It is essential to a contract that there be an offer and, while the offer is still in existence, it must be accepted without qualification. An offer expresses the willingness of the offeror to enter into a contract agreement regarding a particular subject. An invitation to negotiate is not an offer. An invitation to negotiate is merely a preliminary discussion or an invitation by one party to the other to negotiate or make an offer. This form is an invitation to negotiate.

Title: Oklahoma Business Purchase Proposal: Comprehensive Guide and Types Introduction: In this detailed description, we will explore the concept of an Oklahoma Business Purchase Proposal with a focus on its significance, components, and types. Oklahoma, being a thriving state in terms of business growth and opportunities, the purchase proposal serves as a critical document for potential buyers and sellers to initiate and negotiate business acquisitions. Keywords: Oklahoma, business purchase proposal, acquisition, negotiation, potential buyers, potential sellers, business growth, opportunities. I. Understanding the Oklahoma Business Purchase Proposal: 1. Definition: A business purchase proposal is a formal document prepared by a potential buyer or their representative which outlines the terms and conditions for acquiring an existing business in Oklahoma. Keywords: formal document, terms and conditions, acquiring, existing business. 2. Significance: The proposal serves as a foundation for negotiations between the buyer and seller, providing detailed information about the buyer's intent, financial capability, and proposed transaction structure. Keywords: negotiations, buyer, seller, intent, financial capability, transaction structure. II. Components of an Oklahoma Business Purchase Proposal: 1. Introduction: A concise overview of the buyer's intent, including the purpose and objectives of the proposed acquisition. Keywords: overview, buyer's intent, purpose, objectives, proposed acquisition. 2. Business Analysis: Detailed information about the targeted business, such as its industry, operational history, financial performance, market position, and competitive landscape. Keywords: business analysis, industry, operational history, financial performance, market position, competitive landscape. 3. Financial Evaluation: A comprehensive assessment of the company's financial statements, assets, liabilities, cash flow, profitability, and potential risks to determine its value and future sustainability. Keywords: financial evaluation, financial statements, assets, liabilities, cash flow, profitability, potential risks, value, future sustainability. 4. Offer and Price: The proposed purchase price or valuation along with details regarding the payment structure, financing options, and anticipated terms of the transaction. Keywords: offer, purchase price, valuation, payment structure, financing options, anticipated terms, transaction. 5. Due Diligence: Detailed information on the required investigations, inspections, and analysis to be conducted by the buyer to verify the accuracy of provided information and assess any potential risks. Keywords: due diligence, investigations, inspections, analysis, accuracy, potential risks. III. Types of Oklahoma Business Purchase Proposals: 1. Asset Purchase Proposal: This type of proposal focuses on acquiring specific assets (tangible and intangible) of an existing business in Oklahoma, such as inventory, equipment, customer contracts, and intellectual property rights. Keywords: asset purchase proposal, tangible assets, intangible assets, inventory, equipment, customer contracts, intellectual property rights. 2. Stock Purchase Proposal: In this scenario, the buyer aims to purchase majority shares or complete ownership of a company incorporated in Oklahoma, thus acquiring its assets, liabilities, and ongoing operations. Keywords: stock purchase proposal, majority shares, complete ownership, incorporated company, assets, liabilities, ongoing operations. 3. Merger or Joint Venture Proposal: This proposal involves combining the operations and resources of two or more businesses in Oklahoma to form a new entity or jointly operate under a shared umbrella. Keywords: merger proposal, joint venture proposal, combining operations, shared entity, shared umbrella. Conclusion: The Oklahoma Business Purchase Proposal is a vital tool in the process of acquiring an existing business in Oklahoma. It encompasses various components such as business analysis, financial evaluation, and due diligence, providing potential buyers and sellers with a structured approach to negotiate and determine the terms of the acquisition. The types of proposals range from asset purchase to stock purchase and even include merger or joint venture proposals, based on the buyer's objectives and preferences.Title: Oklahoma Business Purchase Proposal: Comprehensive Guide and Types Introduction: In this detailed description, we will explore the concept of an Oklahoma Business Purchase Proposal with a focus on its significance, components, and types. Oklahoma, being a thriving state in terms of business growth and opportunities, the purchase proposal serves as a critical document for potential buyers and sellers to initiate and negotiate business acquisitions. Keywords: Oklahoma, business purchase proposal, acquisition, negotiation, potential buyers, potential sellers, business growth, opportunities. I. Understanding the Oklahoma Business Purchase Proposal: 1. Definition: A business purchase proposal is a formal document prepared by a potential buyer or their representative which outlines the terms and conditions for acquiring an existing business in Oklahoma. Keywords: formal document, terms and conditions, acquiring, existing business. 2. Significance: The proposal serves as a foundation for negotiations between the buyer and seller, providing detailed information about the buyer's intent, financial capability, and proposed transaction structure. Keywords: negotiations, buyer, seller, intent, financial capability, transaction structure. II. Components of an Oklahoma Business Purchase Proposal: 1. Introduction: A concise overview of the buyer's intent, including the purpose and objectives of the proposed acquisition. Keywords: overview, buyer's intent, purpose, objectives, proposed acquisition. 2. Business Analysis: Detailed information about the targeted business, such as its industry, operational history, financial performance, market position, and competitive landscape. Keywords: business analysis, industry, operational history, financial performance, market position, competitive landscape. 3. Financial Evaluation: A comprehensive assessment of the company's financial statements, assets, liabilities, cash flow, profitability, and potential risks to determine its value and future sustainability. Keywords: financial evaluation, financial statements, assets, liabilities, cash flow, profitability, potential risks, value, future sustainability. 4. Offer and Price: The proposed purchase price or valuation along with details regarding the payment structure, financing options, and anticipated terms of the transaction. Keywords: offer, purchase price, valuation, payment structure, financing options, anticipated terms, transaction. 5. Due Diligence: Detailed information on the required investigations, inspections, and analysis to be conducted by the buyer to verify the accuracy of provided information and assess any potential risks. Keywords: due diligence, investigations, inspections, analysis, accuracy, potential risks. III. Types of Oklahoma Business Purchase Proposals: 1. Asset Purchase Proposal: This type of proposal focuses on acquiring specific assets (tangible and intangible) of an existing business in Oklahoma, such as inventory, equipment, customer contracts, and intellectual property rights. Keywords: asset purchase proposal, tangible assets, intangible assets, inventory, equipment, customer contracts, intellectual property rights. 2. Stock Purchase Proposal: In this scenario, the buyer aims to purchase majority shares or complete ownership of a company incorporated in Oklahoma, thus acquiring its assets, liabilities, and ongoing operations. Keywords: stock purchase proposal, majority shares, complete ownership, incorporated company, assets, liabilities, ongoing operations. 3. Merger or Joint Venture Proposal: This proposal involves combining the operations and resources of two or more businesses in Oklahoma to form a new entity or jointly operate under a shared umbrella. Keywords: merger proposal, joint venture proposal, combining operations, shared entity, shared umbrella. Conclusion: The Oklahoma Business Purchase Proposal is a vital tool in the process of acquiring an existing business in Oklahoma. It encompasses various components such as business analysis, financial evaluation, and due diligence, providing potential buyers and sellers with a structured approach to negotiate and determine the terms of the acquisition. The types of proposals range from asset purchase to stock purchase and even include merger or joint venture proposals, based on the buyer's objectives and preferences.

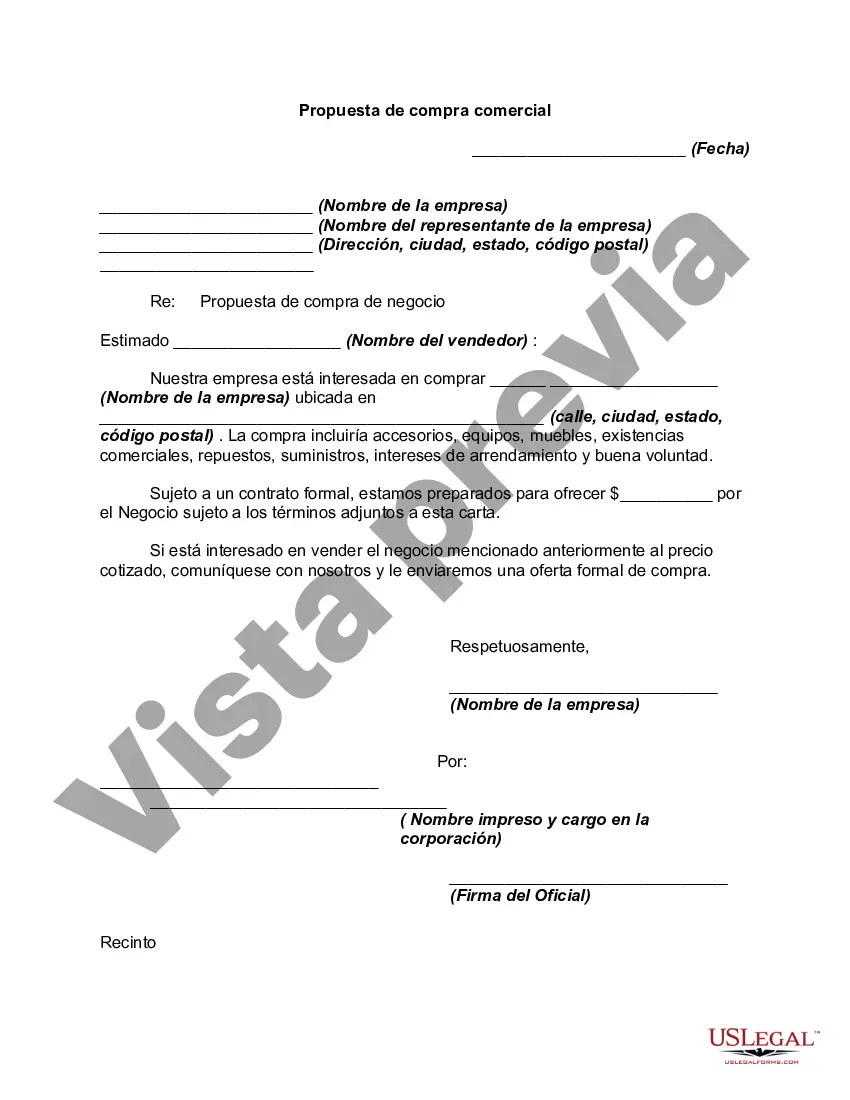

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.