Ohio Breakdown of Savings for Budget and Emergency Fund: A Comprehensive Guide Introduction: Ohio residents often seek financial stability by implementing a Breakdown of Savings for Budget and Emergency Fund. This strategy ensures that individuals can effectively manage their expenses while simultaneously preparing for unexpected financial emergencies. This detailed description will explore how Ohio residents can structure their savings to create a strong financial foundation. 1. Budget Savings: Budget savings form the core of a well-managed financial plan. This type of saving is dedicated to covering regular expenses, including housing, utilities, transportation, groceries, and other essential costs. By having a solid budget savings plan in place, Ohio residents can effectively allocate their monthly income toward necessary expenses, enabling a consistent and stable lifestyle. 2. Emergency Fund Savings: Ohio residents should allocate a specific portion of their savings for emergency funds. These savings act as a safety net, providing immediate financial resources when unexpected expenses arise. Emergency funds can cover a range of unforeseen situations such as medical emergencies, car repairs, home repairs, unexpected job loss, or natural disasters. Allocating a percentage of income to these savings ensures that individuals are well-prepared to tackle any financial crisis effectively. 3. Health and Wellness Savings: Under the Breakdown of Savings for Budget and Emergency Fund, Ohio residents should consider setting aside funds specifically for health and wellness expenses. This category includes health insurance premiums, deductibles, co-pays, and other medical costs. Having dedicated savings for health-related expenses ensures that individuals don't neglect their well-being and can manage healthcare expenses comfortably. 4. Retirement Savings: Planning for the future is vital, and Ohio residents are encouraged to incorporate retirement savings into their financial breakdown. Setting funds aside for retirement guarantees financial stability and comfortable living during the golden years. Residents can explore different retirement savings options such as individual retirement accounts (IRAs) and employer-sponsored retirement plans like 401(k)s. 5. Education Savings: If applicable, families or individuals in Ohio can plan for education expenses by allocating savings specifically for this purpose. These savings can cover costs such as tuition fees, books, and other educational expenses. This category is particularly relevant for parents who want to support their children's higher education or individuals who wish to pursue further education themselves. Conclusion: Creating a comprehensive Breakdown of Savings for Budget and Emergency Fund in Ohio is essential for long-term financial stability and preparedness. By allocating funds specifically for budgeting, emergencies, health and wellness, retirement, and education, individuals can proactively manage their finances, ensuring both short-term necessities and long-term goals are met. Keywords: Ohio, breakdown of savings, budget, emergency fund, budget savings, emergency fund savings, health and wellness savings, retirement savings, education savings, financial stability, expenses, unexpected, medical emergencies, car repairs, home repairs, job loss, natural disasters, health insurance, retirement planning, education expenses.

Ohio Breakdown of Savings for Budget and Emergency Fund

Description

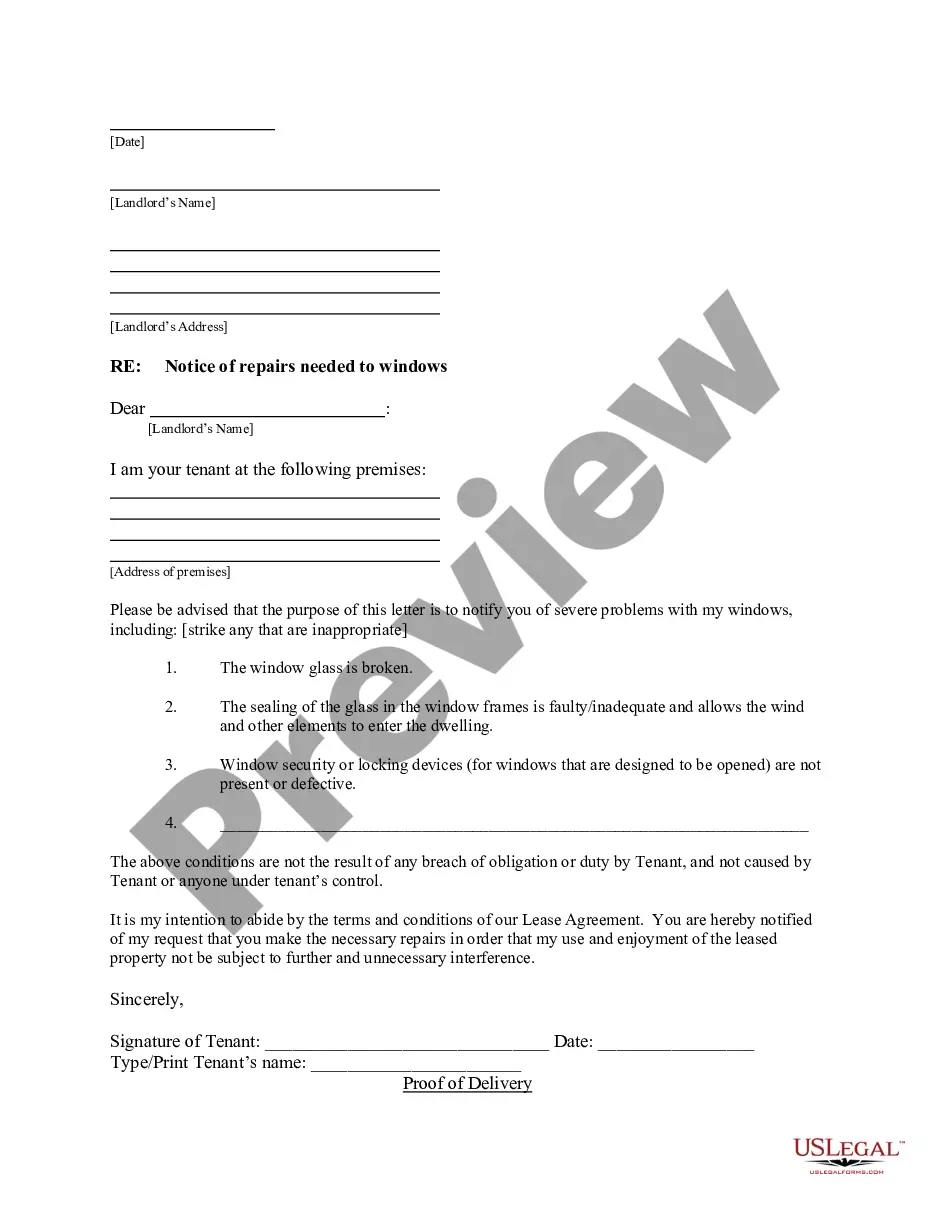

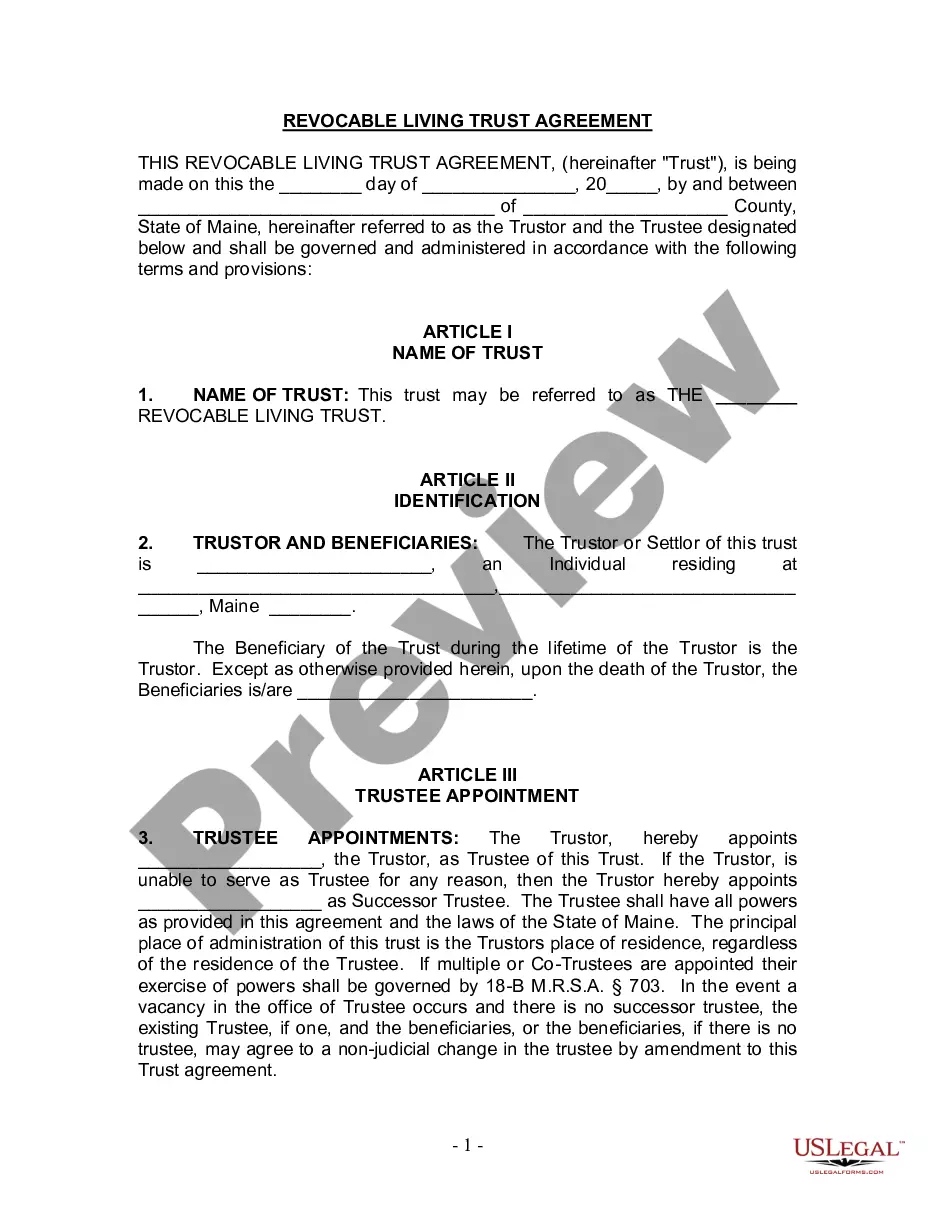

How to fill out Breakdown Of Savings For Budget And Emergency Fund?

Have you been inside a place where you need to have documents for sometimes business or personal uses nearly every day? There are tons of lawful document layouts available online, but locating versions you can rely isn`t straightforward. US Legal Forms gives 1000s of type layouts, just like the Ohio Breakdown of Savings for Budget and Emergency Fund, that are written to fulfill federal and state specifications.

If you are already knowledgeable about US Legal Forms site and also have your account, basically log in. Afterward, you may acquire the Ohio Breakdown of Savings for Budget and Emergency Fund web template.

If you do not provide an profile and need to begin using US Legal Forms, abide by these steps:

- Find the type you want and ensure it is for your appropriate area/region.

- Make use of the Review button to check the form.

- Read the outline to ensure that you have chosen the correct type.

- If the type isn`t what you are searching for, make use of the Look for field to find the type that fits your needs and specifications.

- If you get the appropriate type, just click Get now.

- Select the pricing strategy you need, fill in the desired information to make your bank account, and buy the transaction with your PayPal or charge card.

- Choose a practical document format and acquire your duplicate.

Discover all of the document layouts you possess bought in the My Forms food selection. You can get a more duplicate of Ohio Breakdown of Savings for Budget and Emergency Fund anytime, if possible. Just select the needed type to acquire or print the document web template.

Use US Legal Forms, the most substantial collection of lawful varieties, in order to save efforts and prevent mistakes. The support gives expertly manufactured lawful document layouts that can be used for a range of uses. Make your account on US Legal Forms and start making your daily life a little easier.

Form popularity

FAQ

Standard advice says you should have at least three months' worth of savings put aside in a separate bank account that you only touch in emergencies. Other experts say this amount should be as much as one whole year's worth of cash.

Our 50/30/20 calculator divides your take-home income into suggested spending in three categories: 50% of net pay for needs, 30% for wants and 20% for savings and debt repayment.

Most experts believe you should have enough money in your emergency fund to cover at least 3 to 6 months' worth of living expenses.

While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months' worth of expenses.

Having savings set aside in an emergency fund provides a great source of comfort should something unforeseen like job loss or illness happens.

It's all about your personal expenses Those include things like rent or mortgage payments, utilities, healthcare expenses, and food. If your monthly essentials come to $2,500 a month, and you're comfortable with a four-month emergency fund, then you should be set with a $10,000 savings account balance.

What is the 50/30/20 rule? The 50/30/20 rule is an easy budgeting method that can help you to manage your money effectively, simply and sustainably. The basic rule of thumb is to divide your monthly after-tax income into three spending categories: 50% for needs, 30% for wants and 20% for savings or paying off debt.

An emergency fund is necessary for peace of mind and smoothing out financial bumps in the road. Let's look at the average emergency fund size by age and how much we should have. According to Federal Reserve data, the average savings amount is $8,863 in America as of 2019.

Senator Elizabeth Warren popularized the so-called "50/20/30 budget rule" (sometimes labeled "50-30-20") in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least three to six months' worth of expenses.