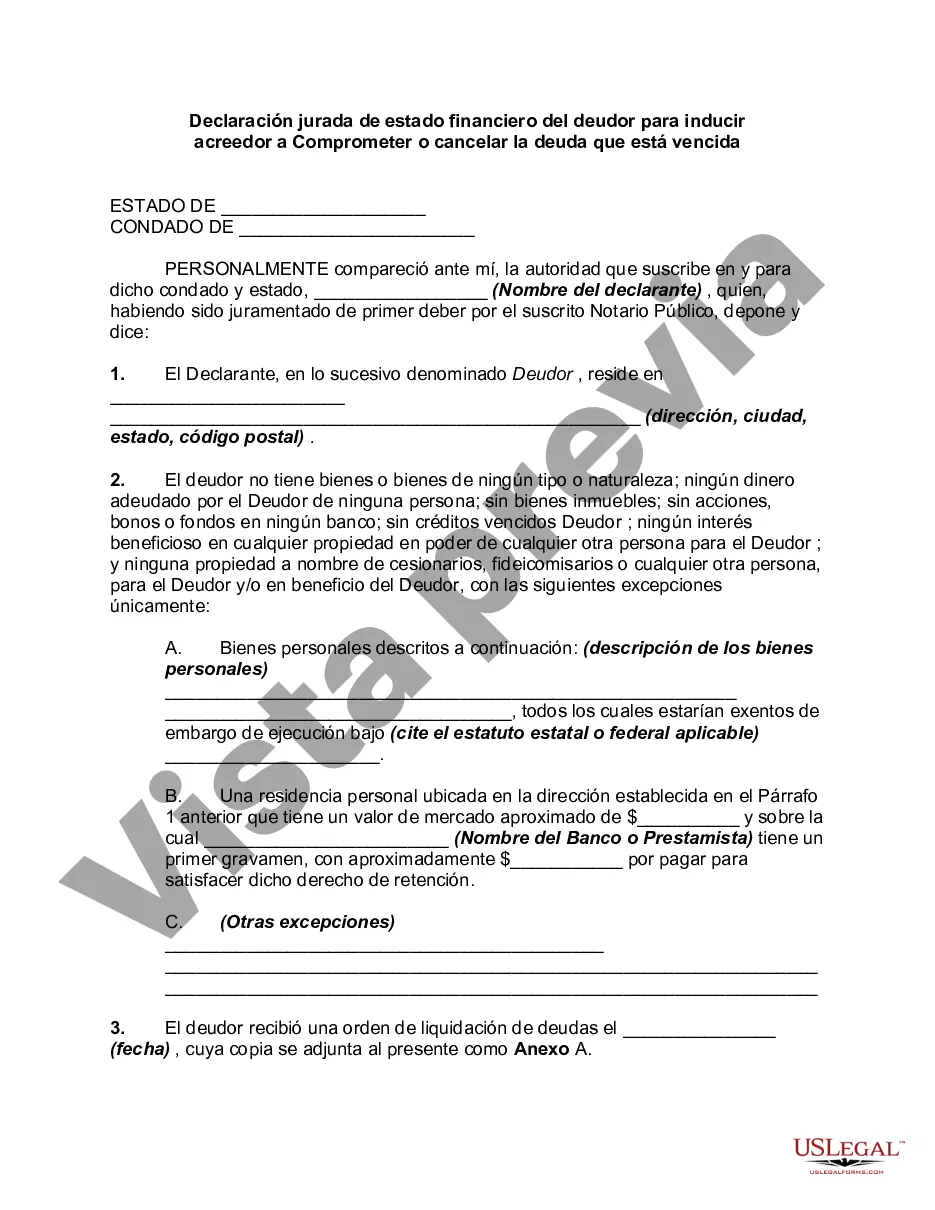

The purpose of this form is to show creditors the dire financial situation that the debtor is in so as to induce the creditors to compromise or write off the debt due.

The Oklahoma Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document used in Oklahoma to provide a detailed overview of an individual's financial situation when attempting to negotiate with a creditor to settle or eliminate a past-due debt. This affidavit helps creditors assess the debtor's financial position and make an informed decision regarding debt reduction or forgiveness. Keywords: Oklahoma, Debtor's Affidavit of Financial Status, assets, liabilities, compromise, write off, past due, debt. There are no specific named variations of the Oklahoma Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities. This affidavit typically consists of the following sections: 1. Introduction: The document starts with an introduction that states the purpose of the affidavit — to provide an overview of the financial status for negotiating a debt compromise or write-off. 2. Personal Information: The debtor provides their full legal name, contact details, and any relevant identification numbers (such as social security number or driver's license number). 3. Financial Assets: The debtor lists all their owned assets, including real estate properties, vehicles, bank accounts, investments, personal belongings, and any other valuable items. Each asset is accompanied by a description and current estimated value. 4. Liabilities and Debts: The debtor discloses all their outstanding debts, including credit card balances, loans, mortgages, medical bills, and any other forms of debt. The debtor provides details such as the creditor's name, account number, current balances, and monthly payments. 5. Income and Expenses: The debtor provides information about their current income sources, such as employment, self-employment, government assistance, or any other sources. They also outline their monthly expenses, including rent or mortgage payments, utilities, groceries, insurance, transportation, and other regular expenses. This section helps the creditor assess the debtor's ability to repay the debt. 6. Supporting Documentation: The debtor may be required to attach supporting documents to verify the financial information provided, such as bank statements, pay stubs, tax returns, or any other relevant documents that support their financial claims. It is crucial to note that the debtor must provide accurate and truthful information in the affidavit. Falsifying information may have legal consequences and can negatively impact the negotiation process with the creditor. Overall, the Oklahoma Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a significant document for debtors seeking to negotiate a debt settlement or forgiveness.The Oklahoma Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a legal document used in Oklahoma to provide a detailed overview of an individual's financial situation when attempting to negotiate with a creditor to settle or eliminate a past-due debt. This affidavit helps creditors assess the debtor's financial position and make an informed decision regarding debt reduction or forgiveness. Keywords: Oklahoma, Debtor's Affidavit of Financial Status, assets, liabilities, compromise, write off, past due, debt. There are no specific named variations of the Oklahoma Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities. This affidavit typically consists of the following sections: 1. Introduction: The document starts with an introduction that states the purpose of the affidavit — to provide an overview of the financial status for negotiating a debt compromise or write-off. 2. Personal Information: The debtor provides their full legal name, contact details, and any relevant identification numbers (such as social security number or driver's license number). 3. Financial Assets: The debtor lists all their owned assets, including real estate properties, vehicles, bank accounts, investments, personal belongings, and any other valuable items. Each asset is accompanied by a description and current estimated value. 4. Liabilities and Debts: The debtor discloses all their outstanding debts, including credit card balances, loans, mortgages, medical bills, and any other forms of debt. The debtor provides details such as the creditor's name, account number, current balances, and monthly payments. 5. Income and Expenses: The debtor provides information about their current income sources, such as employment, self-employment, government assistance, or any other sources. They also outline their monthly expenses, including rent or mortgage payments, utilities, groceries, insurance, transportation, and other regular expenses. This section helps the creditor assess the debtor's ability to repay the debt. 6. Supporting Documentation: The debtor may be required to attach supporting documents to verify the financial information provided, such as bank statements, pay stubs, tax returns, or any other relevant documents that support their financial claims. It is crucial to note that the debtor must provide accurate and truthful information in the affidavit. Falsifying information may have legal consequences and can negatively impact the negotiation process with the creditor. Overall, the Oklahoma Debtor's Affidavit of Financial Status to Induce Creditor to Compromise or Write off the Debt which is Past Due — Assets and Liabilities is a significant document for debtors seeking to negotiate a debt settlement or forgiveness.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.