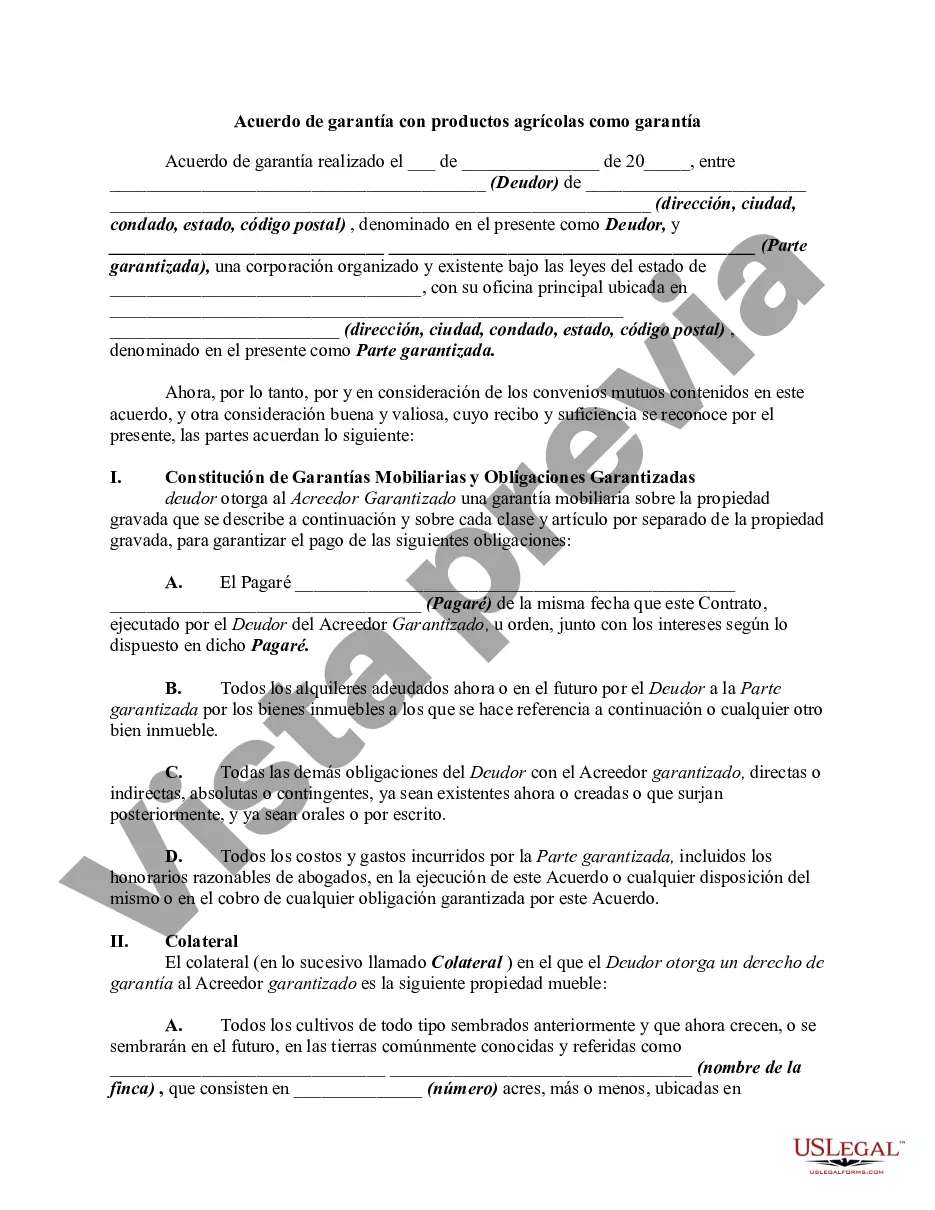

In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

The Oklahoma Security Agreement with Farm Products as Collateral is a legal document designed to protect both lenders and borrowers in the agricultural industry. It serves as a binding contract outlining the terms and conditions related to the use of farm products as collateral in securing a loan. Under this agreement, a borrower pledges their farm products as collateral in exchange for financial assistance from a lender. The lender, often a financial institution or an agricultural lender, agrees to provide the borrower with the necessary funds to support their farming operations. In return, the borrower grants the lender a security interest in their present and future farm products. By establishing a security interest, the lender gains legal protection and the right to repossess, sell, or collect the farm products if the borrower defaults on the loan. In case of default, the lender may exercise their rights to recover the outstanding debt by selling the farm products or utilizing other legal measures outlined in the agreement. Different types of Oklahoma Security Agreement with Farm Products as Collateral may include: 1. Crop-specific Security Agreement: This type of agreement focuses on certain crops or agricultural products, such as corn, wheat, soybeans, or cotton. It ensures that the lender has a security interest in these specific farm products. 2. Livestock-specific Security Agreement: This agreement emphasizes livestock as the collateral for the loan. It typically covers animals like cattle, horses, pigs, or poultry, allowing the lender the right to seize and sell these assets if necessary. 3. General Farm Products Security Agreement: This comprehensive agreement encompasses all types of present and future farm products and crops, providing lenders with a broader range of collateral options. Key factors often addressed in an Oklahoma Security Agreement with Farm Products as Collateral include the identification of the borrower and lender, a detailed description of the farm products offered as collateral, the amount of the loan, repayment terms, interest rates, default clauses, and the legalities involved in case of a dispute or non-payment. By ensuring the appropriate execution and registration of the Oklahoma Security Agreement with Farm Products as Collateral as per state laws, both the borrower and lender can protect their interests and maintain a fair lending environment within the agricultural sector.The Oklahoma Security Agreement with Farm Products as Collateral is a legal document designed to protect both lenders and borrowers in the agricultural industry. It serves as a binding contract outlining the terms and conditions related to the use of farm products as collateral in securing a loan. Under this agreement, a borrower pledges their farm products as collateral in exchange for financial assistance from a lender. The lender, often a financial institution or an agricultural lender, agrees to provide the borrower with the necessary funds to support their farming operations. In return, the borrower grants the lender a security interest in their present and future farm products. By establishing a security interest, the lender gains legal protection and the right to repossess, sell, or collect the farm products if the borrower defaults on the loan. In case of default, the lender may exercise their rights to recover the outstanding debt by selling the farm products or utilizing other legal measures outlined in the agreement. Different types of Oklahoma Security Agreement with Farm Products as Collateral may include: 1. Crop-specific Security Agreement: This type of agreement focuses on certain crops or agricultural products, such as corn, wheat, soybeans, or cotton. It ensures that the lender has a security interest in these specific farm products. 2. Livestock-specific Security Agreement: This agreement emphasizes livestock as the collateral for the loan. It typically covers animals like cattle, horses, pigs, or poultry, allowing the lender the right to seize and sell these assets if necessary. 3. General Farm Products Security Agreement: This comprehensive agreement encompasses all types of present and future farm products and crops, providing lenders with a broader range of collateral options. Key factors often addressed in an Oklahoma Security Agreement with Farm Products as Collateral include the identification of the borrower and lender, a detailed description of the farm products offered as collateral, the amount of the loan, repayment terms, interest rates, default clauses, and the legalities involved in case of a dispute or non-payment. By ensuring the appropriate execution and registration of the Oklahoma Security Agreement with Farm Products as Collateral as per state laws, both the borrower and lender can protect their interests and maintain a fair lending environment within the agricultural sector.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.