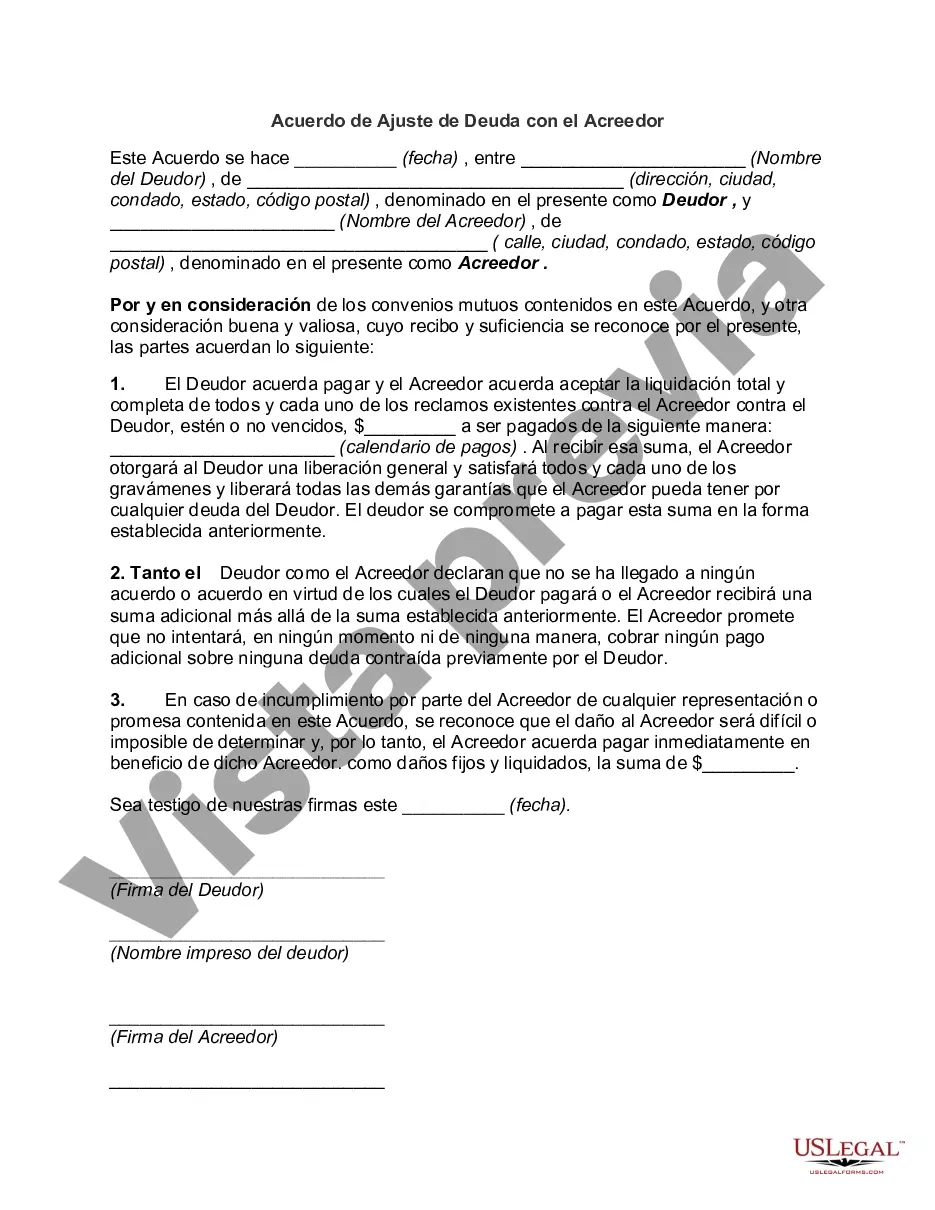

The Oklahoma Debt Adjustment Agreement with Creditor is a legal document used when an individual or business residing in Oklahoma is struggling to repay their debts and seeks to negotiate an alternative payment plan with their creditors. This agreement acts as a tool to help debtors regain financial stability and avoid bankruptcy. The Oklahoma Debt Adjustment Agreement with Creditor outlines the terms and conditions for restructuring the debt, with the primary goal of establishing an affordable payment plan that satisfies both the debtor and the creditor. It is crucial for debtors to understand that this agreement is voluntary and requires the consent of the creditor to move forward. There are several types of Oklahoma Debt Adjustment Agreements with Creditors that the debtor can explore based on their unique financial circumstances: 1. Debt Consolidation Agreement: This type of agreement aims to consolidate multiple debts into a single, more manageable payment. Debtors negotiate with their creditors to reduce interest rates, waive penalties, or extend the repayment period. Once an agreement is reached, the debtor makes regular payments to a trustee or a debt management agency, who will then distribute the funds to the respective creditors. 2. Debt Settlement Agreement: In this case, the debtor negotiates with creditors to reduce the total amount of debt owed. Often, creditors are willing to accept a lump-sum payment that is less than the full debt amount, enabling debtors to settle their debts quickly. It is essential to note that debt settlement may have negative impacts on the debtor's credit score. 3. Debt Management Plan: This type of agreement involves working with a credit counseling agency or debt management company to restructure the debt. The agency negotiates with creditors on behalf of the debtor to lower interest rates, eliminate fees, and establish a repayment plan. The debtor then makes regular payments to the agency, which in turn distributes the funds to the appropriate creditors. Regardless of the type of Oklahoma Debt Adjustment Agreement with Creditor chosen, it is vital for debtors to thoroughly evaluate their financial situation and consult with professionals, such as attorneys or credit counselors, to ensure they make informed decisions. Furthermore, debtors should carefully review the agreement before signing, ensuring all terms and conditions are agreeable and realistic for their financial capabilities. By utilizing Oklahoma Debt Adjustment Agreements with Creditors, debtors can take proactive steps towards managing their debt, avoiding bankruptcy, and ultimately working towards a more stable financial future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oklahoma Acuerdo de Ajuste de Deuda con el Acreedor - Debt Adjustment Agreement with Creditor

Description

How to fill out Oklahoma Acuerdo De Ajuste De Deuda Con El Acreedor?

US Legal Forms - one of several most significant libraries of legal types in the States - gives a variety of legal document themes it is possible to download or printing. Making use of the web site, you can find thousands of types for enterprise and personal uses, categorized by classes, claims, or search phrases.You can get the most recent types of types much like the Oklahoma Debt Adjustment Agreement with Creditor in seconds.

If you already have a monthly subscription, log in and download Oklahoma Debt Adjustment Agreement with Creditor through the US Legal Forms local library. The Acquire key will appear on each develop you see. You have access to all previously saved types within the My Forms tab of your own profile.

If you want to use US Legal Forms initially, here are easy recommendations to obtain began:

- Be sure to have selected the best develop to your city/region. Go through the Preview key to analyze the form`s content. Read the develop explanation to actually have selected the right develop.

- If the develop doesn`t suit your requirements, utilize the Lookup industry at the top of the display to discover the one which does.

- Should you be content with the form, verify your option by visiting the Acquire now key. Then, choose the pricing prepare you want and offer your references to sign up to have an profile.

- Approach the financial transaction. Make use of your bank card or PayPal profile to complete the financial transaction.

- Choose the file format and download the form in your device.

- Make modifications. Load, edit and printing and sign the saved Oklahoma Debt Adjustment Agreement with Creditor.

Every single template you included with your bank account lacks an expiry particular date and is also your own property eternally. So, if you wish to download or printing an additional duplicate, just go to the My Forms segment and click on about the develop you require.

Get access to the Oklahoma Debt Adjustment Agreement with Creditor with US Legal Forms, by far the most comprehensive local library of legal document themes. Use thousands of skilled and state-distinct themes that meet your small business or personal requires and requirements.