Ohio LLC Operating Agreement - Taxed as a Partnership

Description

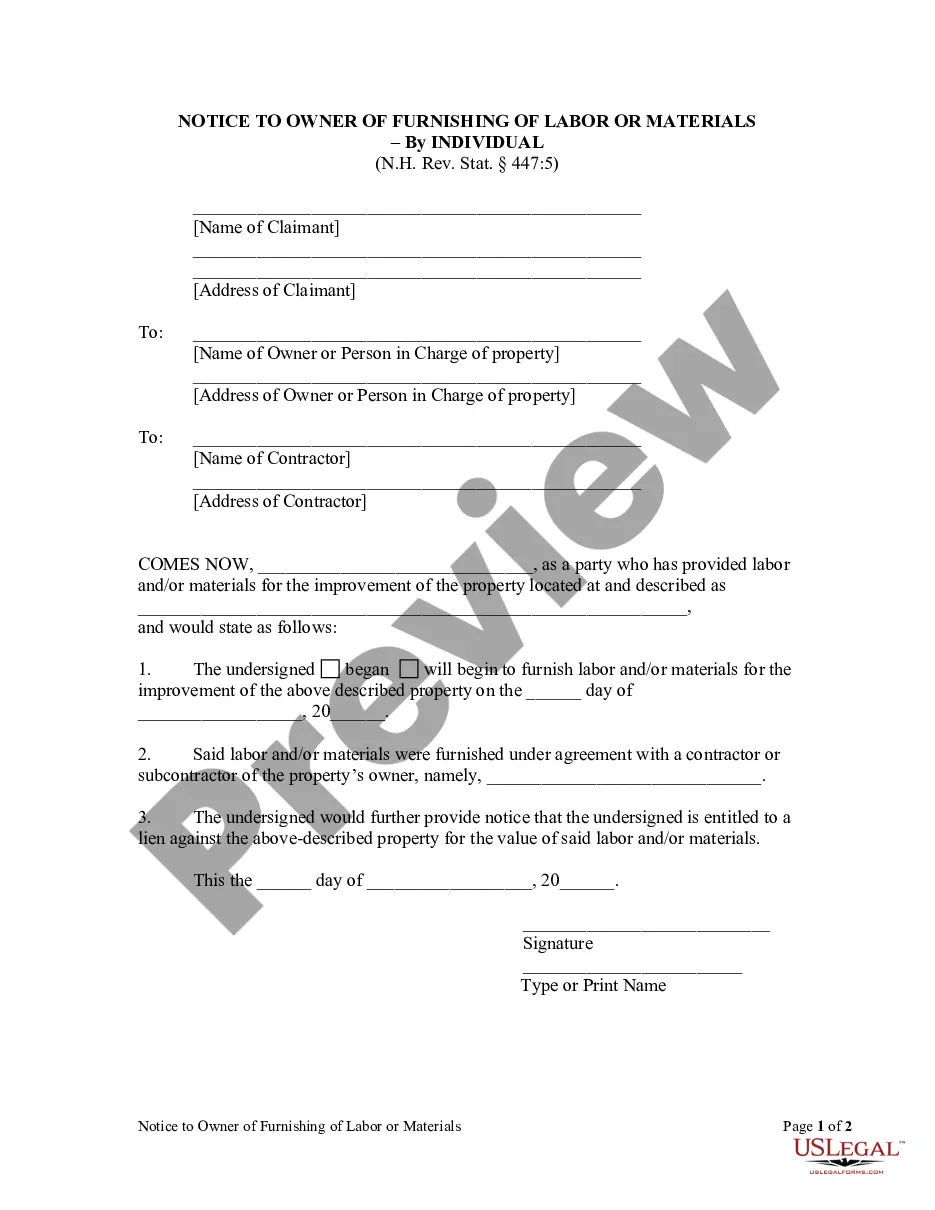

How to fill out LLC Operating Agreement - Taxed As A Partnership?

If you desire to aggregate, obtain, or print authentic document templates, utilize US Legal Forms, the primary collection of legal forms accessible online.

Leverage the site’s straightforward and user-friendly search to locate the documents you require.

A selection of templates for commercial and personal purposes are organized by categories and jurisdictions or keywords.

Step 4. Once you have located the form you need, click on the Purchase now button. Select the payment plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Employ US Legal Forms to acquire the Ohio LLC Operating Agreement for S Corp with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the Ohio LLC Operating Agreement for S Corp.

- You can also access forms you previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Utilize the Review option to examine the form’s details. Don’t forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

For federal tax purposes, you can simply make an election for the LLC to be taxed as an S-Corporation. All you need to do is fill out a form and send it to the IRS. Once the LLC is classified for federal tax purposes as a Corporation, it can file Form 2553 to be taxed as an S-Corporation.

As an LLC, it will have to pay an $800 annual minimum tax with a $6,000 LLC fee totaling $6,800. Meanwhile, an S Corp will only pay $2,250 of S Corp tax based on the 1.5% tax rate. Choosing to be an S Corp can provide tax savings to the owners for self-employment tax purposes.

How to File (4 Steps)Step 1 Select a Business Name.Step 2 Appoint a Statutory Agent.Step 3 File Documents with Secretary of State.Step 4 Execute an Operating Agreement.Step 5 Register Company for Taxation.

An Ohio LLC operating agreement is a legal document that would be used by any sized business that would like to establish the policies, standard operating procedures, member relations, and more, pertaining to their business.

Every Ohio LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Negotiate and execute an operating agreement.Ohio does not require an operating agreement in order to form an LLC, but executing one is highly advisable.

An operating agreement is ONLY required in the five (5) States of California, Delaware, Maine, Missouri, and New York. In all other States, an operating agreement is not required but is recommended to be written and signed by all members of the LLC.

To elect for S-Corp treatment, file Form 2553. You can make this election at the same time you file your taxes by filing Form 1120S, attaching Form 2533 and submitting along with your personal tax return.

You can switch your limited liability company's (LLC) tax status to an S corporation, provided it meets the Internal Revenue Service's (IRS) requirements. You don't have to change your business structure, but you'll need to file a form with the IRS.

Starting an Ohio LLC and electing S corp tax status is easy....Step 1: Name Your LLC.Step 2: Choose Your Ohio Registered Agent.Step 3: File the Ohio LLC Articles of Organization.Step 4: Create an LLC Operating Agreement.More items...?