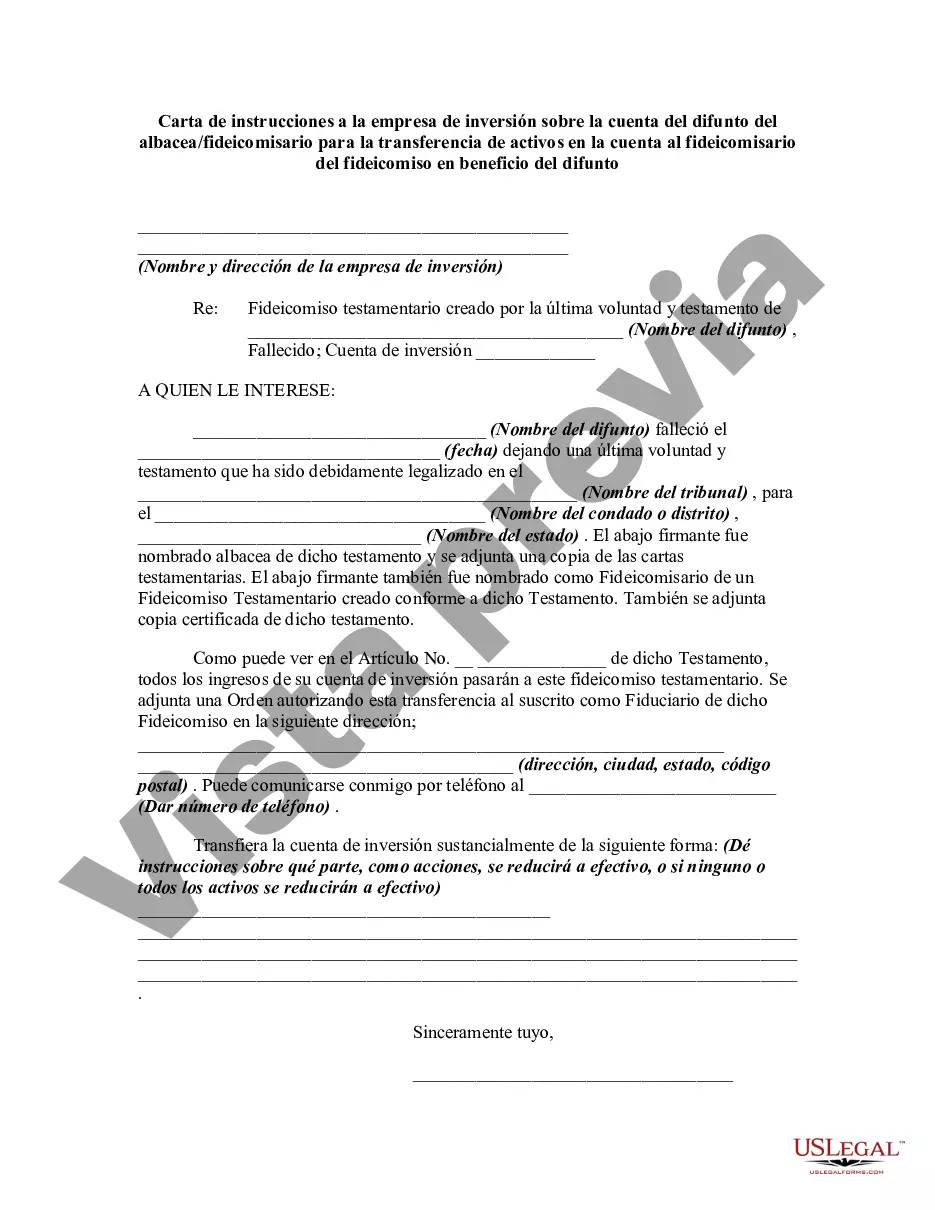

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

The Oklahoma Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent is a legal document used in Oklahoma to transfer assets from a deceased individual's investment account to a trust for the benefit of the decedent. This letter provides detailed instructions to the investment firm regarding the transfer of assets and outlines the roles of the executor/trustee and the trustee of the trust. Keywords: Oklahoma, Letter of Instruction, Investment Firm, Account of Decedent, Executor, Trustee, Transfer of Assets, Trust, Benefit of Decedent. Different types of Oklahoma Letters of Instruction to Investment Firms regarding the account of a decedent may include: 1. Oklahoma Letter of Instruction for Transfer of Individual Retirement Account (IRA) Assets: This type of letter specifically addresses the transfer of IRA assets from a deceased individual's investment account to a trust designated for the benefit of the decedent. 2. Oklahoma Letter of Instruction for Transfer of Brokerage Account Assets: This type of letter focuses on transferring assets from a deceased individual's brokerage account to a trust established for the benefit of the decedent. 3. Oklahoma Letter of Instruction for Transfer of Mutual Fund Account Assets: This letter type provides instructions for transferring mutual fund assets from a deceased individual's investment account to a trust set up for the benefit of the decedent. 4. Oklahoma Letter of Instruction for Transfer of Trust Account Assets: This letter formulates instructions for transferring assets from a trust account linked to the deceased individual to another trust established for the benefit of the decedent. It is important to consult with a legal professional to ensure that the specific content of the letter complies with all applicable laws and accurately reflects the intentions of the decedent and the executor/trustee.The Oklahoma Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent is a legal document used in Oklahoma to transfer assets from a deceased individual's investment account to a trust for the benefit of the decedent. This letter provides detailed instructions to the investment firm regarding the transfer of assets and outlines the roles of the executor/trustee and the trustee of the trust. Keywords: Oklahoma, Letter of Instruction, Investment Firm, Account of Decedent, Executor, Trustee, Transfer of Assets, Trust, Benefit of Decedent. Different types of Oklahoma Letters of Instruction to Investment Firms regarding the account of a decedent may include: 1. Oklahoma Letter of Instruction for Transfer of Individual Retirement Account (IRA) Assets: This type of letter specifically addresses the transfer of IRA assets from a deceased individual's investment account to a trust designated for the benefit of the decedent. 2. Oklahoma Letter of Instruction for Transfer of Brokerage Account Assets: This type of letter focuses on transferring assets from a deceased individual's brokerage account to a trust established for the benefit of the decedent. 3. Oklahoma Letter of Instruction for Transfer of Mutual Fund Account Assets: This letter type provides instructions for transferring mutual fund assets from a deceased individual's investment account to a trust set up for the benefit of the decedent. 4. Oklahoma Letter of Instruction for Transfer of Trust Account Assets: This letter formulates instructions for transferring assets from a trust account linked to the deceased individual to another trust established for the benefit of the decedent. It is important to consult with a legal professional to ensure that the specific content of the letter complies with all applicable laws and accurately reflects the intentions of the decedent and the executor/trustee.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.