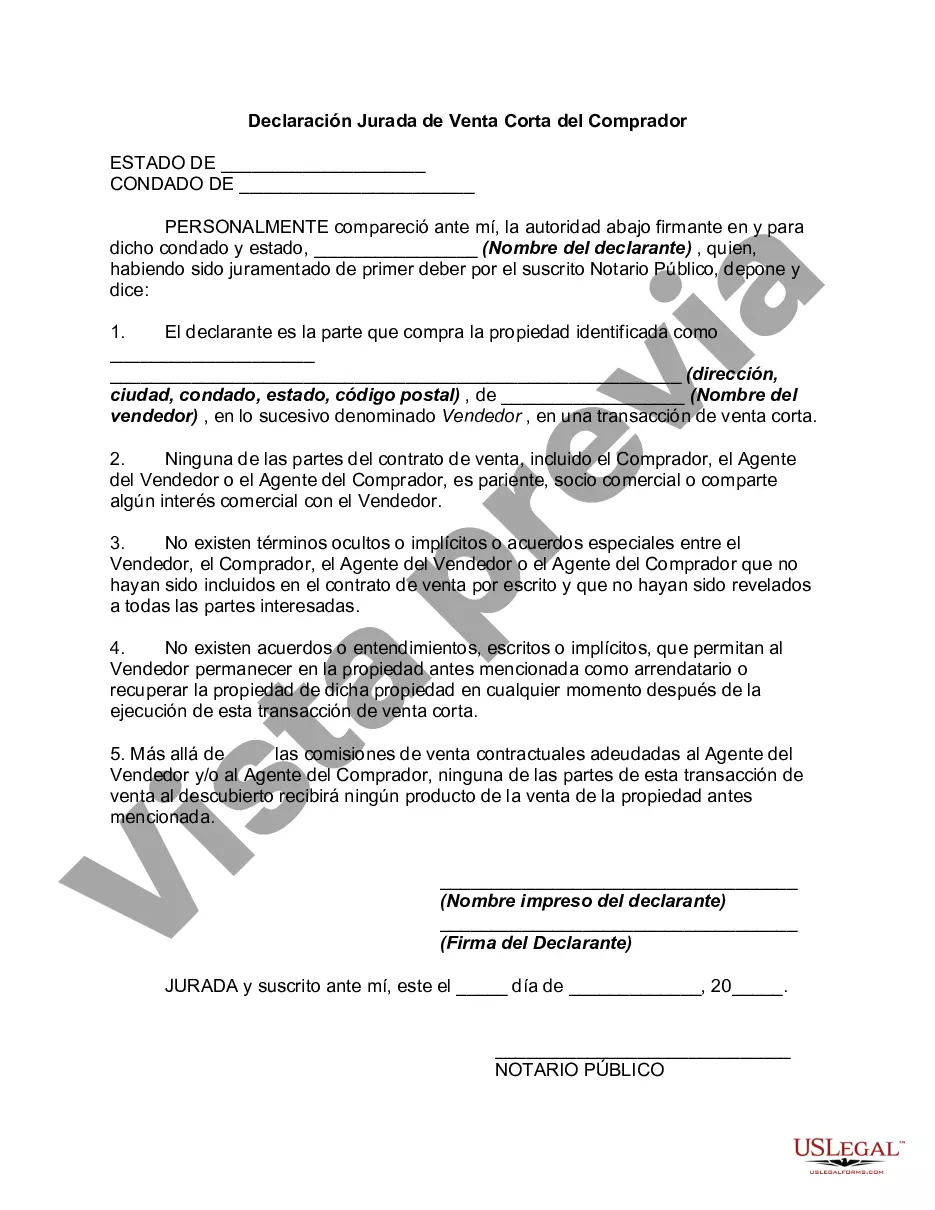

The Oklahoma Short Sale Affidavit of Buyer is a crucial document used during the process of purchasing a property through a short sale in Oklahoma. A short sale occurs when a homeowner sells their property for an amount that is less than the outstanding mortgage balance. This document provides essential information about the buyer's intentions and confirms their understanding of the short sale process. The Oklahoma Short Sale Affidavit of Buyer typically includes the following key details: 1. Buyer Information: The affidavit begins by requiring the buyer's personal information, such as their full name, contact details, and address. This information helps in establishing the buyer's identity and ensures their legal participation in the short sale process. 2. Property Details: The document asks for the property's address, legal description, and tax identification number. These details ensure that the buyer and the lender are on the same page regarding the specific property involved in the short sale. 3. Purchase Intentions: The buyer must declare their intent to purchase the property, acknowledging that they are aware of the short sale nature of the transaction. By signing the affidavit, the buyer confirms their understanding that the property is being sold below the mortgage balance and agrees to abide by the terms and conditions associated with the short sale. 4. Financial Capacity: The affidavit may require the buyer to disclose their financial capacity to complete the transaction successfully. This includes providing information about their income, assets, and ability to secure financing to complete the purchase. The buyer may also be required to submit supporting documents, such as bank statements or loan pre-approval letters. 5. Good Faith: The buyer confirms that they are acting in good faith and not engaging in any fraudulent activities or hidden agreements. This clause helps to protect the seller and the lender from any potential wrongdoing that may occur during the short sale process. 6. Buyer's Representations: The affidavit often includes a section where the buyer makes certain representations about their understanding of the short sale process and their willingness to cooperate with the seller, the lender, and any involved agents or attorneys. While the general framework of the Oklahoma Short Sale Affidavit of Buyer remains consistent, there may be variations or additional clauses specific to different short sale transactions. However, the core purpose is to provide a legally binding document that captures the buyer's commitment, understanding, and compliance with the short sale process. Some potential variations or types of the Oklahoma Short Sale Affidavit of Buyer may include a specific form for residential properties, commercial properties, or even agricultural properties. These variations typically account for the unique elements and considerations involved in each property type and may include additional provisions relevant to the specific transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Declaración Jurada de Venta Corta del Comprador - Short Sale Affidavit of Buyer

Description

How to fill out Oklahoma Declaración Jurada De Venta Corta Del Comprador?

US Legal Forms - one of several largest libraries of authorized varieties in the United States - provides a wide array of authorized record themes you may down load or print. While using internet site, you can find a large number of varieties for organization and person functions, sorted by categories, states, or keywords.You will find the most up-to-date variations of varieties just like the Oklahoma Short Sale Affidavit of Buyer within minutes.

If you have a monthly subscription, log in and down load Oklahoma Short Sale Affidavit of Buyer in the US Legal Forms collection. The Down load key will appear on every single develop you look at. You have access to all in the past saved varieties in the My Forms tab of the bank account.

If you wish to use US Legal Forms initially, listed here are easy recommendations to obtain started:

- Make sure you have picked out the proper develop to your metropolis/area. Click on the Preview key to examine the form`s content. Browse the develop explanation to ensure that you have selected the correct develop.

- When the develop doesn`t suit your specifications, use the Research field towards the top of the screen to obtain the the one that does.

- If you are satisfied with the form, validate your selection by clicking on the Purchase now key. Then, choose the prices strategy you prefer and supply your qualifications to register for an bank account.

- Process the deal. Utilize your bank card or PayPal bank account to finish the deal.

- Find the file format and down load the form on your product.

- Make adjustments. Load, edit and print and indicator the saved Oklahoma Short Sale Affidavit of Buyer.

Every template you put into your money does not have an expiry particular date and is the one you have permanently. So, if you want to down load or print another copy, just visit the My Forms segment and then click on the develop you will need.

Gain access to the Oklahoma Short Sale Affidavit of Buyer with US Legal Forms, the most extensive collection of authorized record themes. Use a large number of skilled and express-certain themes that meet up with your business or person needs and specifications.