This notice is not from a debt collector but from the party to whom the debt is owed.

Oklahoma Notice by Mail to Debtor of Action if Payment not Made

Description

How to fill out Notice By Mail To Debtor Of Action If Payment Not Made?

You are able to devote several hours on the Internet trying to find the authorized papers web template which fits the federal and state demands you require. US Legal Forms provides 1000s of authorized types which are reviewed by pros. You can actually down load or produce the Oklahoma Notice by Mail to Debtor of Action if Payment not Made from your support.

If you already have a US Legal Forms account, you are able to log in and then click the Obtain button. After that, you are able to complete, edit, produce, or indication the Oklahoma Notice by Mail to Debtor of Action if Payment not Made. Each authorized papers web template you acquire is your own property forever. To acquire another version for any purchased form, go to the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms web site the very first time, adhere to the straightforward instructions beneath:

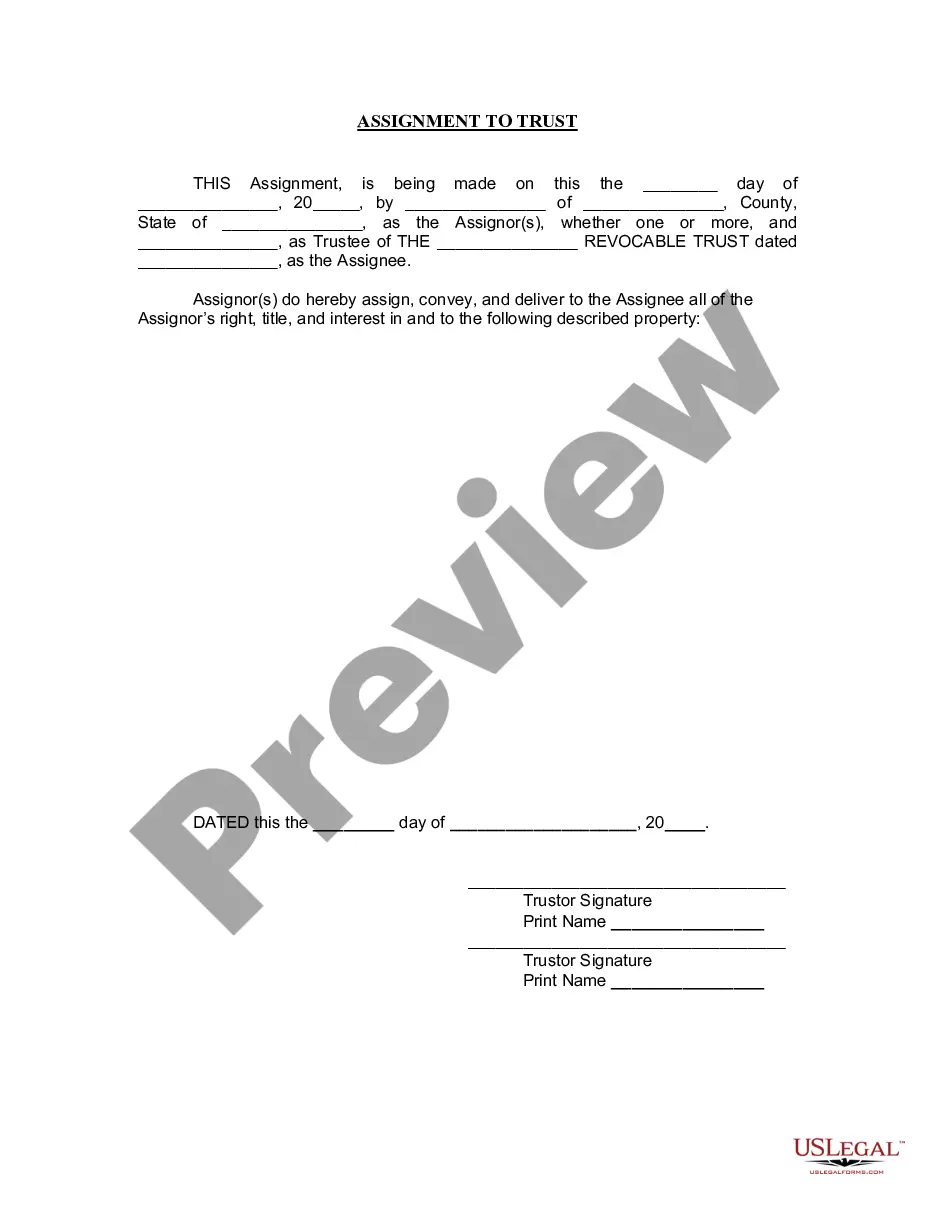

- Initial, be sure that you have selected the right papers web template for that area/town of your liking. Look at the form outline to ensure you have selected the correct form. If available, make use of the Preview button to check with the papers web template too.

- In order to locate another edition from the form, make use of the Research discipline to discover the web template that meets your needs and demands.

- When you have identified the web template you would like, click Get now to move forward.

- Choose the prices prepare you would like, type in your references, and register for your account on US Legal Forms.

- Comprehensive the transaction. You can use your charge card or PayPal account to fund the authorized form.

- Choose the format from the papers and down load it in your gadget.

- Make adjustments in your papers if possible. You are able to complete, edit and indication and produce Oklahoma Notice by Mail to Debtor of Action if Payment not Made.

Obtain and produce 1000s of papers layouts utilizing the US Legal Forms site, which provides the largest assortment of authorized types. Use skilled and status-specific layouts to deal with your company or person needs.

Form popularity

FAQ

The Fair Debt Collection Practices Act (FDCPA) is the main federal law that governs debt collection practices. The FDCPA prohibits debt collection companies from using abusive, unfair, or deceptive practices to collect debts from you.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Summary: You have 20 days to respond to a debt lawsuit in Oklahoma. To respond, you must file a written Answer in which you address each claim against you and assert your affirmative defenses. SoloSuit can help you with each step of responding to a lawsuit and more.. Getting sued is stressful.

Although courts are not bound to this choice, it may impact which statute of limitations that courts may consider in their decision. The statute of limitations on open-account debt, like credit cards, for Oklahoma is five (5) years.

Fair debt collection rules in Oklahoma apply and must be respected. A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Federal law provides consumers with the right to sue for violations of the FDCPA by unscrupulous debt collectors.

Depending on which state you're in, the statute of limitations could be from three to 10 years. If the state has a six-year statute of limitations, that debt would have been collectible using the legal system until 2021?six years after the last activity on the account.

Fair debt collection rules in Oklahoma apply and must be respected. A debt collector may not use unfair or unconscionable means to collect or attempt to collect any debt. Federal law provides consumers with the right to sue for violations of the FDCPA by unscrupulous debt collectors.