Oklahoma Corporate Right of First Refusal is a legal term that refers to the right given to shareholders of a corporation to purchase additional shares of the company's stock before those shares can be sold or transferred to a third party. This right is commonly included in the corporate resolutions of Oklahoma-based corporations and is designed to protect the interests of existing shareholders and maintain the ownership structure of the company. The Corporate Right of First Refusal in Oklahoma is established through corporate resolutions, which are formal decisions or determinations made by the board of directors or shareholders of a corporation. These resolutions set forth the terms and conditions under which the right of first refusal will be exercised. The purpose of this right is to ensure that existing shareholders have the opportunity to maintain or increase their ownership stakes in the corporation before any shares are sold to outside investors. There are different types of Oklahoma Corporate Right of First Refusal — Corporate Resolutions that can be employed. One common type is the general right of first refusal, which grants existing shareholders the first opportunity to purchase any shares that are to be sold or transferred by other shareholders. This means that if a shareholder intends to sell their shares, they must first offer them to existing shareholders at a predetermined price before selling them to an outside party. Another type of Corporate Right of First Refusal is the specific right of first refusal, which is more limited in scope. Under this type, existing shareholders have the right to purchase additional shares only in certain circumstances or under specific conditions, as outlined in the corporate resolutions. For example, if a shareholder wants to sell their shares to a particular buyer, existing shareholders must be given the opportunity to match the buyer's offer and purchase those shares instead. The Oklahoma Corporate Right of First Refusal — Corporate Resolutions are crucial for the protection of shareholders' interests, as they ensure that existing shareholders have the opportunity to maintain their proportionate ownership in the corporation and prevent dilution. This right allows shareholders to participate in any future growth or increase in the value of the company. It also provides a level of stability and control over the ownership structure, as shareholders have the ability to oversee any potential changes in the ownership of the corporation. In summary, the Oklahoma Corporate Right of First Refusal — Corporate Resolutions are legal mechanisms that grant existing shareholders the right to purchase additional shares of a corporation before those shares can be sold or transferred to outside investors. These resolutions serve to protect shareholder interests and maintain the ownership structure of the corporation. Different types of Corporate Right of First Refusal exist, including the general and specific types, each with their own specific terms and conditions outlined in the corporate resolutions.

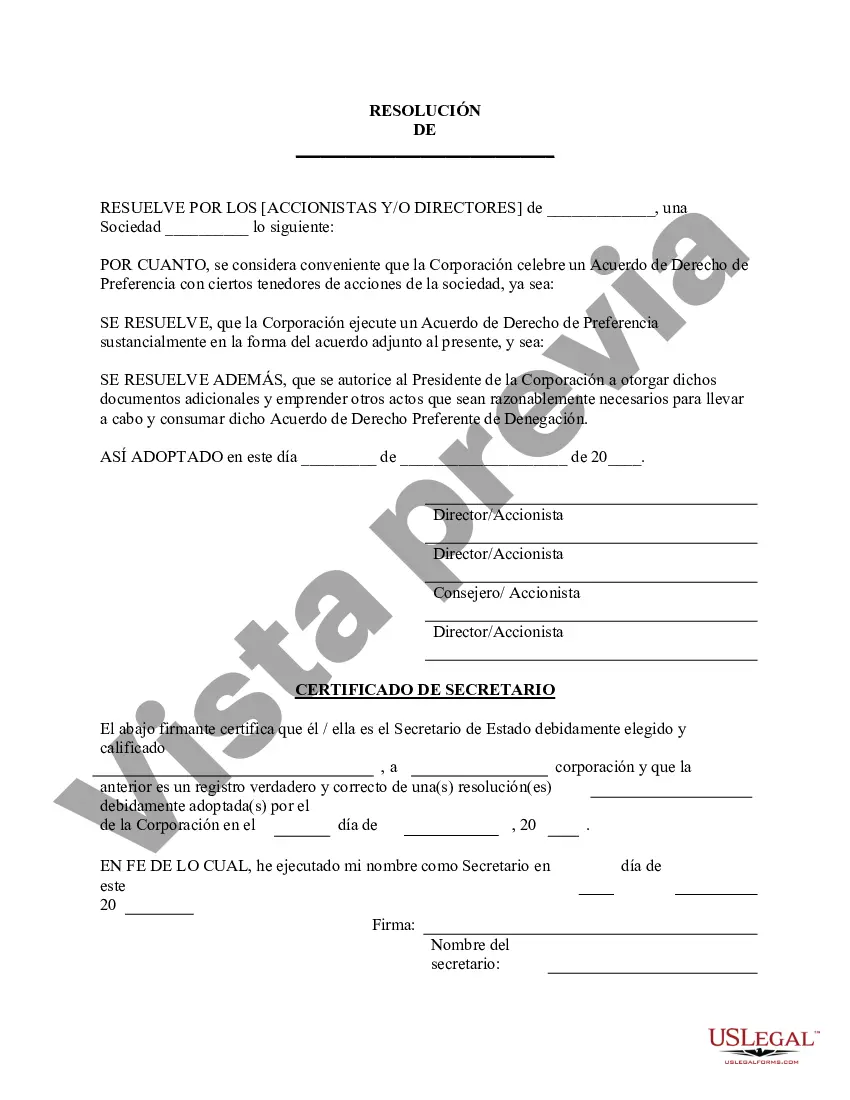

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Derecho Corporativo de Preferencia - Resoluciones Corporativas - Corporate Right of First Refusal - Corporate Resolutions

Description

How to fill out Oklahoma Derecho Corporativo De Preferencia - Resoluciones Corporativas?

US Legal Forms - one of the most significant libraries of legal types in the USA - gives a wide array of legal record layouts it is possible to down load or print. While using internet site, you may get a huge number of types for organization and individual purposes, sorted by groups, states, or key phrases.You will discover the most recent types of types like the Oklahoma Corporate Right of First Refusal - Corporate Resolutions in seconds.

If you have a subscription, log in and down load Oklahoma Corporate Right of First Refusal - Corporate Resolutions from your US Legal Forms library. The Down load key will show up on every single develop you see. You gain access to all earlier downloaded types inside the My Forms tab of the account.

If you wish to use US Legal Forms the very first time, listed here are easy guidelines to help you started out:

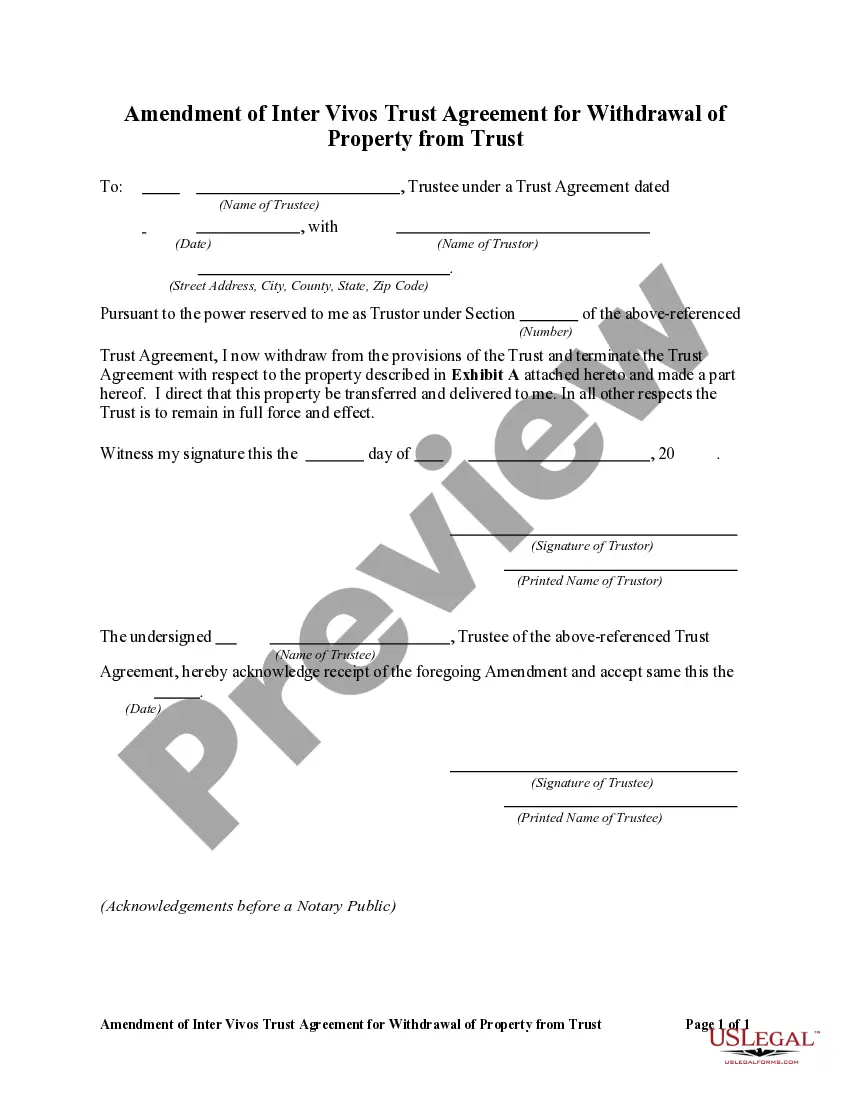

- Ensure you have picked the right develop to your area/area. Click the Preview key to analyze the form`s content. Look at the develop information to ensure that you have selected the right develop.

- In case the develop does not match your needs, take advantage of the Look for field on top of the display to get the one who does.

- If you are satisfied with the form, affirm your option by visiting the Get now key. Then, choose the costs prepare you prefer and give your qualifications to register to have an account.

- Process the transaction. Make use of Visa or Mastercard or PayPal account to accomplish the transaction.

- Find the structure and down load the form on the device.

- Make adjustments. Complete, revise and print and signal the downloaded Oklahoma Corporate Right of First Refusal - Corporate Resolutions.

Every template you added to your bank account does not have an expiry time which is yours forever. So, in order to down load or print an additional copy, just proceed to the My Forms section and then click about the develop you need.

Obtain access to the Oklahoma Corporate Right of First Refusal - Corporate Resolutions with US Legal Forms, probably the most comprehensive library of legal record layouts. Use a huge number of specialist and state-distinct layouts that meet your business or individual demands and needs.