An Oklahoma Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife is a specific type of trust established in Oklahoma law to provide financial security and support for a wife and their children after the death of the husband. This type of trust allows for the efficient administration and distribution of the estate's remaining assets, ensuring the welfare of the wife and children in the long term. The main purpose of an Oklahoma Testamentary Trust of the Residue of an Estate is to manage and distribute the remaining assets of the deceased's estate after payment of debts, taxes, and specific bequests to beneficiaries. The trust is created through a will and takes effect upon the testator's death. It is essential to have a will drafted by a qualified attorney to ensure that the trust is established correctly and complies with Oklahoma laws. The key feature of this testamentary trust is that it provides for the wife's financial well-being throughout her lifetime, while also ensuring that the children continue to receive support and access to the trust's assets after the wife's passing. This type of trust can be particularly beneficial in situations where the wife is not experienced in managing financial affairs or may need assistance in preserving and growing the trust's assets. There can be different variations or types of Oklahoma Testamentary Trusts for the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife. Some of these variations may include specific provisions for: 1. Age-based Distributions: The trust may specify that distributions to the children will be based on their age or certain milestones, such as reaching a certain age or achieving specific educational goals. This ensures that the trust's assets are appropriately managed and distributed over time, providing support when needed. 2. Trustee Selection: The trust document may outline the criteria for selecting a trustee or a successor trustee who will be responsible for managing the trust's assets and making distributions. It is essential to choose a responsible and knowledgeable trustee who can act impartially and in the best interests of both the wife and the children. 3. Discretionary Distributions: The trust may grant the trustee discretionary powers to make distributions based on the individual needs of the wife and children. This allows the trustee to respond to unexpected circumstances or changes in financial needs and adjust the distribution accordingly. 4. Investment Guidelines: The trust document may include specific investment guidelines or restrictions for the trustee to follow when managing the trust's assets. It can outline acceptable investment strategies, risk tolerance, and limits on certain investment types to protect the trust's assets from unnecessary risks. 5. Termination of the Trust: The trust may specify the conditions under which the trust will terminate, such as when all the children reach a certain age or achieve specific milestones. This provision ensures that the trust's assets are ultimately distributed to the beneficiaries according to the testator's wishes. An Oklahoma Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for the Benefit of Children after the Death of the Wife is a powerful estate planning tool that can provide financial security and support for both a wife and her children. It allows for careful management and distribution of assets, ensuring the ongoing well-being of the family members involved. Consulting with an experienced estate planning attorney in Oklahoma is crucial to establish this type of trust effectively and according to the specific needs and goals of the testator.

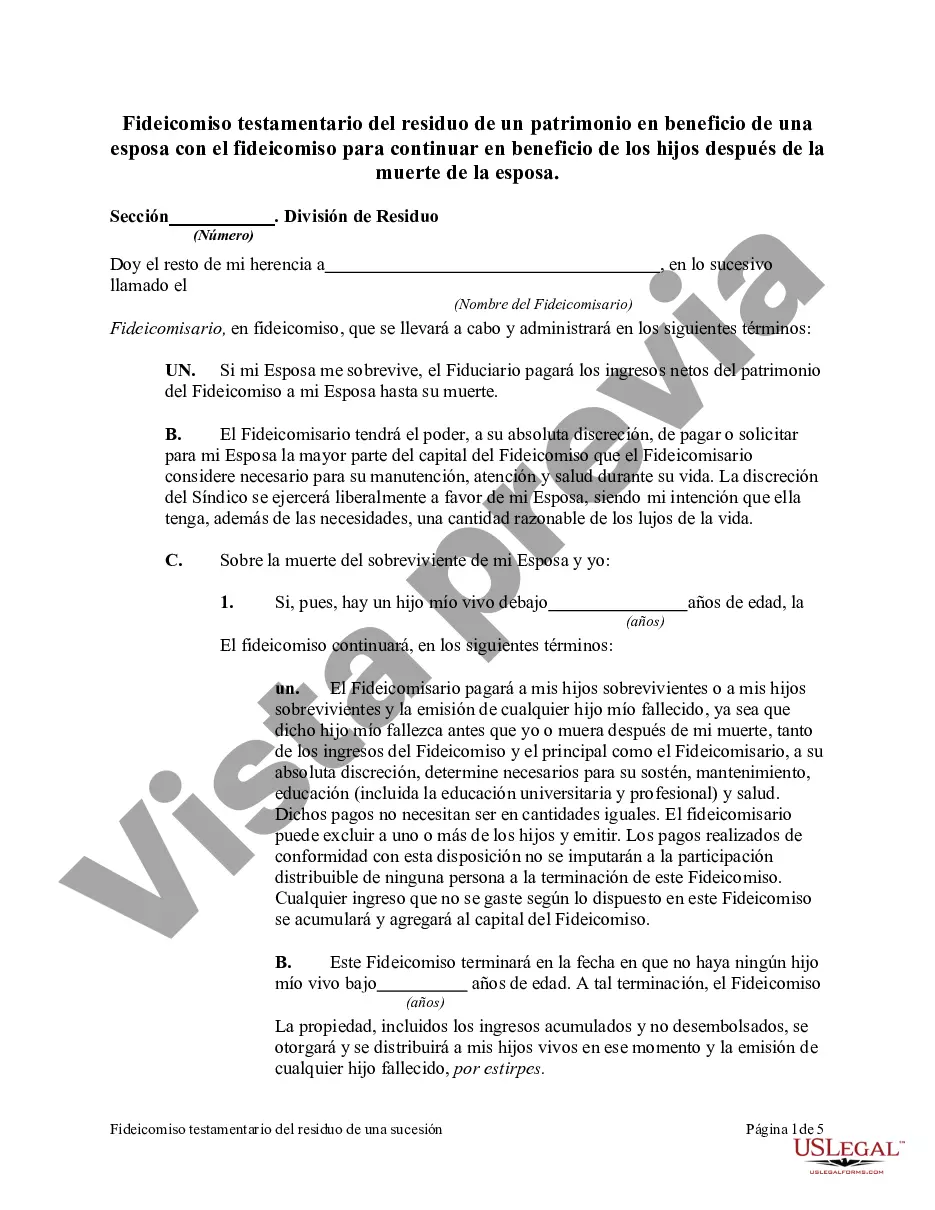

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Fideicomiso testamentario del residuo de un patrimonio en beneficio de una esposa con el fideicomiso para continuar en beneficio de los hijos después de la muerte de la esposa - Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife

Description

How to fill out Oklahoma Fideicomiso Testamentario Del Residuo De Un Patrimonio En Beneficio De Una Esposa Con El Fideicomiso Para Continuar En Beneficio De Los Hijos Después De La Muerte De La Esposa?

Choosing the right lawful papers web template can be a struggle. Of course, there are a variety of web templates available on the net, but how can you get the lawful form you want? Utilize the US Legal Forms web site. The service delivers a large number of web templates, for example the Oklahoma Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife, that you can use for enterprise and private demands. All the kinds are checked out by professionals and satisfy federal and state requirements.

When you are previously signed up, log in to your profile and click the Download button to find the Oklahoma Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife. Make use of your profile to appear throughout the lawful kinds you might have bought earlier. Proceed to the My Forms tab of your own profile and get one more backup from the papers you want.

When you are a brand new consumer of US Legal Forms, listed below are simple guidelines that you can adhere to:

- Initially, make sure you have selected the appropriate form for your personal area/region. You may examine the form using the Review button and look at the form description to make sure it is the right one for you.

- In the event the form fails to satisfy your needs, utilize the Seach field to get the appropriate form.

- Once you are sure that the form is suitable, select the Purchase now button to find the form.

- Choose the prices prepare you want and enter the required info. Build your profile and purchase the transaction utilizing your PayPal profile or credit card.

- Opt for the data file structure and obtain the lawful papers web template to your device.

- Total, change and produce and indicator the acquired Oklahoma Testamentary Trust of the Residue of an Estate for the Benefit of a Wife with the Trust to Continue for Benefit of Children after the Death of the Wife.

US Legal Forms will be the largest local library of lawful kinds that you can find a variety of papers web templates. Utilize the company to obtain professionally-created files that adhere to status requirements.