Oklahoma Triple Net Lease for Commercial Real Estate: A Comprehensive Overview A Triple Net Lease (NNN) is a common type of lease agreement in commercial real estate, including properties in Oklahoma. This lease structure is heavily favored by both landlords and tenants due to its unique characteristics and clear delineation of responsibilities. In an NNN lease, the tenant assumes the obligations for not only the monthly rent but also for property taxes, insurance, and maintenance costs associated with the leased property. This arrangement offers several advantages to both parties involved. For commercial property owners in Oklahoma, a Triple Net Lease provides a stable and predictable income stream as the tenant takes on the majority of expenses. This reduced financial burden for the landlord allows for easier cash flow management and increased profitability. Additionally, the tenant's responsibility for property maintenance and repairs ensures that the property is well-maintained and in good condition throughout the lease term, making it an attractive option for property owners looking to minimize their involvement in day-to-day operations. From a tenant's perspective, the Oklahoma Triple Net Lease grants them greater control over the property and the ability to operate their business on their terms. By assuming responsibility for property-related expenses, tenants can better forecast and budget their overall operational costs. This lease structure is particularly popular among established businesses and national brands with multiple locations, as it allows them to maintain consistent control over their brand image and property upkeep. In Oklahoma, there are various types of Triple Net Leases that tenants and landlords can consider based on their specific needs. Some common variations of Triple Net Leases include: 1. Single-Tenant, Single-Asset Lease: This type of lease involves a single tenant leasing a single property, such as a standalone retail store or office building. The tenant is responsible for all costs associated with the property, including taxes, insurance, and maintenance. 2. Multi-Tenant, Single-Asset Lease: This lease involves multiple tenants leasing separate portions of a single property, such as a shopping center or office complex. Each tenant bears responsibility for their allocated share of property expenses, typically based on the square footage they occupy. 3. Ground Lease: A ground lease is a long-term lease in which the tenant leases the land independently of any improvements on it. The tenant assumes all property expenses, including those related to constructing and maintaining buildings on the leased land. 4. Absolute Triple Net Lease: This lease structure places even greater responsibility on the tenant, making them solely responsible for all property costs, including major structural repairs or replacements. Absolute Triple Net Leases are less common but can be seen in long-term lease agreements with large corporate tenants. It's essential for both landlords and tenants to carefully review and negotiate the terms of an Oklahoma Triple Net Lease to ensure a fair and mutually beneficial agreement. Consulting with experienced real estate professionals, such as attorneys and commercial brokers, is recommended to navigate the complexities of these lease structures effectively.

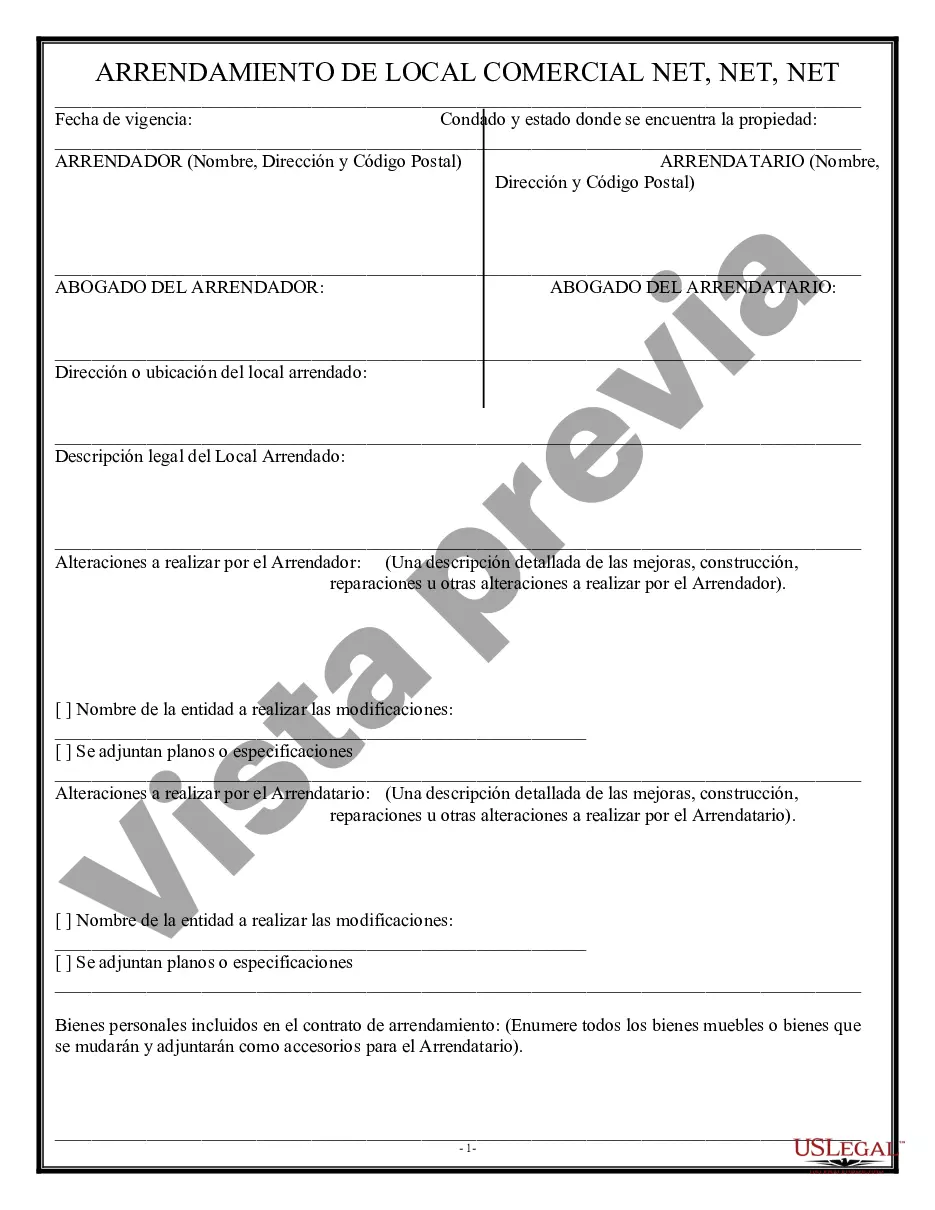

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Arrendamiento neto triple para bienes raíces comerciales - Triple Net Lease for Commercial Real Estate

Description

How to fill out Oklahoma Arrendamiento Neto Triple Para Bienes Raíces Comerciales?

US Legal Forms - one of the greatest libraries of legitimate forms in the USA - offers an array of legitimate file templates it is possible to acquire or produce. Making use of the internet site, you may get 1000s of forms for company and person uses, categorized by classes, claims, or keywords.You will find the most up-to-date versions of forms just like the Oklahoma Triple Net Lease for Commercial Real Estate within minutes.

If you currently have a membership, log in and acquire Oklahoma Triple Net Lease for Commercial Real Estate in the US Legal Forms local library. The Acquire switch can look on each type you look at. You have accessibility to all previously saved forms in the My Forms tab of your respective profile.

If you wish to use US Legal Forms initially, listed below are straightforward instructions to help you get began:

- Be sure to have picked out the right type for your personal town/state. Select the Preview switch to analyze the form`s content material. Browse the type explanation to actually have selected the appropriate type.

- When the type doesn`t satisfy your requirements, utilize the Lookup industry at the top of the monitor to discover the one who does.

- When you are happy with the shape, verify your choice by simply clicking the Acquire now switch. Then, select the rates plan you favor and offer your credentials to register for the profile.

- Approach the deal. Use your charge card or PayPal profile to accomplish the deal.

- Select the formatting and acquire the shape on the gadget.

- Make changes. Fill up, revise and produce and sign the saved Oklahoma Triple Net Lease for Commercial Real Estate.

Every format you included in your money does not have an expiration time and is yours eternally. So, if you want to acquire or produce an additional copy, just proceed to the My Forms area and then click about the type you require.

Obtain access to the Oklahoma Triple Net Lease for Commercial Real Estate with US Legal Forms, probably the most comprehensive local library of legitimate file templates. Use 1000s of specialist and state-specific templates that fulfill your organization or person requirements and requirements.