Ohio Approval of deferred compensation investment account plan

Description

How to fill out Approval Of Deferred Compensation Investment Account Plan?

Discovering the right authorized record design can be a have a problem. Needless to say, there are a lot of web templates accessible on the Internet, but how will you obtain the authorized kind you require? Take advantage of the US Legal Forms website. The services provides 1000s of web templates, including the Ohio Approval of deferred compensation investment account plan, which can be used for business and personal requires. Each of the kinds are inspected by professionals and satisfy state and federal requirements.

Should you be already signed up, log in to your bank account and click the Download button to find the Ohio Approval of deferred compensation investment account plan. Make use of your bank account to appear with the authorized kinds you might have ordered formerly. Proceed to the My Forms tab of your own bank account and obtain another duplicate from the record you require.

Should you be a fresh end user of US Legal Forms, listed here are basic recommendations that you should stick to:

- Very first, be sure you have selected the appropriate kind for your personal area/county. You can look through the shape making use of the Review button and browse the shape description to ensure it will be the right one for you.

- In case the kind is not going to satisfy your requirements, utilize the Seach discipline to get the correct kind.

- Once you are positive that the shape is acceptable, click on the Get now button to find the kind.

- Choose the costs strategy you desire and enter the required details. Design your bank account and buy an order with your PayPal bank account or charge card.

- Select the document file format and acquire the authorized record design to your device.

- Total, modify and produce and indicator the acquired Ohio Approval of deferred compensation investment account plan.

US Legal Forms may be the most significant library of authorized kinds in which you will find various record web templates. Take advantage of the company to acquire skillfully-produced documents that stick to state requirements.

Form popularity

FAQ

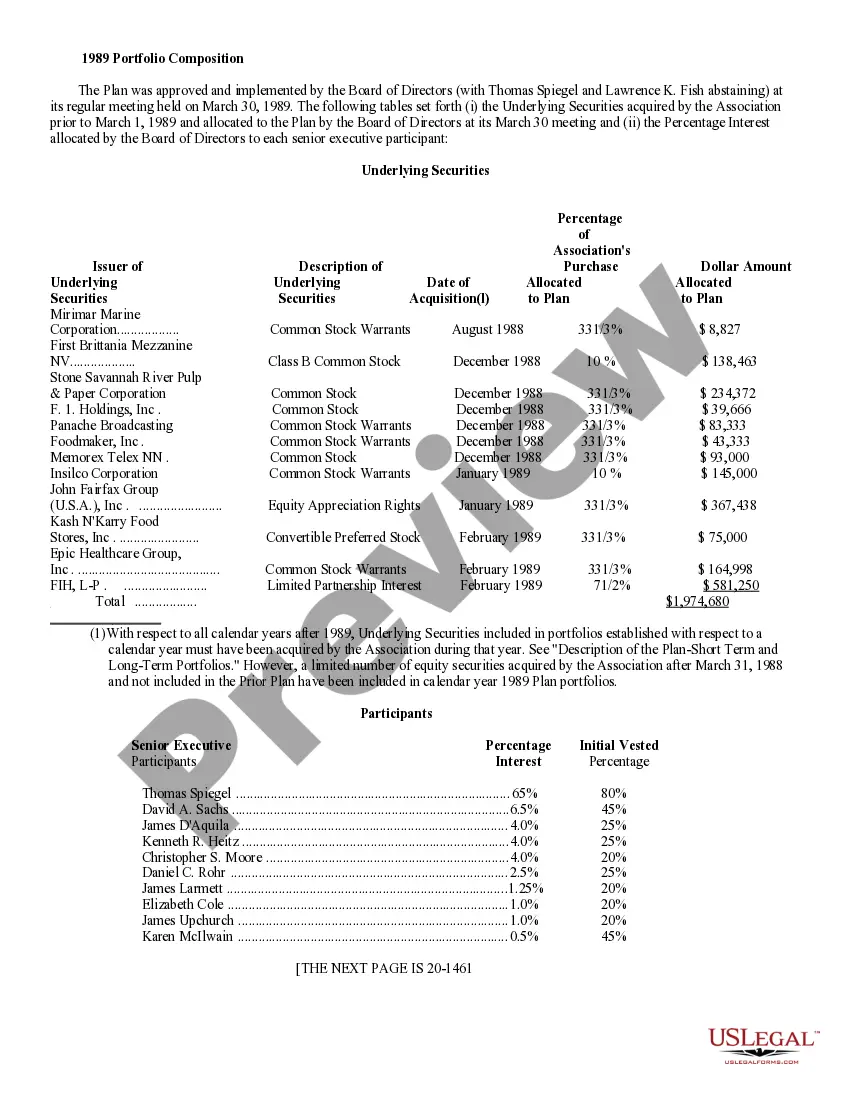

Deferred compensation plans are funded informally. There's essentially a promise from the employer to pay the deferred funds, plus any investment earnings, to the employee at the time specified. In contrast, with a 401(k), a formally established account exists.

Ohio Deferred Compensation is a supplemental 457(b) retirement plan for all Ohio public employees and one of the largest 457(b) plans in the country. Deferred compensation has been Ohio DC's only responsibility since 1976. Because of Ohio DC's size, plan expenses are low.

If people are not comfortable leaving deferred compensation in the hands of their employer, pre-retirement distributions allow them to protect their money by withdrawing it from the plan, paying tax on it, and investing it elsewhere.

You can request a loan by logging in to your DCP account, completing a Loan Application Form, or calling the Service Center at 844-523-2457.

How does SMarT work? By enrolling in the SMarT Plan, your payroll contribution deferral amount will automatically increase each year by the amount you specify (not to exceed the annual limit allowed by law). The amount selected must be a whole number between $5 and $250.

You may withdraw funds from the Program only upon: 1. Ending your employment (including termination, retirement, or death) 2. An Unforeseeable Emergency (as defined by Section 457 of the IRC) 3.

Withdrawals may begin after separation from employment and Ohio DC's receipt of the employer's verification of separation, final contribution, and Withdrawal Form. Withdrawals of pre-tax contributions are taxable as ordinary income and subject to income tax in the year received.

The Bottom Line. If you have a qualified plan and have passed the vesting period, your deferred compensation is yours, even if you quit with no notice on very bad terms. If you have a non-qualified plan, you may have to forfeit all of your deferred compensation by quitting depending on your plan's specific terms.