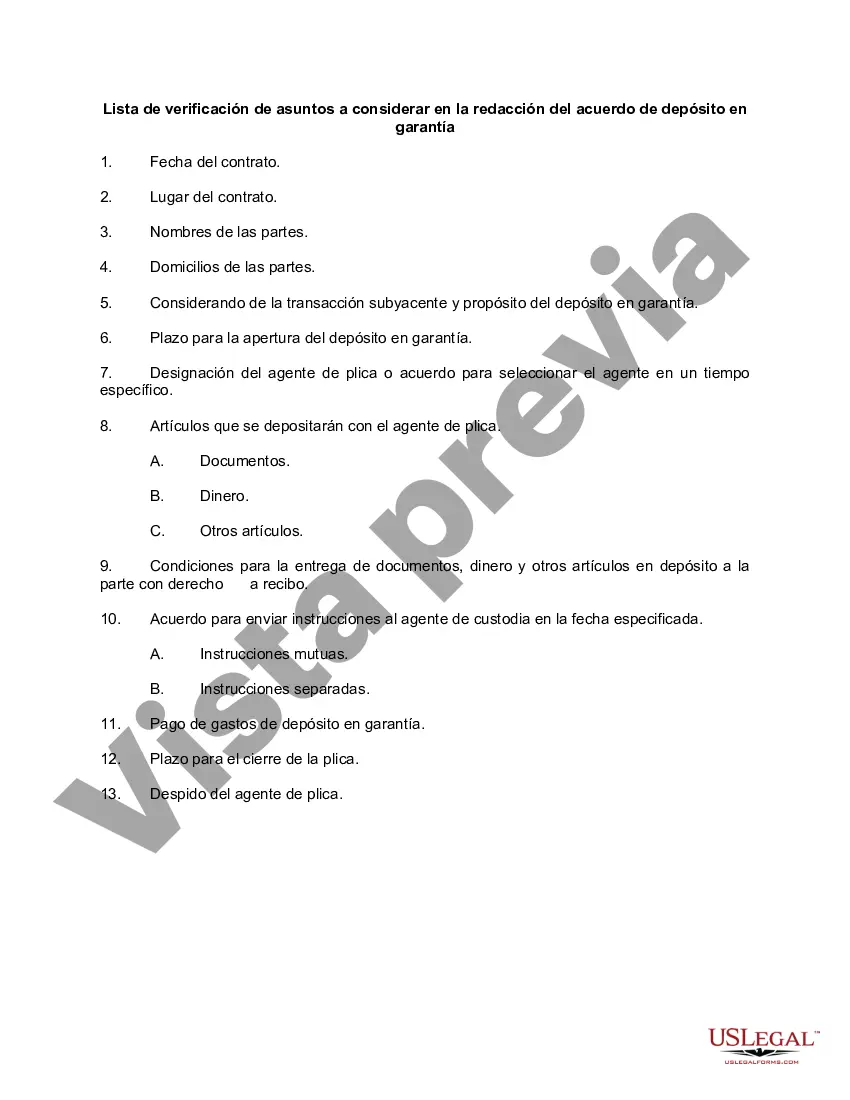

Title: Oklahoma Checklist of Matters to be Considered in Drafting Escrow Agreement: A Comprehensive Guide Introduction: An escrow agreement is a critical legal document that outlines the terms and conditions for holding funds or assets by a neutral third party until certain conditions are met. In the state of Oklahoma, several essential aspects should be addressed when drafting an escrow agreement. This article serves as a comprehensive guide, outlining the key considerations and providing insights into the different types of Oklahoma checklists related to escrow agreements. 1. Identification of Parties: — Clearly identify the involved parties in the escrow agreement, including the buyer(s), seller(s), and the escrow agent. — Provide accurate contact information for each party to ensure ease of communication. 2. Description of the Subject: — Precisely describe the nature of the transaction that necessitates the escrow, such as real estate purchase, mergers and acquisitions, or other contractual agreements. — Include specific details regarding the assets or funds involved in the escrow, ensuring clarity and preventing any potential ambiguity. 3. Escrow Agent Roles and Responsibilities: — Specify the duties and obligations of the escrow agent, including their fiduciary responsibilities, disbursement conditions, and the overall scope of their involvement in the transaction. — Outline the timeframe within which the escrow agent should complete their tasks. 4. Conditions for Release of Es crowed Funds/Assets: — Clearly define the conditions that must be met for the release of the BS crowed funds/assets, such as agreed-upon terms, completion of due diligence, or fulfillment of other contractual obligations. — Specify the process of obtaining mutual consent or instructions from all involved parties for the release of BS crowed funds/assets. 5. Dispute Resolution: — Include a provision addressing dispute resolution mechanisms, such as mediation, arbitration, or litigation, in case any conflicts arise during the escrow period. — Consider incorporating an arbitration clause, specifying the jurisdiction and the rules governing the arbitration process. 6. Termination and Cancellation: — Define the circumstances under which either party can terminate or cancel the escrow agreement before its natural completion. — Specify whether any penalties or fees may be levied upon termination or cancellation. Types of Oklahoma Checklist for Matters to be Considered in Drafting Escrow Agreements: 1. Real Estate Escrow Agreement Checklist: — A specialized checklist for real estate transactions, covering aspects like property titles, existing liens, inspection reports, and documentation required for title transfer. 2. Merger and Acquisition Escrow Agreement Checklist: — A checklist intended for M&A transactions that may include considerations regarding financial statements, regulatory compliance, tax implications, and non-disclosure agreements. 3. Contract Escrow Agreement Checklist: — A comprehensive checklist for contract-related escrow agreements, focusing on contract terms, performance indicators, penalties, and specific conditions outlined in the agreement. Conclusion: Drafting an escrow agreement requires careful consideration of numerous factors to protect the interests of all parties involved in a transaction. By adhering to the Oklahoma Checklist of Matters to be Considered in Drafting Escrow Agreement and utilizing specialized checklists tailored to different transactions, one can ensure a legally sound and smooth escrow process. Seek legal counsel to draft a customized escrow agreement that aligns with specific requirements and legal nuances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Lista de verificación de asuntos a considerar en la redacción del acuerdo de depósito en garantía - Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Oklahoma Lista De Verificación De Asuntos A Considerar En La Redacción Del Acuerdo De Depósito En Garantía?

Discovering the right lawful document web template can be a have a problem. Naturally, there are a lot of layouts available online, but how do you find the lawful form you require? Take advantage of the US Legal Forms internet site. The service delivers thousands of layouts, like the Oklahoma Checklist of Matters to be Considered in Drafting Escrow Agreement, which you can use for business and private needs. All the forms are checked out by experts and meet up with state and federal requirements.

Should you be previously registered, log in in your account and click on the Obtain option to find the Oklahoma Checklist of Matters to be Considered in Drafting Escrow Agreement. Make use of your account to search throughout the lawful forms you possess purchased formerly. Proceed to the My Forms tab of your respective account and have an additional version of the document you require.

Should you be a whole new customer of US Legal Forms, allow me to share easy guidelines that you can follow:

- First, ensure you have chosen the correct form for the town/county. It is possible to look through the form using the Preview option and browse the form explanation to guarantee it will be the right one for you.

- In case the form will not meet up with your preferences, make use of the Seach discipline to obtain the proper form.

- When you are positive that the form is suitable, click the Get now option to find the form.

- Select the prices strategy you desire and enter in the essential information and facts. Design your account and pay money for the transaction using your PayPal account or bank card.

- Select the document file format and download the lawful document web template in your product.

- Comprehensive, change and printing and signal the received Oklahoma Checklist of Matters to be Considered in Drafting Escrow Agreement.

US Legal Forms is the most significant collection of lawful forms in which you will find numerous document layouts. Take advantage of the service to download skillfully-produced paperwork that follow state requirements.

Form popularity

FAQ

In an escrow, a legal document or property are delivered by a promisor to a third party to be held for a specified amount of time or until the satisfaction of a condition, at which time the third party is legally obliged to hand over the document or property to the promisee.

A thorough escrow agreement will list out the information that should be included in JWI or any instructions, such as the amount to be released, the party to whom the funds should be delivered, payment instructions and tax characterizations, or alternatively attach an instructions template to the escrow agreement.

Escrow instructions normally identify the escrow holder's contact information and escrow number, license number, important dates including the date escrow opened, as well as the date it is scheduled to close, the names of the parties to the escrow, the property address and legal description, purchase price and terms,

An Escrow Account is an account held by a third party on behalf of the beneficial owner of the money in the account.

Most escrow agreements are put into place when one party wants to make sure the other party meets certain conditions or obligations before it moves forward with a deal. For instance, a seller may set up an escrow agreement to ensure a potential homebuyer can secure financing before the sale goes through.

A Standard Clause providing for an escrow of a portion of the purchase price in an M&A transaction to satisfy the seller's obligations to pay any adjustments to the purchase price and any potential indemnification claims. It can be used in connection with a private stock purchase, asset purchase, or merger.

"In escrow" is a type of legal holding account for items, which can't be released until predetermined conditions are satisfied. Typically, items are held in escrow until the process involving a financial transaction has been completed. Valuables held in escrow can include real estate, money, stocks, and securities.

Before making a transaction, tokens are transferred to a third-party smart contract called the escrow. The escrow holds the deposited tokens until the payment conditions are satisfied. Context. The parties involved in the transaction need to ensure that both the agreed product/service is delivered and payment is made.

Escrow agreements provide security by delegating an asset to an escrow agent for safekeeping until each party meets his or her contractual obligations.

The two essential elements for a valid sale escrow are a binding contract/agreement between buyer and seller and the conditional delivery to a neutral third party of something of value, as defined, which typically includes written instruments of conveyance (grant deed) or encumbrance (deed of trust) and related