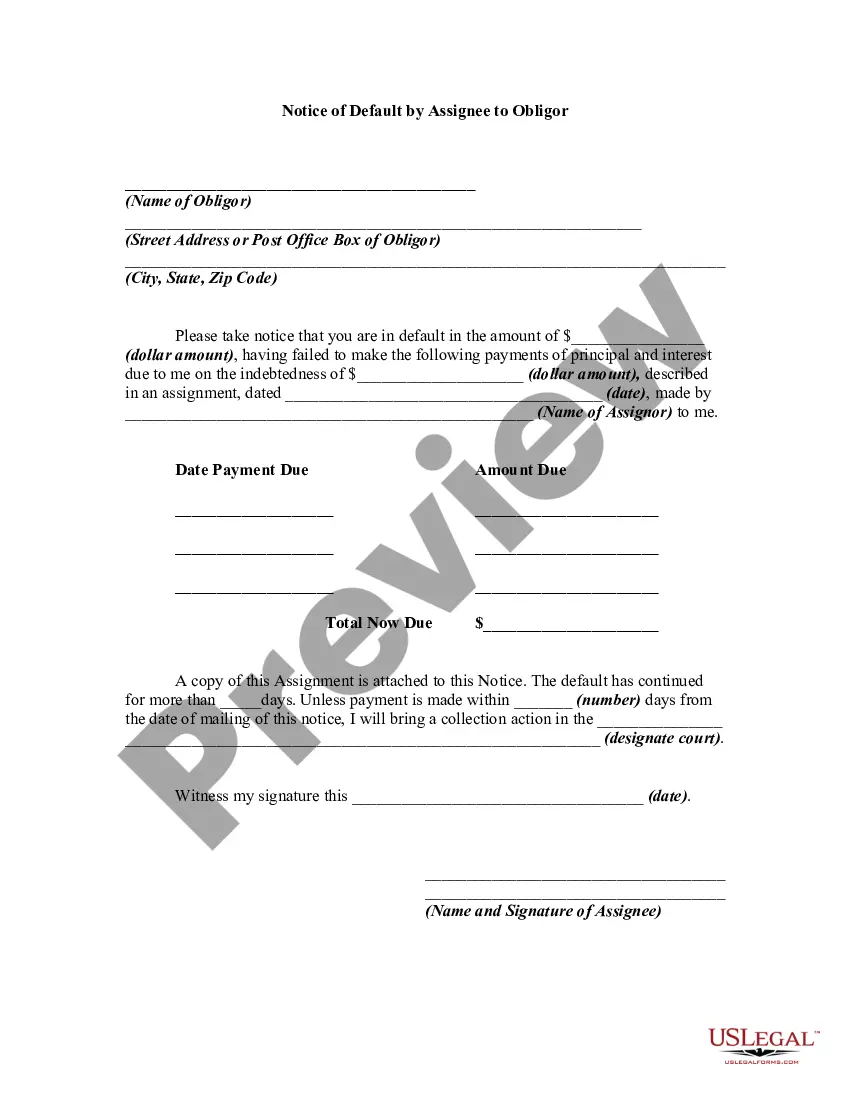

An assignment is a transfer of rights that a party has under a contract to another person, called an assignee. The assigning party is called the assignor. An assignee of a contract may generally sue directly on the contract rather than suing in the name of the assignor. The obligor is the person responsible to make payments to the assignee.

Oklahoma Notice of Default by Assignee to Obligor

Description

How to fill out Notice Of Default By Assignee To Obligor?

Choosing the best legitimate document format could be a struggle. Needless to say, there are plenty of web templates accessible on the Internet, but how do you get the legitimate kind you need? Make use of the US Legal Forms website. The support offers 1000s of web templates, for example the Oklahoma Notice of Default by Assignee to Obligor, that you can use for business and personal requirements. Every one of the types are examined by pros and meet federal and state demands.

If you are currently signed up, log in to your account and click the Acquire key to find the Oklahoma Notice of Default by Assignee to Obligor. Use your account to appear from the legitimate types you might have ordered earlier. Visit the My Forms tab of your account and get an additional duplicate of your document you need.

If you are a whole new end user of US Legal Forms, allow me to share basic guidelines so that you can adhere to:

- Initial, be sure you have chosen the appropriate kind for the metropolis/region. You may look through the shape utilizing the Preview key and study the shape information to guarantee this is the right one for you.

- In case the kind is not going to meet your requirements, make use of the Seach industry to discover the right kind.

- Once you are positive that the shape is proper, go through the Buy now key to find the kind.

- Choose the rates plan you want and type in the necessary information. Build your account and pay money for the transaction making use of your PayPal account or credit card.

- Choose the file format and download the legitimate document format to your system.

- Comprehensive, revise and print out and signal the received Oklahoma Notice of Default by Assignee to Obligor.

US Legal Forms may be the largest collection of legitimate types that you can see a variety of document web templates. Make use of the service to download expertly-created paperwork that adhere to status demands.

Form popularity

FAQ

If the defendant simply does not pay, you may execute on the defendant's property, you may have a garnishment issued against the defendant's assets or wages and you may compel the defendant to come to court for a Hearing on Assets to determine what assets are available.

Section 219A provides that where an employee has executed a covenant not to compete with the employer, the employee ?shall be permitted to engage in the same business as that conducted by the former employer as long as the former employee does not directly solicit the sale of goods, services or a combination of goods ...

In Oklahoma it is crucial to keep in mind the (5) year statute of limitation on your judgment. After that period, if the judgment is not renewed, it cannot legally be recognized in a court of law and can no longer be renewed if renewal period has passed.

Once a plaintiff has obtained a default judgment against a defendant, they can use it to collect a debt or damages in several ways. Collection efforts may include wage garnishments, property liens, seizure of assets held in bank accounts, and more.

You have 20 days from the date the Plaintiff can prove you were served to file an answer to the Petition with the court where the case is filed and send a copy to the Plaintiff. If you do not file an answer within 20 days, you are technically in default.

No seller in any sales transaction may impose a surcharge on a cardholder who elects to use a credit card or debit card in lieu of payment by cash, check or similar means.

Once a plaintiff has obtained a default judgment against a defendant, they can use it to collect a debt or damages in several ways. Collection efforts may include wage garnishments, property liens, seizure of assets held in bank accounts, and more.

§15-221. "Construction agreement" defined - Limitations on liability arising out of death or bodily injury void - Exceptions.