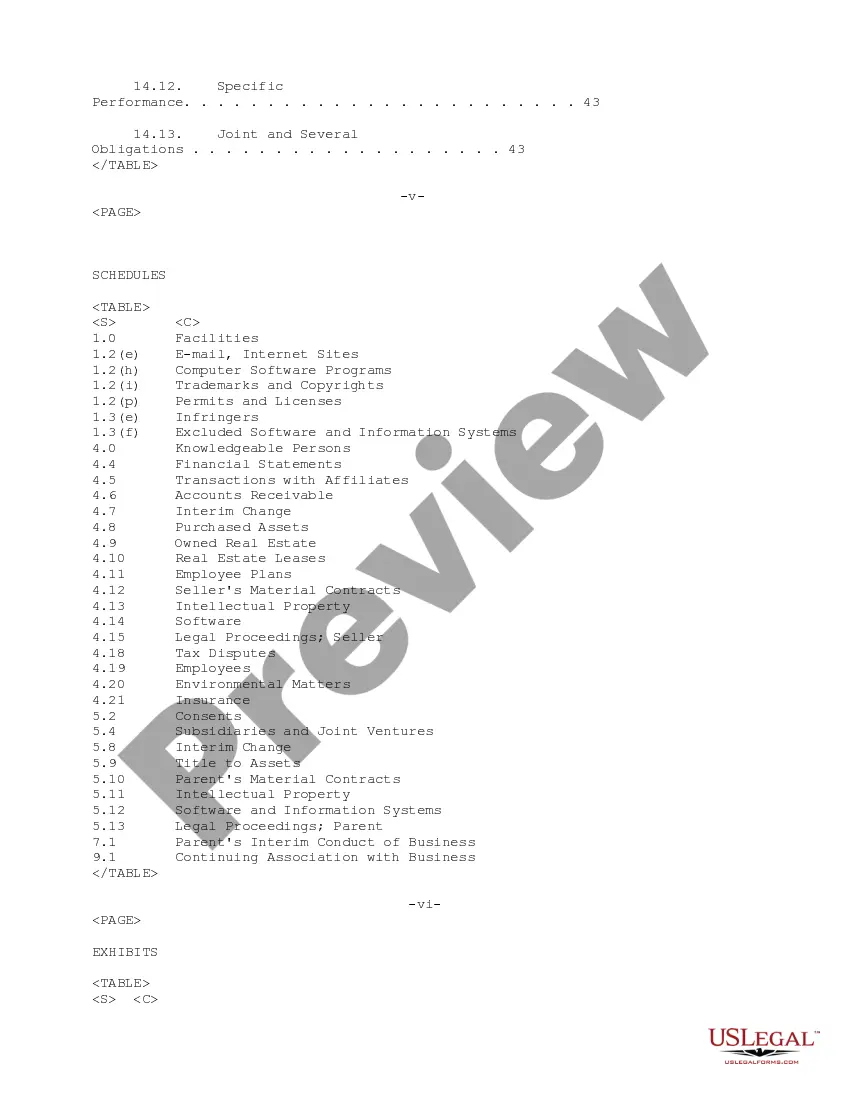

The Ohio Sample Purchase and Sale Agreement and Sale of Assets between Moore North America, Inc., Vista DMS, Inc., and Vista Information Solutions, Inc. is a legally binding document that outlines the terms and conditions of the sale of assets between these companies. This agreement governs the transfer of assets from the seller to the buyer, establishing the rights and responsibilities of all parties involved. Key elements of this agreement include the identification and description of the assets being sold, such as intellectual property, equipment, inventory, and contracts. The agreement also specifies the purchase price, payment terms, and any additional conditions that need to be fulfilled before the sale is finalized. The Ohio Sample Purchase and Sale Agreement and Sale of Assets can vary based on the nature of the transaction and the specific needs of the parties involved. Different types of purchase and sale agreements include: 1. Asset Purchase Agreement: This type of agreement focuses primarily on the sale of tangible and intangible assets, such as machinery, trademarks, technology, and customer lists. The buyer acquires these assets to continue operating the business or expand its operations. 2. Stock Purchase Agreement: In a stock purchase agreement, the buyer acquires the shares or ownership interest of the target company. This type of agreement transfers ownership of the entire company, including its assets, liabilities, contracts, and employees. 3. Merger Agreement: A merger agreement is used when two or more companies decide to combine and operate as a single entity. This agreement outlines the terms of the merger, including the exchange ratio for the shares of each company, governance structure, management changes, and other relevant details. 4. Membership Interest Purchase Agreement: This type of agreement is used in the sale of membership interests in a limited liability company (LLC). It governs the transfer of ownership rights, obligations, and liabilities associated with the membership interests. 5. Securities Purchase Agreement: A securities purchase agreement is employed when a company sells or purchases securities, such as stocks, bonds, or other financial instruments. This agreement outlines the terms of the sale, including price, quantity, representations, and warranties. It is crucial for the parties involved to consult with legal professionals to draft an agreement that meets their specific requirements and complies with the relevant laws and regulations in Ohio. Additionally, the agreement must be carefully reviewed and negotiated to safeguard the interests of all parties and ensure a smooth and successful transaction.

Ohio Sample Purchase and Sale Agreement and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc.

Description

How to fill out Ohio Sample Purchase And Sale Agreement And Sale Of Assets Between Moore North America, Inc., Vista DMS, Inc. And Vista Information Solutions, Inc.?

If you wish to complete, acquire, or print out authorized file web templates, use US Legal Forms, the most important collection of authorized varieties, which can be found on-line. Take advantage of the site`s basic and practical search to obtain the paperwork you need. A variety of web templates for company and person uses are categorized by classes and says, or key phrases. Use US Legal Forms to obtain the Ohio Sample Purchase and Sale Agreement and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc. with a few clicks.

If you are already a US Legal Forms consumer, log in in your bank account and click the Download button to have the Ohio Sample Purchase and Sale Agreement and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc.. Also you can entry varieties you earlier saved within the My Forms tab of your respective bank account.

If you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Make sure you have selected the form for the right city/nation.

- Step 2. Make use of the Preview solution to look over the form`s information. Never forget about to read through the explanation.

- Step 3. If you are unsatisfied with the form, take advantage of the Lookup discipline on top of the display screen to get other types of the authorized form template.

- Step 4. Once you have identified the form you need, select the Acquire now button. Choose the pricing plan you choose and add your accreditations to register for an bank account.

- Step 5. Method the purchase. You can utilize your credit card or PayPal bank account to accomplish the purchase.

- Step 6. Find the formatting of the authorized form and acquire it on the device.

- Step 7. Complete, revise and print out or signal the Ohio Sample Purchase and Sale Agreement and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc..

Each authorized file template you acquire is yours eternally. You have acces to every single form you saved inside your acccount. Click the My Forms section and decide on a form to print out or acquire once again.

Contend and acquire, and print out the Ohio Sample Purchase and Sale Agreement and Sale of Assets between Moore North America, Inc., Vista DMS, Inc. and Vista Information Solutions, Inc. with US Legal Forms. There are millions of expert and condition-distinct varieties you may use to your company or person requirements.