This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Oklahoma Agreement to Extend Debt Payment Terms is a legally binding agreement between a debtor and a creditor that allows the debtor to extend the payment terms or reschedule payments for an outstanding debt. It provides a structured framework for negotiating and amending payment arrangements to avoid default or bankruptcy. This agreement is designed to provide both parties with flexibility in managing their financial obligations. It allows debtors facing temporary financial difficulties to request an extension of their existing payment plan, providing them with more time to meet their obligations. Creditors, on the other hand, may agree to extend the repayment schedule to avoid potential losses or to maintain a positive relationship with the debtor. Oklahoma offers various types of agreements to extend debt payment terms, including: 1. Installment Agreement: One common type of agreement is an installment plan, where the debtor agrees to make regular payments over an extended period until the debt is fully repaid. This allows debtors to potentially lower their monthly payments and gradually catch up on their obligations. 2. Lump Sum Settlement Agreement: In certain cases, debtors may negotiate a lump sum settlement agreement with their creditors. This agreement involves a reduced payment amount that is less than the total owed, which is paid as a one-time settlement. Creditors may accept this option to recover a portion of the debt quickly rather than waiting for full repayment. 3. Forbearance Agreement: A forbearance agreement allows debtors to temporarily suspend or reduce payments for an agreed-upon period. This is often offered when debtors are experiencing temporary financial hardships, such as unemployment or medical emergencies. It provides a reprieve while the debtor gets back on their feet financially. 4. Consolidation Agreement: Debt consolidation agreements merge multiple debts into a single, more manageable payment plan. This option is often used when debtors have numerous outstanding debts and want to simplify their payments by combining them into one debt. Regardless of the type of agreement, it is crucial to have the terms and conditions clearly defined in writing. Parties need to outline payment schedules, interest rates, any applicable fees, and the consequences of non-compliance for both parties. Legal advice is recommended to ensure that all aspects of the agreement comply with Oklahoma's legal requirements. In conclusion, the Oklahoma Agreement to Extend Debt Payment Terms is a valuable tool for debtors and creditors to manage financial difficulties and maintain a healthy financial relationship. It offers various types of agreements, including installment plans, lump sum settlements, forbearance agreements, and consolidation agreements, providing flexibility and options for resolving outstanding debts.The Oklahoma Agreement to Extend Debt Payment Terms is a legally binding agreement between a debtor and a creditor that allows the debtor to extend the payment terms or reschedule payments for an outstanding debt. It provides a structured framework for negotiating and amending payment arrangements to avoid default or bankruptcy. This agreement is designed to provide both parties with flexibility in managing their financial obligations. It allows debtors facing temporary financial difficulties to request an extension of their existing payment plan, providing them with more time to meet their obligations. Creditors, on the other hand, may agree to extend the repayment schedule to avoid potential losses or to maintain a positive relationship with the debtor. Oklahoma offers various types of agreements to extend debt payment terms, including: 1. Installment Agreement: One common type of agreement is an installment plan, where the debtor agrees to make regular payments over an extended period until the debt is fully repaid. This allows debtors to potentially lower their monthly payments and gradually catch up on their obligations. 2. Lump Sum Settlement Agreement: In certain cases, debtors may negotiate a lump sum settlement agreement with their creditors. This agreement involves a reduced payment amount that is less than the total owed, which is paid as a one-time settlement. Creditors may accept this option to recover a portion of the debt quickly rather than waiting for full repayment. 3. Forbearance Agreement: A forbearance agreement allows debtors to temporarily suspend or reduce payments for an agreed-upon period. This is often offered when debtors are experiencing temporary financial hardships, such as unemployment or medical emergencies. It provides a reprieve while the debtor gets back on their feet financially. 4. Consolidation Agreement: Debt consolidation agreements merge multiple debts into a single, more manageable payment plan. This option is often used when debtors have numerous outstanding debts and want to simplify their payments by combining them into one debt. Regardless of the type of agreement, it is crucial to have the terms and conditions clearly defined in writing. Parties need to outline payment schedules, interest rates, any applicable fees, and the consequences of non-compliance for both parties. Legal advice is recommended to ensure that all aspects of the agreement comply with Oklahoma's legal requirements. In conclusion, the Oklahoma Agreement to Extend Debt Payment Terms is a valuable tool for debtors and creditors to manage financial difficulties and maintain a healthy financial relationship. It offers various types of agreements, including installment plans, lump sum settlements, forbearance agreements, and consolidation agreements, providing flexibility and options for resolving outstanding debts.

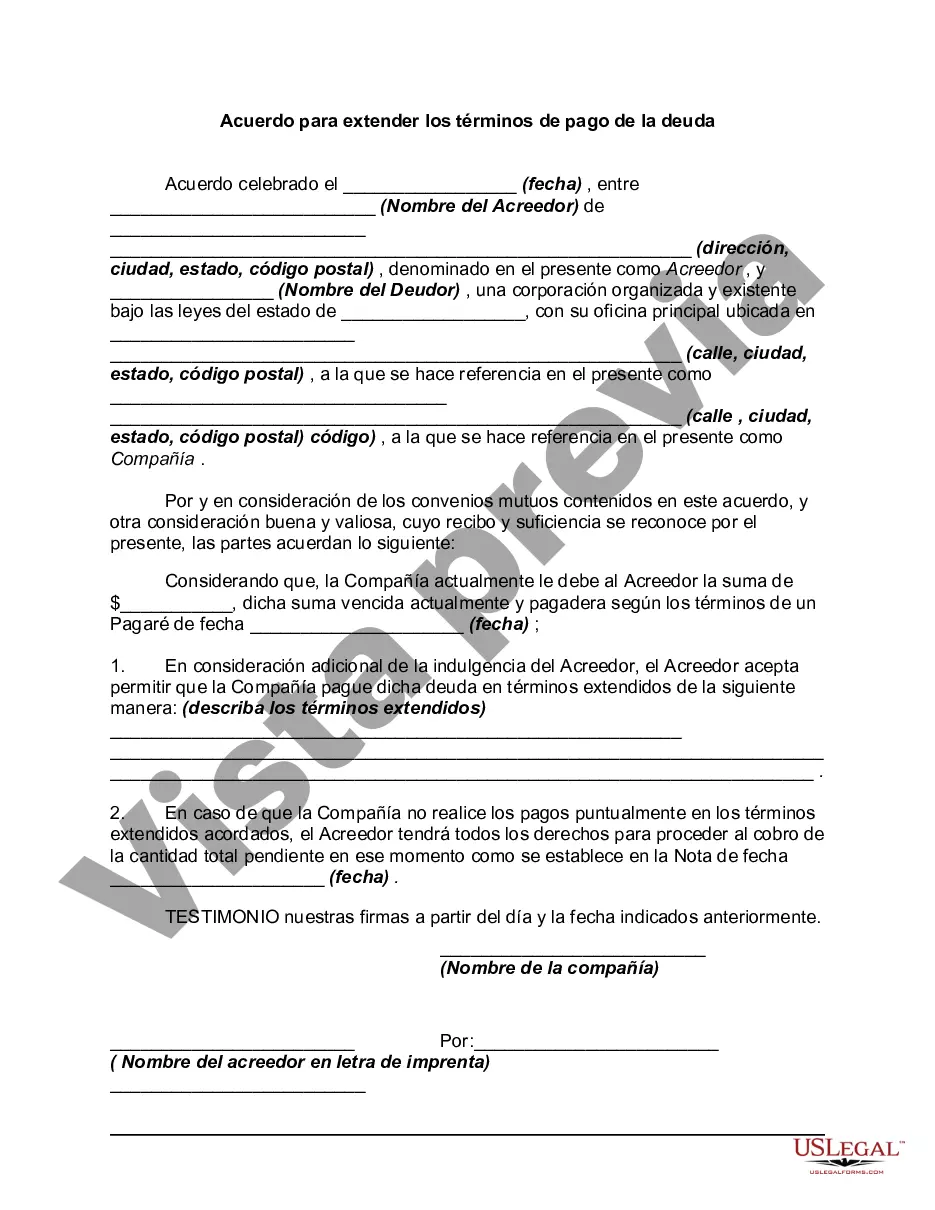

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.