Liquidated damages may be incorporated as a clause in an agreement when the parties to the agreement agree to the payment of a certain sum as a fixed and agreed upon payment for doing or not doing certain things particularly mentioned in the agreement. It is the amount of money specified in a contract to be awarded in the event that the agreement is violated, often when the actual damages are difficult to determine with specificity.

The Oklahoma Declaration of Cash Gift with Condition is a legal document used to outline the terms and conditions of a cash gift given to an individual or entity within the state of Oklahoma. This declaration ensures that both the giver and receiver are aware of the specific conditions and requirements associated with the cash gift. Keywords: Oklahoma Declaration of Cash Gift, cash gift, conditions, terms, legal document, state of Oklahoma. There are different types of Oklahoma Declaration of Cash Gift with Condition, each designed for specific circumstances. Here are a few notable types: 1. Conditional Cash Gift for Education: This type of declaration is used when someone wishes to gift a specific amount of cash for education-related purposes, such as college tuition, books, or supplies. The conditions may include requirements like maintaining a certain GPA or enrolling in a specific educational program. 2. Conditional Cash Gift for Property Purchase: In this case, the cash gift is intended to assist the recipient in purchasing a property, such as a house or land. The declaration may stipulate that the gifted cash can only be used towards a down payment or mortgage payment for the intended property. 3. Conditional Cash Gift for Charitable Purposes: This type of declaration is commonly used by donors who want to support charitable organizations or causes. The conditions may include guidelines on how the gifted cash should be used, ensuring that it is allocated for specific charitable projects or initiatives. 4. Conditional Cash Gift for Business Start-ups: Entrepreneurs or individuals looking to start their own business may receive a cash gift with the condition that the funds are utilized solely for business-related expenses. Stipulations may include providing periodic reports on how the funds are being used, or achieving certain business milestones to continue receiving the gift. 5. Conditional Cash Gift for Medical Expenses: This declaration type is relevant for financial assistance specifically designated for covering medical expenses. The gift may be subject to conditions such as providing receipts and documentation for medical bills or using the cash solely for medical purposes. It should be noted that these are just a few examples, and there may be other types of Oklahoma Declarations of Cash Gift with Conditions based on individual circumstances and preferences. It is crucial to consult with legal professionals or seek expert advice to ensure compliance with relevant laws and accurately draft the declaration to reflect the specific gift and conditions.

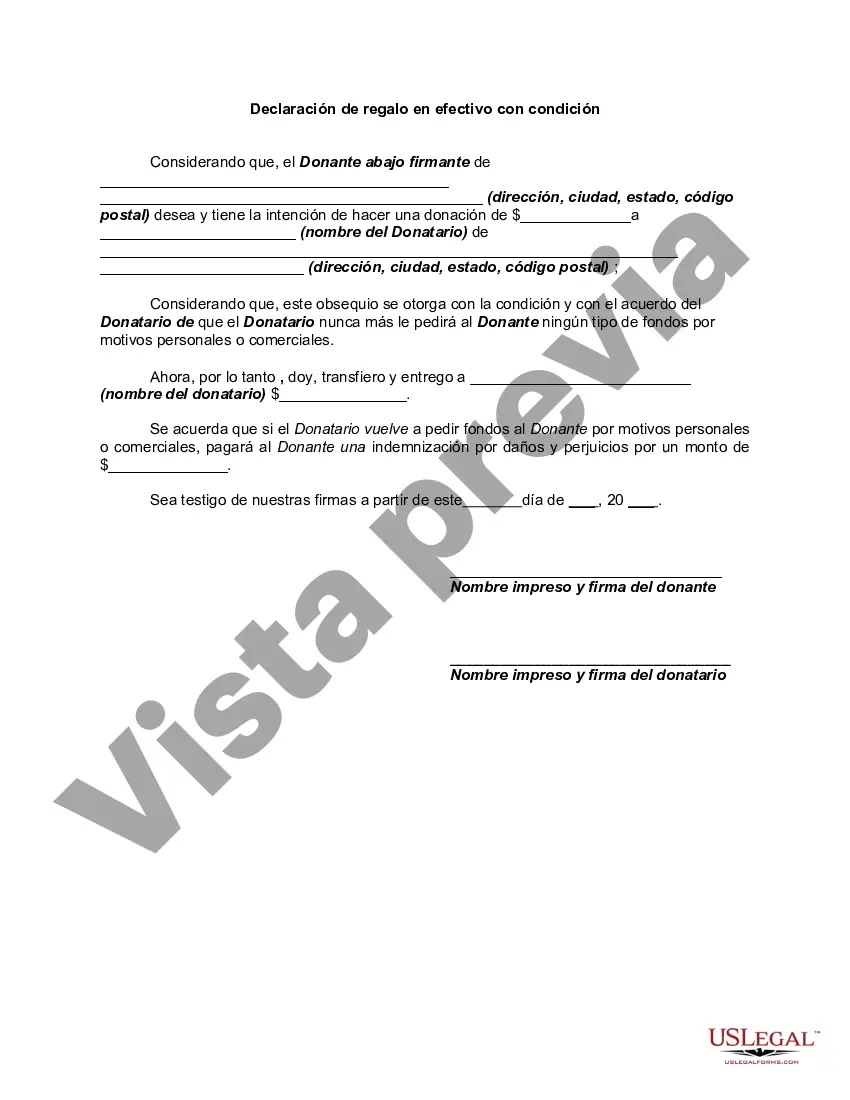

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.