Title: Understanding Oklahoma Agreement to Repay Cash Advance on Credit Card: Types and Details Introduction: In the world of personal finance, credit cards provide a valuable tool to manage day-to-day expenses. However, sometimes individuals may find themselves in need of immediate cash, which is when a cash advance on a credit card comes into play. In Oklahoma, the Agreement to Repay Cash Advance on Credit Card outlines the terms and conditions associated with accessing and repaying these cash advances. This article aims to provide a detailed description of this agreement, including its various types, so that borrowers can make informed decisions. Types of Oklahoma Agreements to Repay Cash Advance on Credit Card: 1. Standard Cash Advance: A standard cash advance is the most common type available on credit cards. It allows individuals to withdraw a certain amount of cash, often up to a predetermined credit limit, directly from the card issuer. This type of cash advance typically involves high interest rates and additional fees. 2. Express Cash Advance: Some credit cards provide an express cash advance option, which enables users to withdraw cash instantly at participating ATMs or affiliated financial institutions. Express cash advances may come with higher fees or interest rates compared to standard cash advances, highlighting the importance of carefully reading the agreement before proceeding. 3. Balance Transfer Cash Advance: In certain situations, credit cardholders can transfer a portion of their card's credit limit into their bank account, effectively turning it into cash. While this type of cash advance is convenient for debt consolidation or urgent financial needs, it often involves additional fees and may have specific repayment terms. Important Details to Understand in the Agreement: 1. Interest Rates: Credit card issuers typically charge higher interest rates for cash advances compared to regular purchases. Understanding the precise interest rate and how it applies is crucial to avoid unnecessary debt and financial strain. 2. Fees: In addition to interest rates, cash advances usually come with upfront fees, generally a percentage of the total cash advance amount or a flat fee. These fees differ among credit card issuers, so individuals should pay close attention to this information within the agreement. 3. Repayment Terms: The Agreement to Repay Cash Advance on Credit Card outlines how the borrowed amount should be repaid. Often, credit card issuers require the minimum payment along with subsequent monthly payments. Delinquency or failure to adhere to the repayment terms can result in additional fees, higher interest rates, or damage to the individual's credit score. Conclusion: Oklahoma Agreement to Repay Cash Advance on Credit Card plays a significant role in clarifying the terms, conditions, and repayment obligations associated with cash advances on credit cards. Understanding the different types of cash advances offered, along with interest rates, fees, and repayment terms, is crucial for borrowers to make informed decisions and avoid potential financial pitfalls.

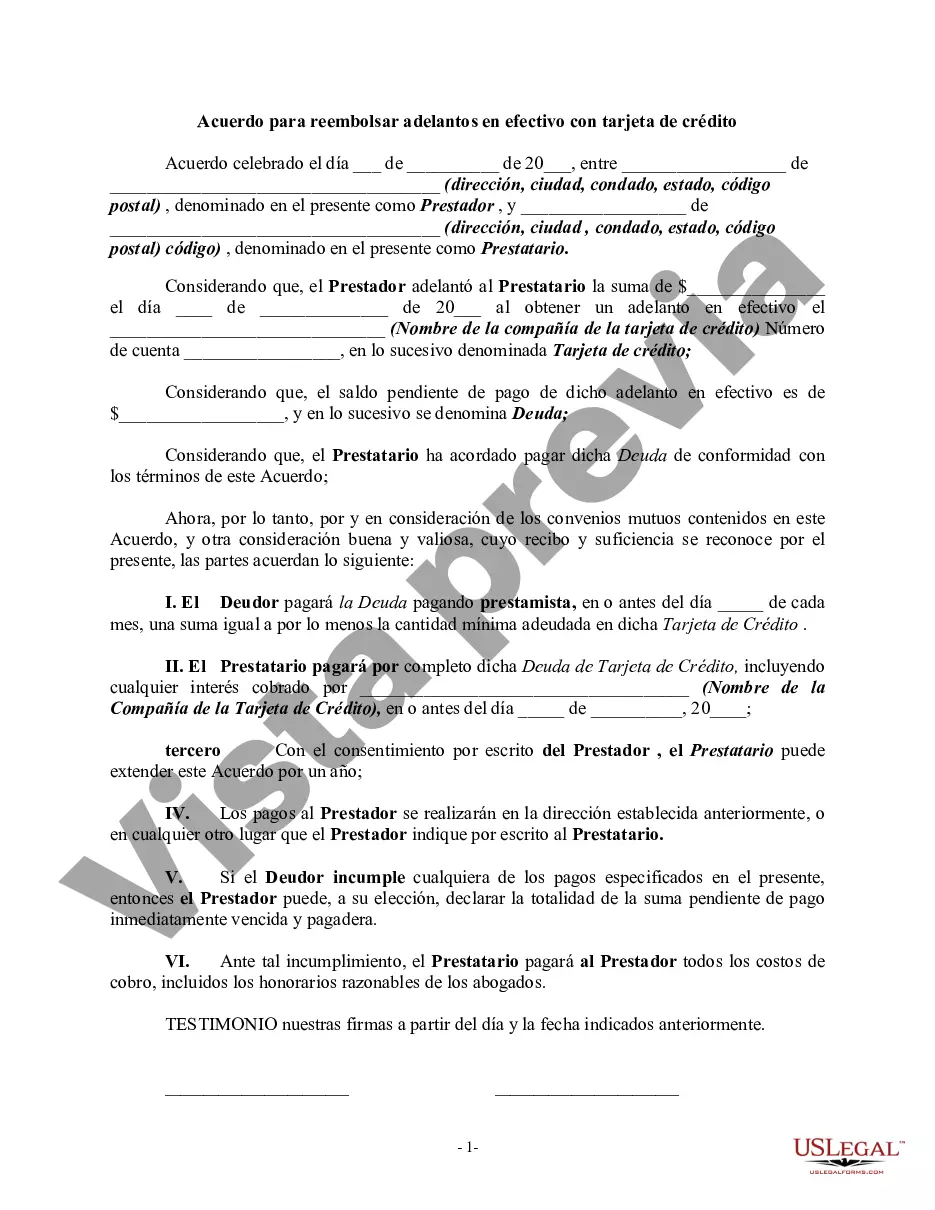

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Acuerdo para reembolsar adelantos en efectivo con tarjeta de crédito - Agreement to Repay Cash Advance on Credit Card

Description

How to fill out Oklahoma Acuerdo Para Reembolsar Adelantos En Efectivo Con Tarjeta De Crédito?

US Legal Forms - one of several greatest libraries of legal varieties in the USA - delivers a wide array of legal record layouts you can down load or print. Utilizing the internet site, you will get a large number of varieties for business and individual purposes, categorized by types, states, or keywords and phrases.You can get the newest models of varieties such as the Oklahoma Agreement to Repay Cash Advance on Credit Card within minutes.

If you have a membership, log in and down load Oklahoma Agreement to Repay Cash Advance on Credit Card through the US Legal Forms library. The Download button can look on each kind you see. You get access to all previously delivered electronically varieties in the My Forms tab of the bank account.

If you want to use US Legal Forms the first time, here are basic directions to help you started off:

- Be sure you have chosen the right kind for the metropolis/region. Go through the Review button to examine the form`s information. Browse the kind description to ensure that you have selected the appropriate kind.

- In the event the kind doesn`t satisfy your needs, take advantage of the Research discipline at the top of the display to discover the one which does.

- In case you are content with the shape, validate your decision by visiting the Buy now button. Then, pick the pricing strategy you like and offer your credentials to register to have an bank account.

- Procedure the transaction. Make use of Visa or Mastercard or PayPal bank account to complete the transaction.

- Find the formatting and down load the shape on your gadget.

- Make adjustments. Complete, edit and print and indicator the delivered electronically Oklahoma Agreement to Repay Cash Advance on Credit Card.

Each design you added to your bank account does not have an expiration time and it is your own eternally. So, if you would like down load or print yet another backup, just go to the My Forms segment and click around the kind you need.

Gain access to the Oklahoma Agreement to Repay Cash Advance on Credit Card with US Legal Forms, by far the most extensive library of legal record layouts. Use a large number of expert and express-specific layouts that meet your company or individual needs and needs.