Ohio Inquiry of Credit Cardholder Concerning Billing Error is a legal procedure designed to protect credit cardholders in Ohio from incorrect billing charges. This procedure allows credit cardholders to dispute billing errors and seek resolution. Under Ohio law, credit card companies are required to provide a specific process for credit cardholders to inquire about billing errors. The procedure involves the following steps: 1. Filing a written inquiry: Credit cardholders must submit a written inquiry to their credit card company within a specified timeframe (usually 60 days) from the date of the billing statement that contains the error. The inquiry should provide detailed information about the error, including the nature of the error, the amount in dispute, and any supporting documents. 2. Investigation by the credit card company: Upon receiving the inquiry, the credit card company is obligated to conduct a thorough investigation into the billing error. They must review the cardholder's account records and any other relevant information to determine the accuracy of the charges. 3. Provisional credit and notification: During the investigation, the credit card company may offer a provisional credit to the cardholder. This means that they will temporarily remove the disputed amount from the cardholder's account while the investigation is ongoing. Additionally, the credit card company must provide a written acknowledgment of the dispute within 30 days of receiving the inquiry. 4. Resolution and final determination: Once the investigation is complete, the credit card company must inform the cardholder of the results. If the error is confirmed, the credit card company must correct the billing statement and reimburse any unauthorized charges. If the error is not confirmed, the credit card company must provide a written explanation to the cardholder explaining their findings. It's important to note that Ohio law specifically defines different types of errors that can be disputed by credit cardholders. These include: 1. Unauthorized charges: Any charges made on the credit card without the consent or knowledge of the cardholder. 2. Incorrect amounts: Charges that are higher or different from what was agreed upon or authorized. 3. Duplicate charges: Instances where the same transaction appears multiple times on the billing statement. 4. Math errors: Calculation mistakes resulting in inaccurate charging amounts. 5. Failure to credit payments: Instances where the credit card company fails to credit the cardholder's payment to their account. Overall, the Ohio Inquiry of Credit Cardholder Concerning Billing Error procedure ensures that credit cardholders in Ohio have a legal recourse to address and resolve billing disputes with their credit card companies. By following this process, cardholders can protect their rights and ensure fair and accurate billing practices are maintained.

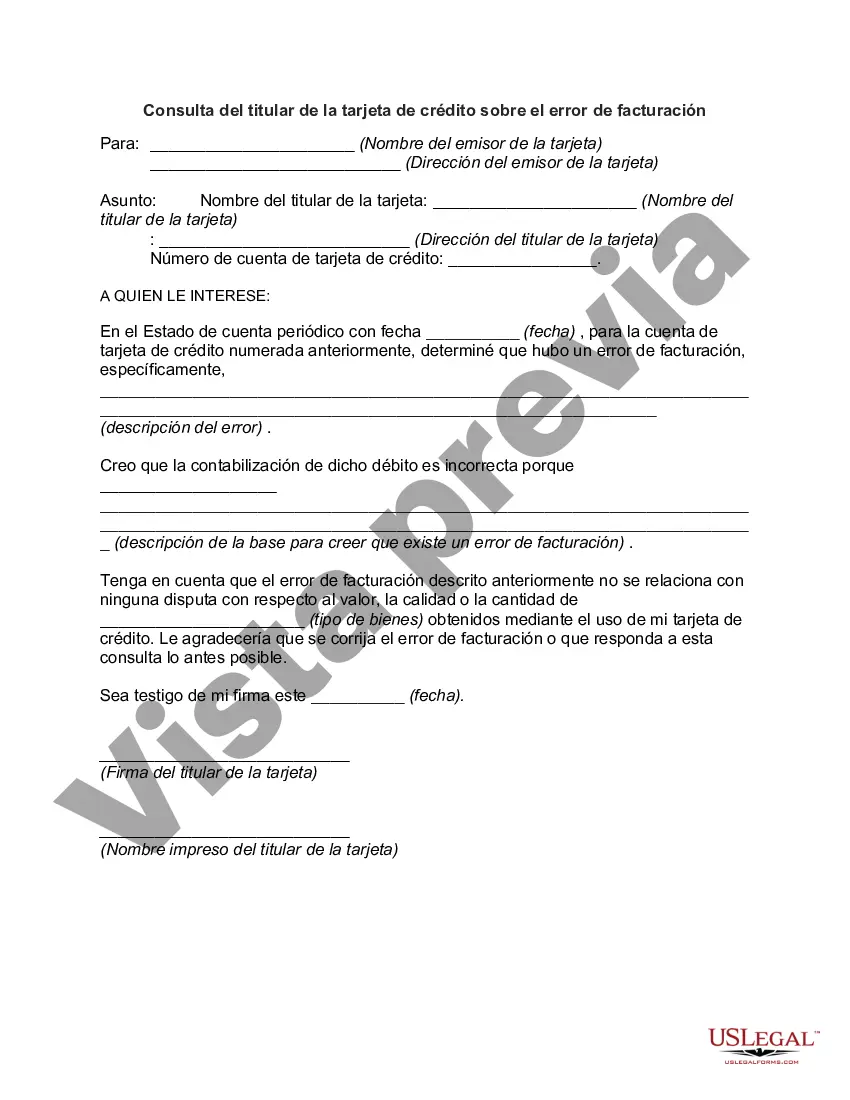

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Ohio Consulta del titular de la tarjeta de crédito sobre un error de facturación - Inquiry of Credit Cardholder Concerning Billing Error

Description

How to fill out Ohio Consulta Del Titular De La Tarjeta De Crédito Sobre Un Error De Facturación?

You are able to commit several hours online searching for the lawful record template which fits the federal and state demands you will need. US Legal Forms offers a huge number of lawful kinds which can be analyzed by specialists. It is possible to acquire or produce the Ohio Inquiry of Credit Cardholder Concerning Billing Error from my support.

If you currently have a US Legal Forms accounts, you are able to log in and click on the Down load key. After that, you are able to complete, edit, produce, or indication the Ohio Inquiry of Credit Cardholder Concerning Billing Error. Each and every lawful record template you buy is your own permanently. To get one more version of the obtained kind, proceed to the My Forms tab and click on the related key.

If you work with the US Legal Forms web site initially, follow the straightforward directions under:

- Very first, make sure that you have chosen the correct record template for the region/area that you pick. Read the kind description to ensure you have selected the right kind. If available, utilize the Preview key to appear with the record template too.

- If you wish to find one more edition of your kind, utilize the Research field to obtain the template that suits you and demands.

- Once you have found the template you desire, click on Buy now to carry on.

- Select the prices program you desire, type your accreditations, and register for your account on US Legal Forms.

- Total the deal. You may use your credit card or PayPal accounts to cover the lawful kind.

- Select the formatting of your record and acquire it for your device.

- Make changes for your record if necessary. You are able to complete, edit and indication and produce Ohio Inquiry of Credit Cardholder Concerning Billing Error.

Down load and produce a huge number of record web templates using the US Legal Forms website, which offers the most important variety of lawful kinds. Use specialist and state-distinct web templates to handle your business or specific requirements.