Ohio Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code (Date) Place: (Time): I. Call to Order The meeting was called to order by (Chairman/President) at (Time) at (Location). II. Roll Call The following members of the Board of Directors were present: 1. (Name of Director) 2. (Name of Director) 3. (Name of Director) 4. (Name of Director) 5. (Name of Director) III. Approval of Agenda The agenda for the meeting was circulated and discussed. It was moved by (Name of Director) to approve the agenda. The motion was seconded by (Name of Director) and carried unanimously. IV. Stock Ownership Plan under Section 1244 of the Internal Revenue Code The Chairman introduced the topic of adopting a Stock Ownership Plan under Section 1244 of the Internal Revenue Code. The purpose of this plan is to provide shareholders with certain tax benefits in case of losses incurred by the corporation. The Chairman presented a detailed explanation of Section 1244 of the Internal Revenue Code, highlighting its key provisions and benefits to the corporation and its shareholders. V. Discussion A comprehensive discussion followed, during which the following points were raised and addressed: 1. Understanding Section 1244: The Board members expressed the need for a clear understanding of the requirements and implications of Section 1244. The Chairman provided a detailed explanation, emphasizing the need to meet specific criteria to qualify for the benefits outlined in the code. 2. Advantages and Risks: Various benefits and risks associated with adopting the Stock Ownership Plan were discussed, including the potential tax savings for eligible shareholders and the impact on the corporation's financials. The Board members engaged in an in-depth analysis to evaluate the plan's feasibility and potential risks. 3. Implementation and Communication: The Board discussed the steps required to implement the Stock Ownership Plan successfully. It was emphasized that effective communication and transparency with shareholders would be key to ensure a smooth adoption process. VI. Resolution After thorough discussion, it was moved by (Name of Director) to adopt the Stock Ownership Plan under Section 1244 of the Internal Revenue Code. The motion was seconded by (Name of Director) and carried unanimously. The following resolution was proposed: "Be it resolved, that the Board of Directors of (Name of Corporation) hereby authorizes the adoption of the Stock Ownership Plan under Section 1244 of the Internal Revenue Code, as presented and discussed." VII. Adjournment There being no further business to discuss, the meeting was adjourned at (Time). Prepared by: (Name of Secretary) Secretary Approved by: (Name of Chairman/President) (Title)

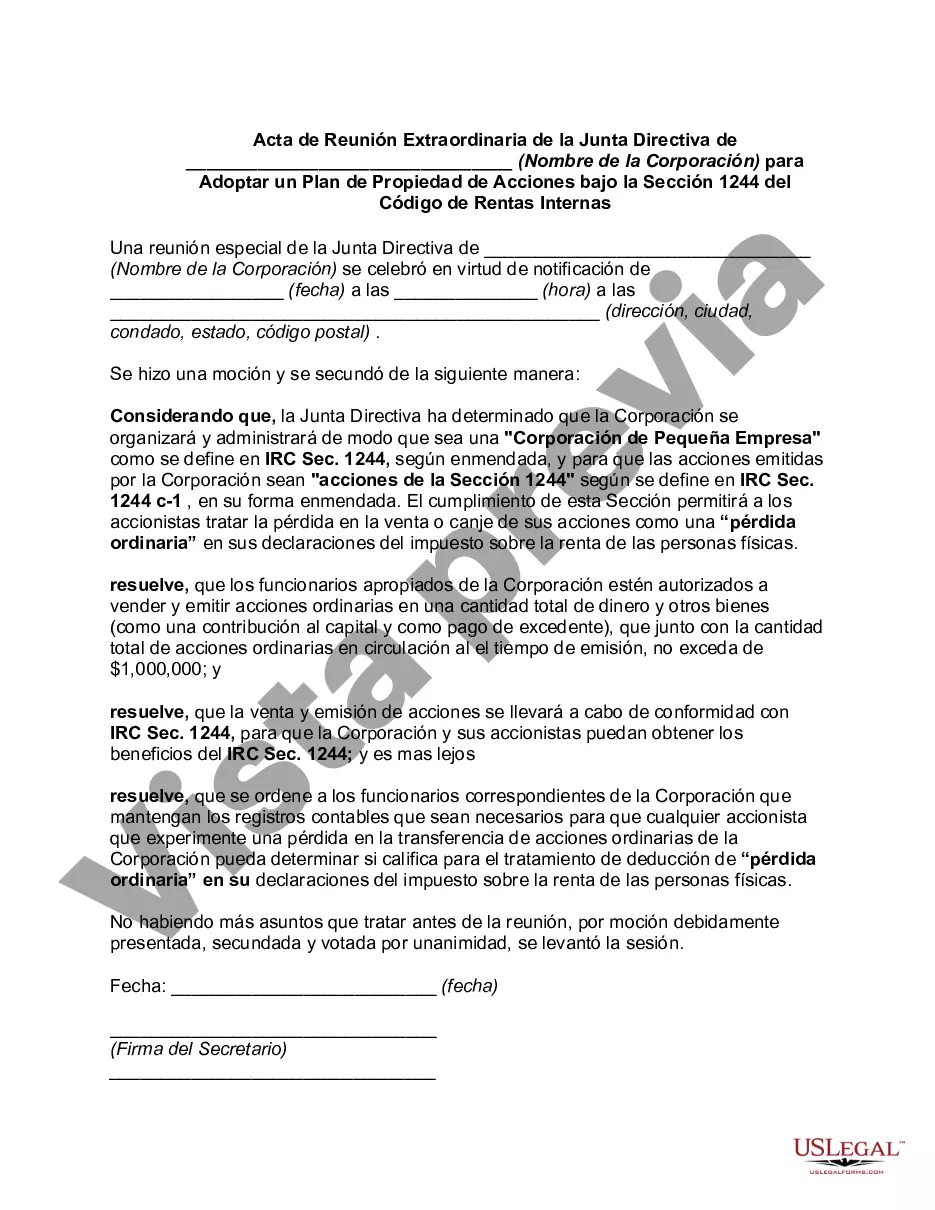

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Minutas de la reunión especial de la Junta Directiva de (Nombre de la corporación) para adoptar el Plan de propiedad de acciones bajo la Sección 1244 del Código de Rentas Internas - Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code

Description

How to fill out Ohio Minutas De La Reunión Especial De La Junta Directiva De (Nombre De La Corporación) Para Adoptar El Plan De Propiedad De Acciones Bajo La Sección 1244 Del Código De Rentas Internas?

Discovering the right legitimate papers web template can be a have difficulties. Naturally, there are a variety of themes accessible on the Internet, but how would you get the legitimate develop you want? Make use of the US Legal Forms internet site. The support provides a large number of themes, including the Ohio Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code, which can be used for enterprise and personal needs. Every one of the kinds are checked out by specialists and fulfill state and federal needs.

If you are currently registered, log in to the profile and click the Obtain option to obtain the Ohio Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code. Use your profile to check with the legitimate kinds you have bought earlier. Go to the My Forms tab of the profile and obtain one more version from the papers you want.

If you are a brand new user of US Legal Forms, listed below are simple recommendations so that you can stick to:

- Very first, make sure you have selected the correct develop for the town/county. You are able to examine the form utilizing the Preview option and browse the form outline to guarantee it is the best for you.

- If the develop will not fulfill your expectations, utilize the Seach field to discover the correct develop.

- When you are certain that the form would work, select the Purchase now option to obtain the develop.

- Choose the costs prepare you would like and enter in the needed information and facts. Create your profile and purchase your order making use of your PayPal profile or credit card.

- Choose the data file file format and obtain the legitimate papers web template to the product.

- Full, change and print out and signal the attained Ohio Minutes of Special Meeting of the Board of Directors of (Name of Corporation) to Adopt Stock Ownership Plan under Section 1244 of the Internal Revenue Code.

US Legal Forms will be the largest catalogue of legitimate kinds in which you can see different papers themes. Make use of the company to obtain skillfully-made documents that stick to express needs.