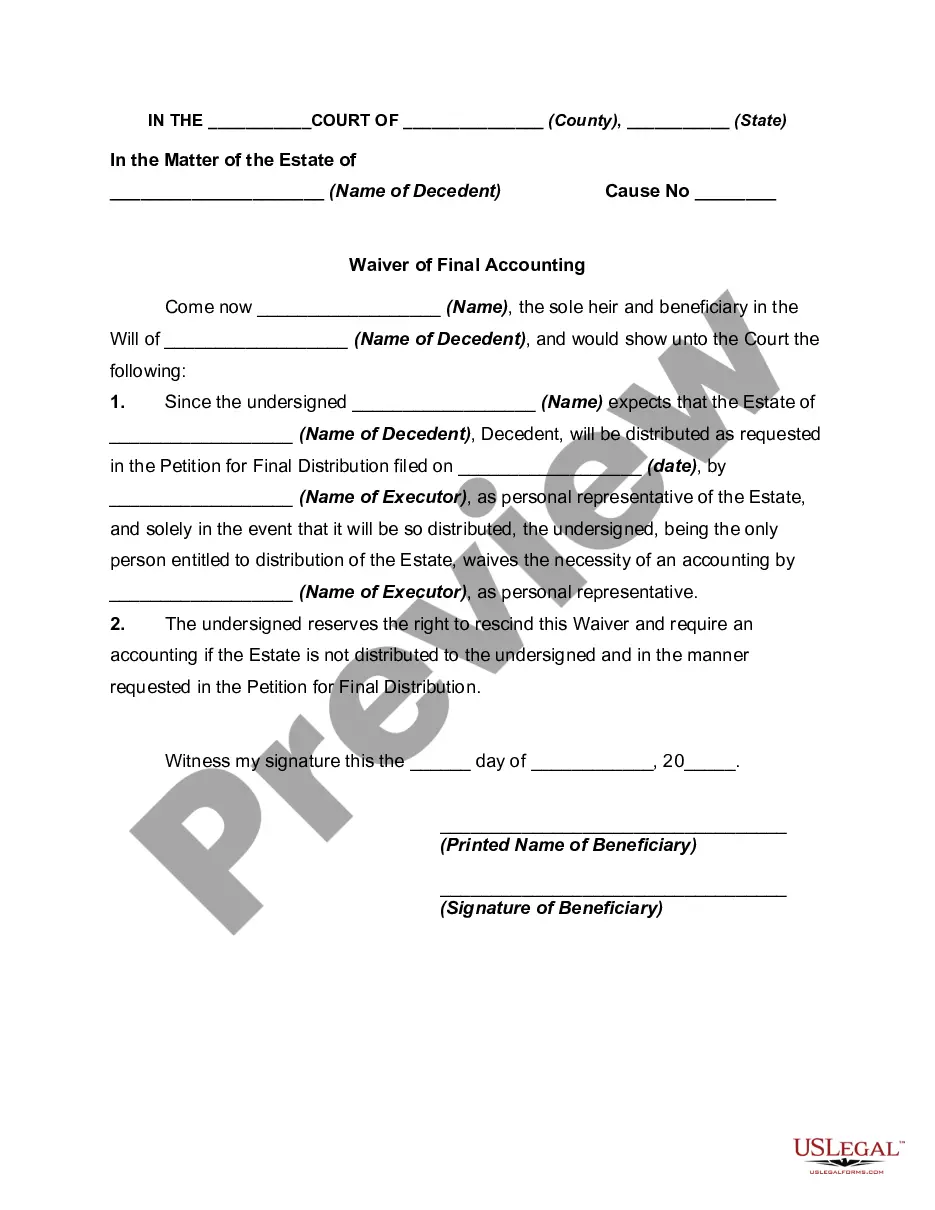

In order to close an estate a petition for final distribution should be filed before the court showing that the estate can be closed and requesting distribution to be made to the beneficiaries. Usually when a petition for final distribution is filed, the court requires detailed accounting of all the monies and other items received and all monies paid out during administration. However, the accounting may be waived when all persons entitled to receive property from the estate have executed a written waiver of accounting. Waiver simplifies the closing of the estate. When all the beneficiaries are friendly obtaining waiver is not a problem.

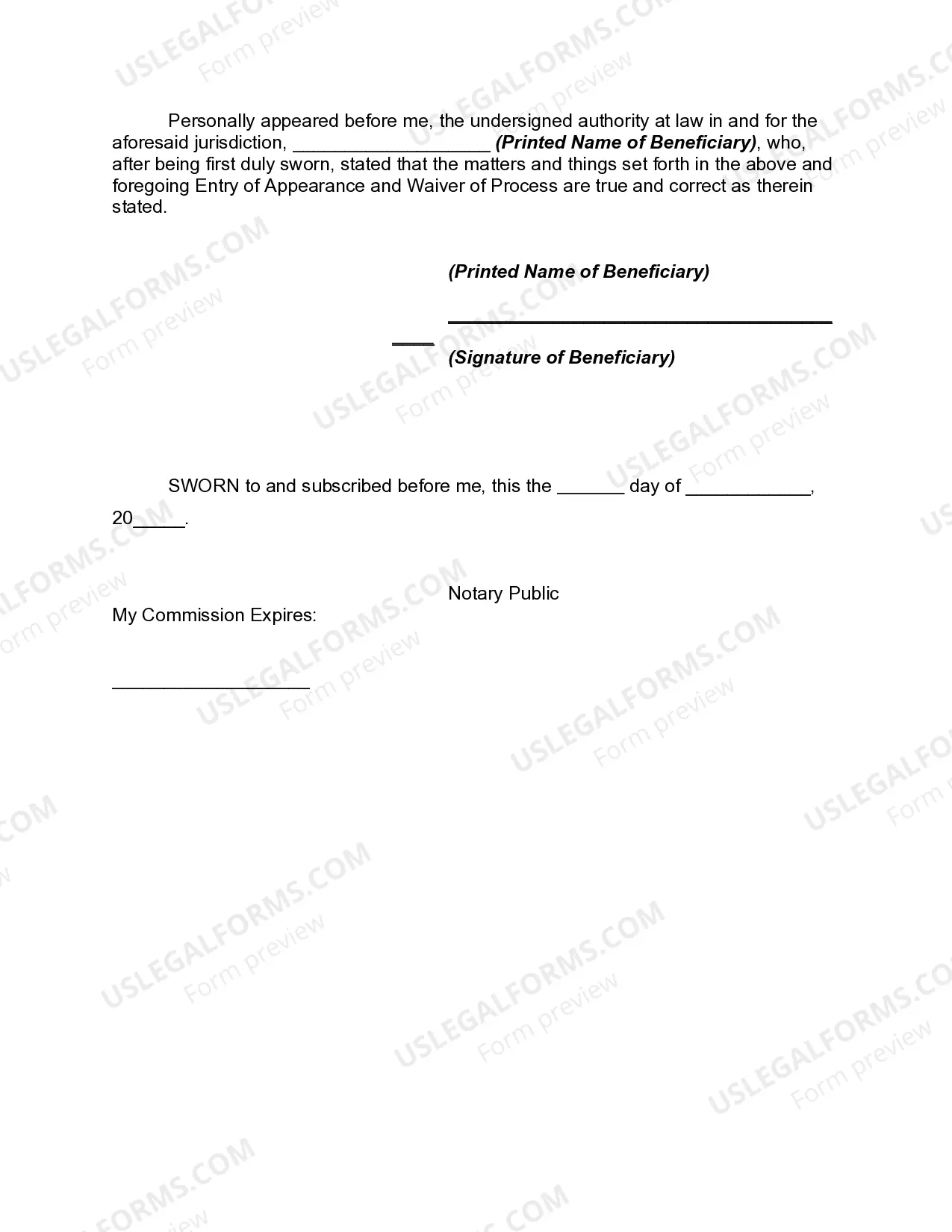

An Oklahoma Waiver of Final Accounting by Sole Beneficiary is a legal document that relinquishes a beneficiary's right to receive a detailed account of the administration of an estate by the executor or personal representative. This waiver can be used in probate cases in the state of Oklahoma, and it releases the executor from providing a final accounting report to the sole beneficiary. By signing this waiver, the beneficiary acknowledges that they have been fully informed of their rights to receive an accounting and have willingly and voluntarily decided to waive those rights. This waiver is typically used when the sole beneficiary of an estate fully trusts the executor or personal representative and feels no need to review the financial transactions and distribution of assets. The Oklahoma Waiver of Final Accounting by Sole Beneficiary is meant to simplify the probate process by eliminating the need for a comprehensive and time-consuming final accounting, saving both time and money for all parties involved. This waiver can be especially useful when the beneficiary and the executor have a close relationship or when the estate's assets are simple and straightforward. However, it is important to note that this waiver is specific to the state of Oklahoma, and its use may differ in other jurisdictions. Additionally, it is crucial for the sole beneficiary to fully understand the implications of signing this waiver, as it permanently relinquishes their right to demand an accounting in the future. Consulting with an attorney experienced in probate law is advisable to ensure that the beneficiary's rights are protected and all legal requirements are met. Different variations or types of the Oklahoma Waiver of Final Accounting by Sole Beneficiary may include specific waivers for different types of assets, such as real estate, bank accounts, investments, or personal property. These variations allow the beneficiary to choose which specific rights they are waiving, providing more flexibility in the probate process and tailoring the waiver to their individual circumstances. In conclusion, the Oklahoma Waiver of Final Accounting by Sole Beneficiary is a legal document used in probate cases that allows the sole beneficiary to waive their right to receive a detailed account of the estate's administration. It simplifies the probate process by saving time and money, but it's crucial for the beneficiary to understand the implications of signing this waiver. Consulting with an attorney is recommended to ensure compliance with Oklahoma probate laws.An Oklahoma Waiver of Final Accounting by Sole Beneficiary is a legal document that relinquishes a beneficiary's right to receive a detailed account of the administration of an estate by the executor or personal representative. This waiver can be used in probate cases in the state of Oklahoma, and it releases the executor from providing a final accounting report to the sole beneficiary. By signing this waiver, the beneficiary acknowledges that they have been fully informed of their rights to receive an accounting and have willingly and voluntarily decided to waive those rights. This waiver is typically used when the sole beneficiary of an estate fully trusts the executor or personal representative and feels no need to review the financial transactions and distribution of assets. The Oklahoma Waiver of Final Accounting by Sole Beneficiary is meant to simplify the probate process by eliminating the need for a comprehensive and time-consuming final accounting, saving both time and money for all parties involved. This waiver can be especially useful when the beneficiary and the executor have a close relationship or when the estate's assets are simple and straightforward. However, it is important to note that this waiver is specific to the state of Oklahoma, and its use may differ in other jurisdictions. Additionally, it is crucial for the sole beneficiary to fully understand the implications of signing this waiver, as it permanently relinquishes their right to demand an accounting in the future. Consulting with an attorney experienced in probate law is advisable to ensure that the beneficiary's rights are protected and all legal requirements are met. Different variations or types of the Oklahoma Waiver of Final Accounting by Sole Beneficiary may include specific waivers for different types of assets, such as real estate, bank accounts, investments, or personal property. These variations allow the beneficiary to choose which specific rights they are waiving, providing more flexibility in the probate process and tailoring the waiver to their individual circumstances. In conclusion, the Oklahoma Waiver of Final Accounting by Sole Beneficiary is a legal document used in probate cases that allows the sole beneficiary to waive their right to receive a detailed account of the estate's administration. It simplifies the probate process by saving time and money, but it's crucial for the beneficiary to understand the implications of signing this waiver. Consulting with an attorney is recommended to ensure compliance with Oklahoma probate laws.