditors. 2. Ohio Dynasty Trust: A dynasty trust is designed to benefit multiple generations of the trust or's family. The trust can hold and distribute income to the trust or during their lifetime, with the remaining assets continuing to benefit future generations without being subject to estate taxes. 3. Ohio Special Needs Trust: This type of trust is created to provide financial support and asset management for individuals with special needs or disabilities. The trust assets can generate income to support the trust or's needs while also preserving eligibility for government benefits. 4. Ohio Charitable Remainder Trust: With this trust, the trust or transfers assets to a trust, retaining the right to income for a specified time. After that period, the remaining trust assets are distributed to a charitable organization or foundation, providing both income for the trust or and supporting a charitable cause. 5. Ohio Granter Retained Income Trust: In this trust, the trust or retains the right to receive income for a specified term, after which the remaining assets are transferred to the beneficiaries. This type of trust allows the trust or to transfer assets while reducing potential estate taxes. Ohio Irrevocable Trusts for Future Benefit of Trust or with Income Payable to Trust or after Specified Time provide individuals with flexibility, asset protection, and financial security. It is crucial to consult with an experienced attorney and financial advisor to determine the most suitable type of trust based on individual goals, needs, and financial circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Fideicomiso irrevocable para beneficio futuro del fideicomitente con ingresos pagaderos al fideicomitente después del tiempo especificado - Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Ohio Fideicomiso Irrevocable Para Beneficio Futuro Del Fideicomitente Con Ingresos Pagaderos Al Fideicomitente Después Del Tiempo Especificado?

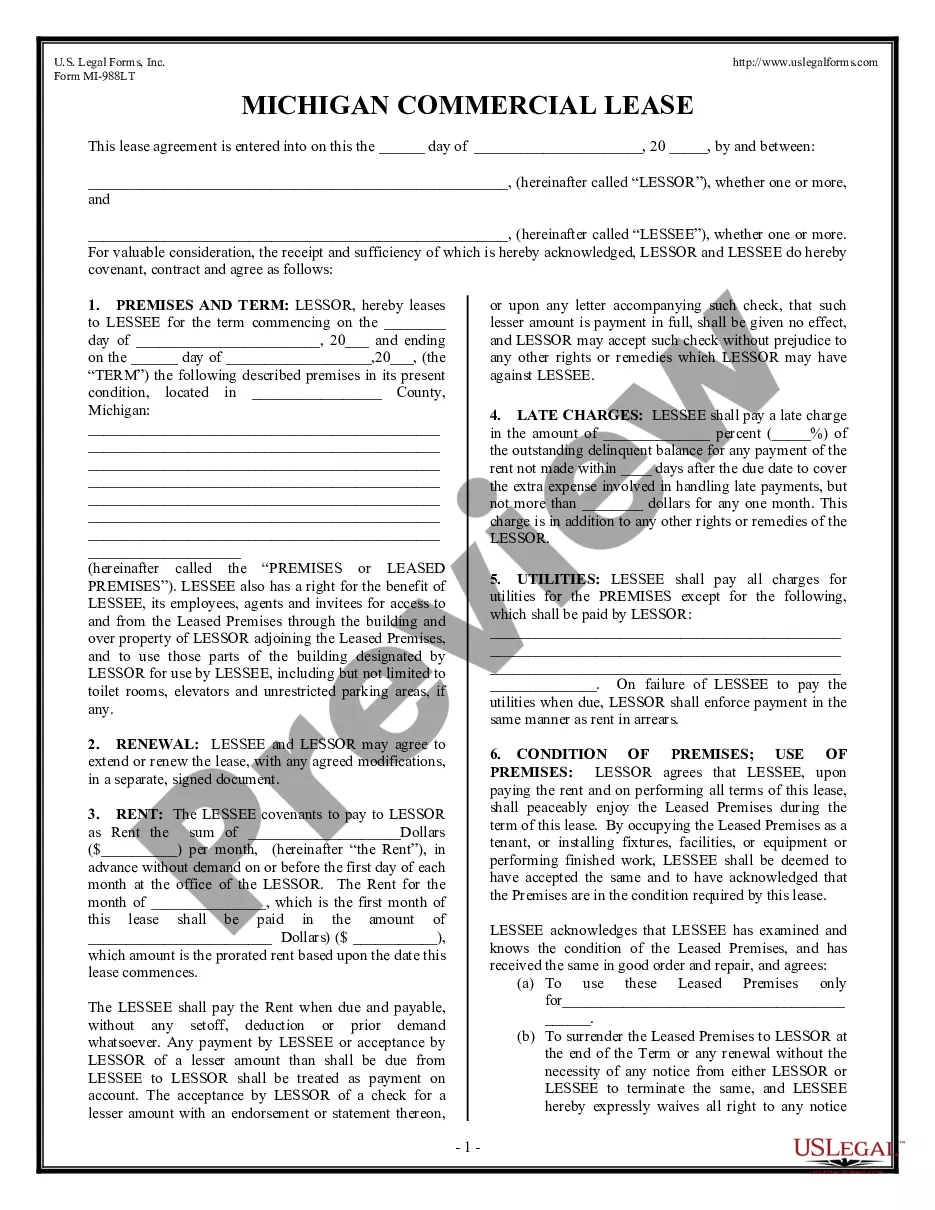

If you wish to comprehensive, down load, or produce lawful file themes, use US Legal Forms, the largest assortment of lawful types, which can be found on the web. Take advantage of the site`s easy and handy search to discover the documents you require. Different themes for enterprise and person purposes are categorized by classes and suggests, or keywords and phrases. Use US Legal Forms to discover the Ohio Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time in a number of mouse clicks.

In case you are currently a US Legal Forms buyer, log in for your accounts and click the Obtain button to get the Ohio Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time. You may also entry types you in the past delivered electronically within the My Forms tab of your accounts.

Should you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Make sure you have chosen the form for your proper city/land.

- Step 2. Utilize the Review option to look over the form`s content. Don`t neglect to learn the explanation.

- Step 3. In case you are unhappy with the form, utilize the Look for discipline at the top of the display screen to locate other variations from the lawful form web template.

- Step 4. Upon having found the form you require, click on the Buy now button. Pick the pricing strategy you like and add your accreditations to register for the accounts.

- Step 5. Process the financial transaction. You can utilize your charge card or PayPal accounts to complete the financial transaction.

- Step 6. Pick the structure from the lawful form and down load it in your device.

- Step 7. Comprehensive, edit and produce or indicator the Ohio Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

Every lawful file web template you purchase is your own property permanently. You might have acces to each and every form you delivered electronically in your acccount. Go through the My Forms portion and decide on a form to produce or down load yet again.

Remain competitive and down load, and produce the Ohio Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time with US Legal Forms. There are many specialist and express-specific types you may use for the enterprise or person needs.