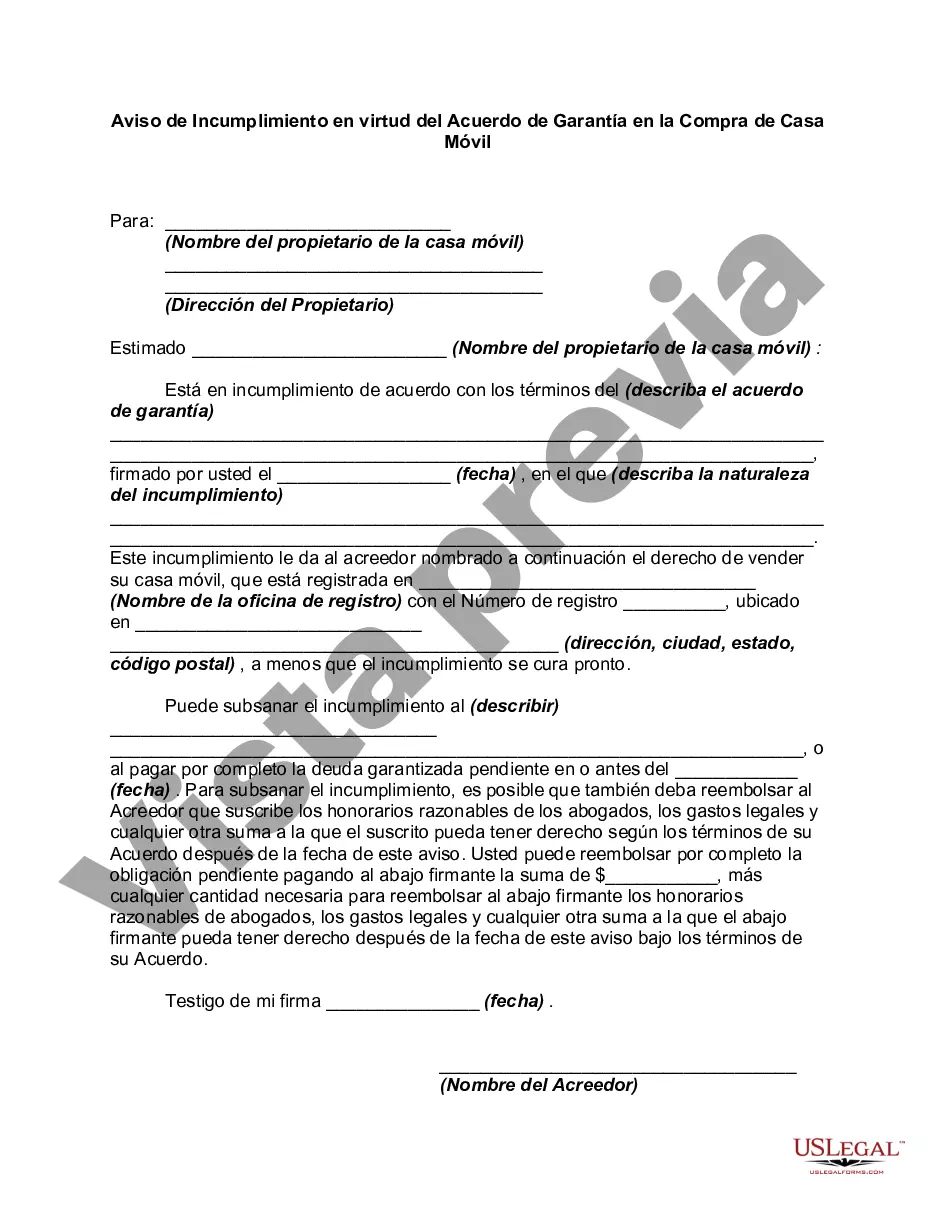

Oklahoma Notice of Default under Security Agreement in Purchase of Mobile Home is a legal document that outlines the process and consequences when a borrower fails to meet the terms and conditions of a security agreement related to the purchase of a mobile home in Oklahoma. This notice serves as a warning to the borrower that they have defaulted on their obligations and provides necessary information about the steps the lender can take to recover the debt. Keywords: Oklahoma, notice of default, security agreement, purchase, mobile home, borrower, terms and conditions, defaulted, obligations, lender, recover debt. There are different types of Oklahoma Notice of Default under Security Agreement in Purchase of Mobile Home. Here are some of them: 1. Preliminary Notice of Default: This is the initial notice sent to the borrower when they are in default under the security agreement. It serves as a formal communication, informing the borrower of their default and the potential consequences. 2. Cure Notice: This notice is sent to the borrower after the preliminary notice of default, providing them with a specific period within which they can "cure" or rectify the default by making the necessary payments or taking required actions. 3. Notice of Acceleration: If the borrower fails to cure the default within the specified time frame, the lender may issue a notice of acceleration. This notice demands the immediate payment of the entire outstanding debt, often including accrued interest and other charges. 4. Notice of Sale: When the borrower fails to comply with the notice of acceleration, the lender may proceed with selling the mobile home to recover the debt. A notice of sale is sent to inform the borrower about the scheduled sale, allowing them a final opportunity to address the default before losing ownership. 5. Notice of Surplus Funds: In some cases, if the sale of the mobile home generates proceeds higher than the outstanding debt, the lender may issue a notice of surplus funds. This notice informs the borrower that they are entitled to claim the surplus amount after deducting any applicable fees and expenses. It is important for both borrowers and lenders involved in a security agreement for the purchase of a mobile home in Oklahoma to be aware of the different types of notices of default and their implications. These notices provide a clear framework for resolving defaults and protecting the rights of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Aviso de Incumplimiento en virtud del Acuerdo de Garantía en la Compra de Casa Móvil - Notice of Default under Security Agreement in Purchase of Mobile Home

Description

How to fill out Oklahoma Aviso De Incumplimiento En Virtud Del Acuerdo De Garantía En La Compra De Casa Móvil?

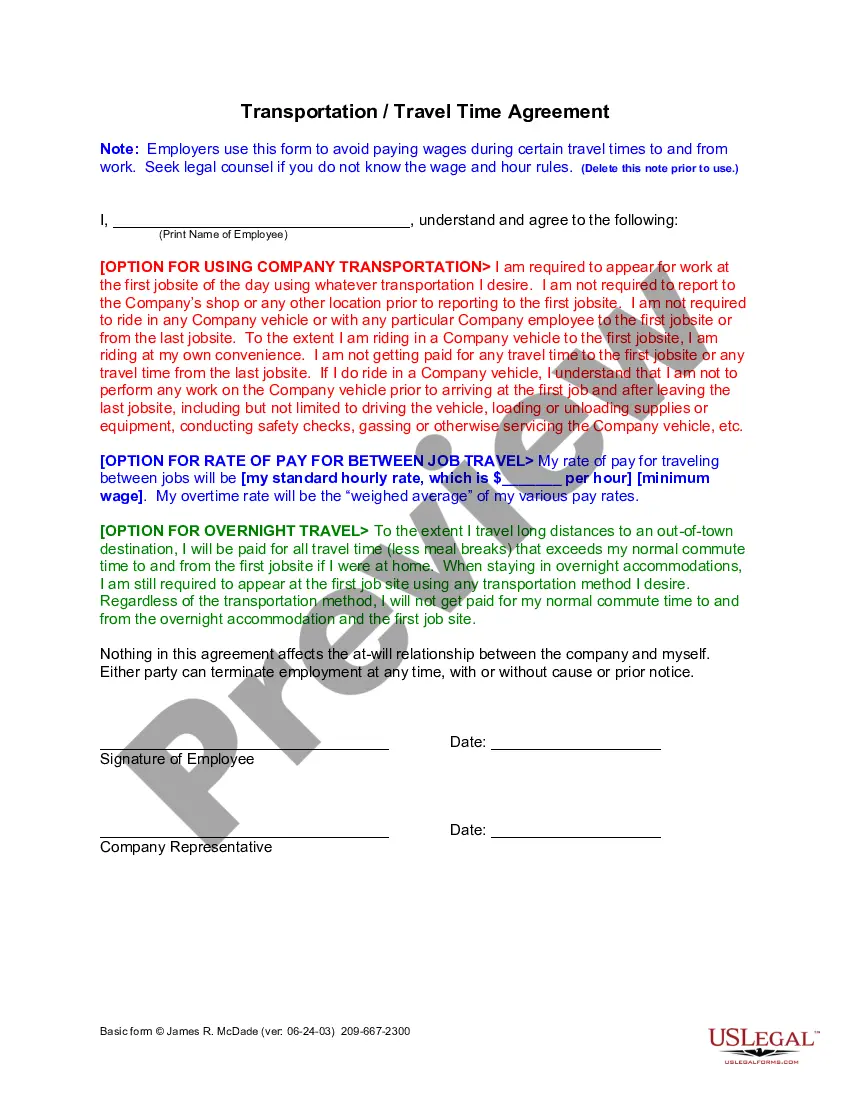

Choosing the best authorized file web template could be a have difficulties. Naturally, there are a variety of themes available online, but how can you discover the authorized form you need? Make use of the US Legal Forms site. The service gives thousands of themes, for example the Oklahoma Notice of Default under Security Agreement in Purchase of Mobile Home, which can be used for business and private demands. Each of the varieties are checked by specialists and meet federal and state demands.

Should you be already authorized, log in to your bank account and then click the Acquire button to get the Oklahoma Notice of Default under Security Agreement in Purchase of Mobile Home. Make use of bank account to look with the authorized varieties you may have ordered formerly. Visit the My Forms tab of your own bank account and acquire yet another copy in the file you need.

Should you be a brand new user of US Legal Forms, listed below are basic directions for you to comply with:

- Very first, ensure you have chosen the appropriate form for the area/state. You may look over the form using the Preview button and read the form explanation to make certain it will be the right one for you.

- When the form fails to meet your expectations, utilize the Seach industry to get the right form.

- Once you are sure that the form is proper, go through the Purchase now button to get the form.

- Choose the prices plan you desire and enter the needed info. Design your bank account and buy your order using your PayPal bank account or bank card.

- Pick the data file file format and down load the authorized file web template to your gadget.

- Total, change and print out and indicator the attained Oklahoma Notice of Default under Security Agreement in Purchase of Mobile Home.

US Legal Forms is definitely the greatest library of authorized varieties for which you will find numerous file themes. Make use of the service to down load appropriately-manufactured documents that comply with express demands.