An indemnification agreement for a trust in Ohio is a legal document that outlines the terms and conditions under which a trustee or fiduciary is protected from liabilities and expenses incurred during the administration of a trust. This agreement provides assurances to trustees that they will be held harmless in the event of any legal claims, lawsuits, or financial losses that may arise during the course of administering the trust. The Ohio Indemnification Agreement for a Trust is a valuable tool to ensure trustees can carry out their duties without the fear of personal financial loss. Trustees are often entrusted with managing significant assets on behalf of beneficiaries, and this agreement acts as a shield against personal liability. When beneficiaries or other parties file claims, lawsuits, or challenges against a trustee, the indemnification agreement offers legal protection. The Ohio Indemnification Agreement for a Trust typically includes explicit provisions that protect trustees from claims arising from actions taken in good faith and with reasonable prudence. It covers costs such as attorney fees, court expenses, and settlements or judgments against the trustee. This agreement is essential as it encourages individuals to take on the significant responsibilities of a trustee, knowing that they will not bear the financial burden if disputes or legal actions arise. Different types of Ohio Indemnification Agreements for a Trust may include: 1. Standard Indemnification Agreement for a Trust: This is a comprehensive agreement that covers the general rights and protections of a trustee, ensuring they are shielded from liability and expenses. 2. Limited Indemnification Agreement for a Trust: This agreement may limit the indemnification protections, offering partial coverage or excluding certain types of liabilities or circumstances. 3. Special Indemnification Agreement for a Trust: This type of agreement may be tailored to specific situations or trustee roles. It includes provisions unique to the trustee's responsibilities or the nature of the trust assets. It is crucial for trustees, beneficiaries, and any parties involved in the administration of a trust to carefully review the specific terms and conditions outlined in the Ohio Indemnification Agreement for a Trust. Consulting with legal professionals experienced in trust law can provide guidance on drafting or interpreting the agreement to ensure all the necessary protections are in place. Overall, the Ohio Indemnification Agreement for a Trust is a vital instrument in safeguarding trustees from potential personal liabilities and expenses, thereby allowing them to carry out their fiduciary duties with confidence and efficiency.

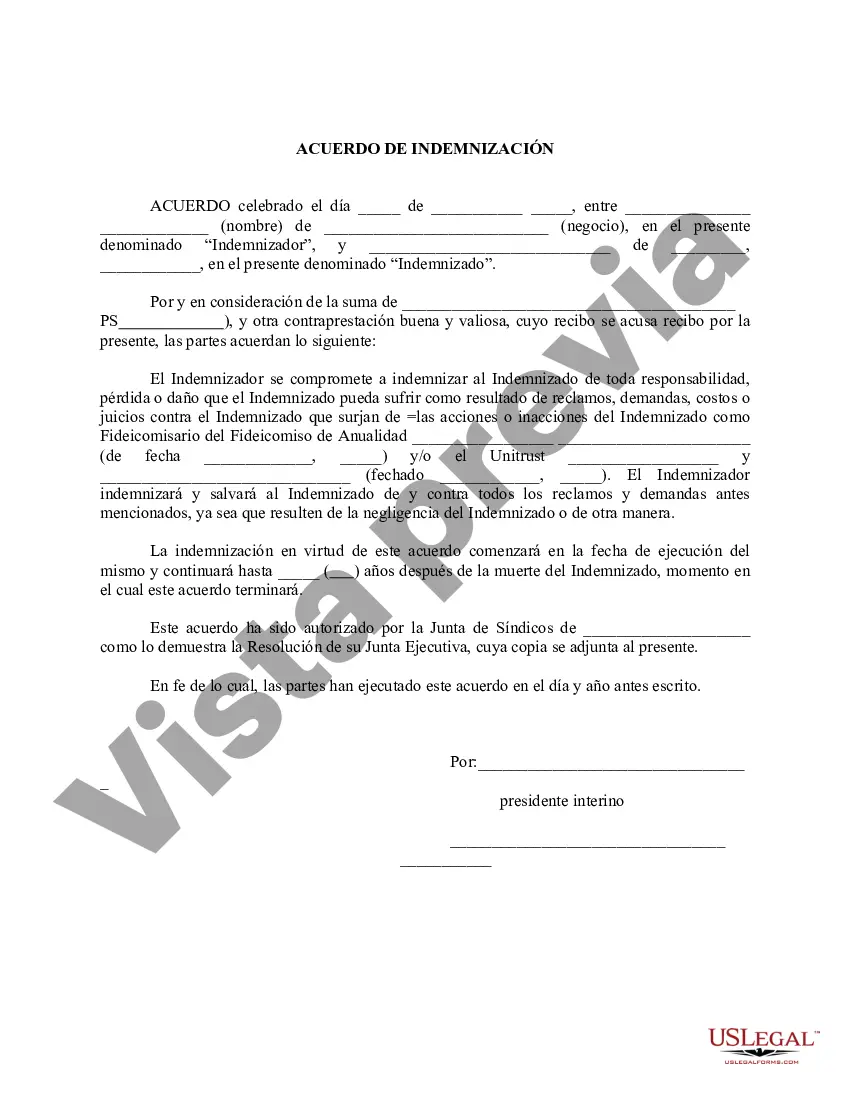

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Acuerdo de Indemnización por un Fideicomiso - Indemnification Agreement for a Trust

Description

How to fill out Ohio Acuerdo De Indemnización Por Un Fideicomiso?

Are you currently in the position in which you need files for sometimes enterprise or personal functions nearly every day time? There are plenty of legal file themes accessible on the Internet, but locating kinds you can trust isn`t effortless. US Legal Forms offers a huge number of form themes, much like the Ohio Indemnification Agreement for a Trust, which can be created in order to meet federal and state needs.

In case you are currently acquainted with US Legal Forms internet site and possess an account, basically log in. Following that, it is possible to obtain the Ohio Indemnification Agreement for a Trust web template.

Should you not have an accounts and wish to start using US Legal Forms, abide by these steps:

- Find the form you require and make sure it is for that appropriate town/area.

- Take advantage of the Review option to examine the form.

- Look at the explanation to ensure that you have chosen the right form.

- If the form isn`t what you`re looking for, make use of the Lookup field to get the form that meets your needs and needs.

- Whenever you get the appropriate form, click on Acquire now.

- Choose the pricing strategy you desire, submit the necessary details to make your bank account, and buy an order making use of your PayPal or credit card.

- Select a convenient data file structure and obtain your duplicate.

Find all of the file themes you may have purchased in the My Forms food selection. You may get a extra duplicate of Ohio Indemnification Agreement for a Trust anytime, if needed. Just select the needed form to obtain or print out the file web template.

Use US Legal Forms, one of the most extensive variety of legal kinds, to conserve time and steer clear of mistakes. The service offers expertly created legal file themes that can be used for a selection of functions. Make an account on US Legal Forms and commence creating your lifestyle easier.